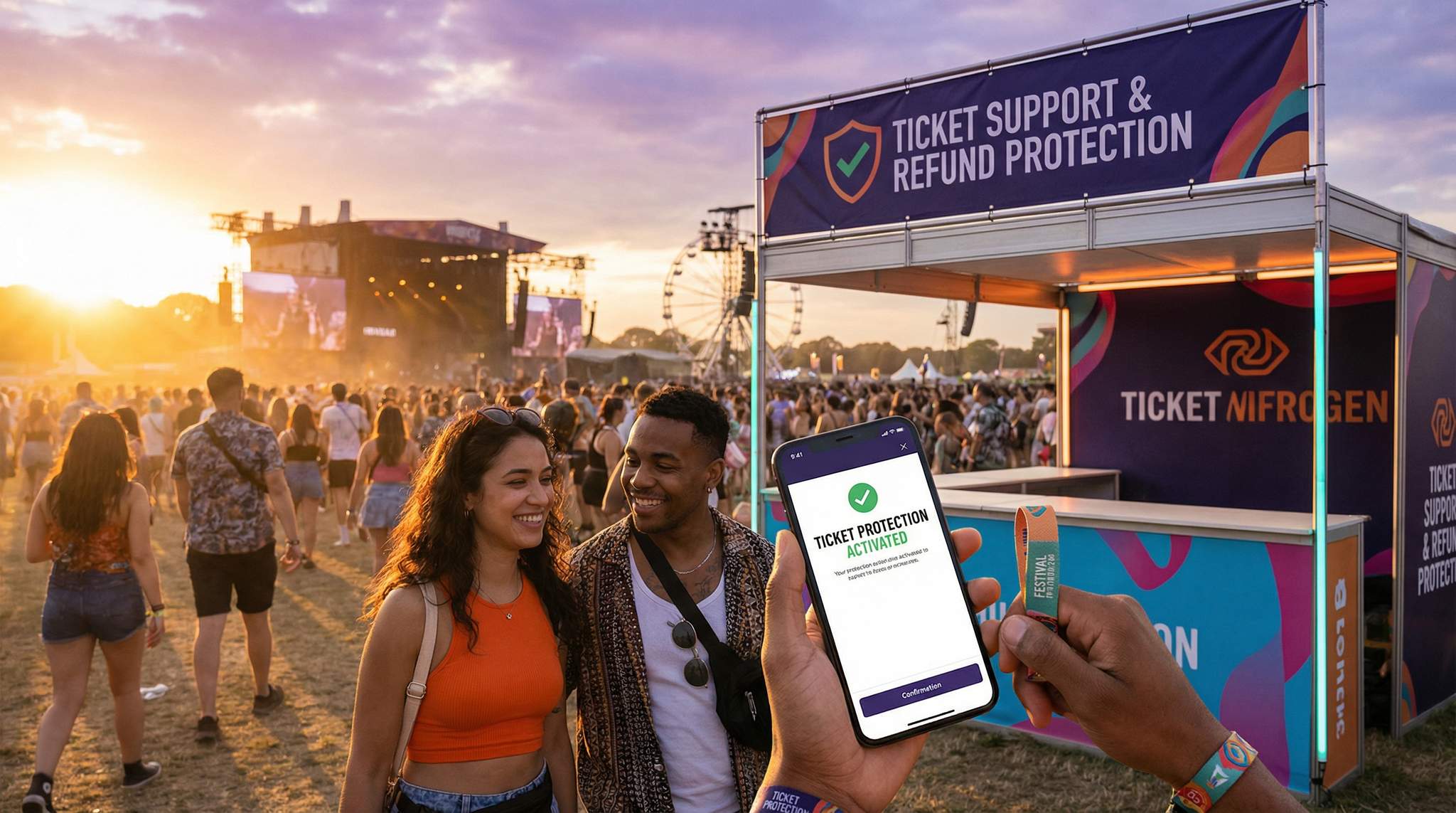

Festival producers know the stakes: fans invest significant time and money to attend epic events, and unexpected life events can derail even the best-laid plans. To protect both attendees and the festival’s bottom line, more festival organizers are turning to optional ticket insurance and refund protection as part of the ticketing process. This add-on gives ticket buyers peace of mind that if they can’t make it due to illness or emergencies, they won’t lose out – and it ensures the festival isn’t left handling last-minute refund demands or chargebacks. In a post-pandemic world where flexibility and trust are paramount, offering refund protection is emerging as a win-win strategy to boost confidence and safeguard revenue.

Understanding Ticket Insurance and Refund Protection

What Is Ticket Refund Protection?

Ticket refund protection (also known as ticket insurance or event cancellation coverage for attendees) is a voluntary add-on that ticket buyers can purchase during checkout. It functions similarly to travel insurance, but is focused on the festival ticket itself. If a fan cannot attend the festival for a covered reason, the insurance allows them to claim a refund for their ticket price even when the event’s standard policy is “no refunds.” Covered reasons are typically unexpected, legitimate events that prevent attendance. Common examples include:

– Illness or Injury: If the attendee (or sometimes an immediate family member) falls sick or is injured and can’t attend.

– Family Emergencies: Serious situations like a close relative’s hospitalization or a death in the family right before the event.

– Travel Disruptions: Unforeseen flight cancellations, serious transit delays, or even car breakdowns on the way to the venue.

– Work or School Conflicts: An unavoidable work obligation or exam that gets scheduled over the festival dates unexpectedly.

– Weather & Home Emergencies: Natural disasters or home damage (flood, fire, etc.) that require the attendee to stay home.

This type of ticket insurance is about protecting the attendee’s ticket investment. For instance, if someone spent $250 on a festival pass and breaks their leg a week before the event, refund protection would reimburse that $250 (usually excluding the small insurance fee), sparing the fan a financial loss. Without insurance, that money would normally be forfeited under the “all sales final” terms most festivals have.

Not a Free Pass – What’s Not Covered

It’s important to note that refund protection is meant for genuine, unforeseen impediments. It won’t cover situations like simply deciding not to go, disliking the lineup, poor weather forecasts, or other change-of-mind scenarios. It also typically does not apply if the event itself is cancelled – in those cases, the festival’s own refund policy kicks in for all ticket holders. Attendees should understand that insurance is for personal emergencies, not for general dissatisfaction. Clear communication about coverage exclusions (such as voluntary no-shows or predictable conflicts) will prevent misunderstandings. The goal is to offer peace of mind for legitimate emergencies while still upholding the festival’s standard no-refund policy for routine cases.

Boost Revenue With Smart Upsells

Sell merchandise, VIP upgrades, parking passes, and add-ons during checkout and via post-purchase emails. Increase average order value by up to 220%.

Why Offer Insurance at Checkout?

In the wake of global events like the COVID-19 pandemic and frequent travel disruptions, ticket buyers have become far more risk-aware. Offering insurance at checkout taps into this need for security. Attendees are more likely to click “Purchase” when they know there’s a safety net. According to TicketPlan research, UK event-goers are 85% more likely to pay for tickets in advance if refund protection is available, as it removes the fear of losing money if something goes wrong. In other words, insurance isn’t just a nice perk; it can actually increase ticket sales by encouraging earlier and more confident purchases. Fans feel taken care of, and festivals benefit from that boost in conversion.

Benefits for Attendees and Organizers

Peace of Mind Boosts Sales

For fans, the primary benefit of ticket insurance is peace of mind. Knowing their investment is protected makes them more comfortable buying tickets, especially well in advance. Festivals often go on sale months before showtime – plenty of time for plans to change or emergencies to arise. By giving ticket buyers an option to safeguard their purchase, festivals remove a major barrier to purchase. In fact, data from insurance partners shows that adding a protection option at checkout can increase overall ticket conversion rates by around 8%, as more shoppers complete the transaction instead of hesitating. This “protection effect” means that some fans who might otherwise hold off or skip buying tickets will take the leap, knowing they have an exit plan if needed. The result? Higher ticket sales and potentially faster sell-outs, all without the festival taking on additional risk.

Planning a Festival?

Ticket Fairy's festival ticketing platform handles multi-day passes, RFID wristbands, and complex festival operations.

Fewer Chargebacks and Refund Disputes

From the festival organizer’s perspective, one of the biggest advantages of refund protection is the reduction in chargebacks and payment disputes. In the absence of insurance or refunds, a ticket-buyer who can’t attend might be tempted to call their credit card company and dispute the charge (a form of “friendly fraud”). For example, if an attendee wakes up sick on festival day with no recourse for a refund, they may file a chargeback claiming they didn’t get the service they paid for. These disputes are costly and time-consuming – merchants often pay penalty fees and risk their payment processor relationships when chargebacks run high. By offering ticket insurance, festivals provide an alternate path for customers to recoup their money legitimately, greatly cutting down on chargeback cases. An attendee who purchased refund protection can get their money back from the insurer (for a valid claim) instead of dragging the festival into a dispute. Over time, this can save the festival tens of thousands in reversed transactions, bank fees, and administrative headaches. It also filters out the “sympathy” refund requests – customers are less likely to plead for special-case refunds or unleash anger on social media if they had the option to protect their purchase up front.

Protecting Revenue and Reputation

Crucially, offering insurance ensures that the festival’s revenue remains protected. When a fan uses their insurance to claim a ticket refund, the payout comes from the insurance provider, not the festival’s coffers. The festival keeps the ticket revenue (unless the event is cancelled entirely), so there’s no hit to the budget for one attendee’s emergency. This setup lets you show empathy to fans without jeopardizing your finances – a balance that’s hard to achieve otherwise. Festivals can uphold a firm no-refunds policy and still say to fans, “We’ve got you covered if life happens.” That in turn builds goodwill and trust. Attendees appreciate an event that anticipates their needs and offers solutions. As a result, your festival’s reputation for customer care grows. People are more likely to buy from you again, tell their friends, and view your event brand positively because you offered a worry-free buying experience. In an era of online reviews and instant feedback, that goodwill is worth its weight in gold.

Choosing the Right Insurance Partner

Researching Providers and Plans

To implement ticket insurance, festival organizers typically partner with a specialized third-party insurance provider. It’s important to choose a reputable partner experienced in live events. Key players in the ticket refund protection space include companies like Allianz Global Assistance (a large travel insurer that also covers event tickets), Booking Protect/Cover Genius (known for their XCover refund protection platform), TicketPlan (a UK-based refund protection pioneer), Protecht (which offers FanShield in some markets), and others. When evaluating providers, compare their coverage policies, claim processes, fees, and reputation:

– Coverage Scope: What reasons for cancellation do they cover? (e.g. illness, injury, etc. – most providers have similar lists, but some offer extras like “any reason” coverage for a higher premium).

– Price to Buyer: Is the insurance cost a flat fee or a percentage of the ticket? It should be affordable (often around 5-10% of the ticket price) so buyers feel it’s worth adding.

– Claim Process: How do ticket holders make a claim if they can’t attend? The best partners have a streamlined online claims portal and quick payout turnaround, to keep customers happy.

– Payout and Risk: Ensure the insurer pays the refunds directly to the customer so your festival isn’t tying up cash. Also clarify if there’s any minimum or maximum coverage per ticket.

– Reputation and Support: Look for providers with good reviews and solid backing. An insurance product is only valuable if the company truly honors valid claims without hassle. Check references from other festivals or venues who have used that service.

It can be helpful to ask potential providers for client references or case studies from other festivals. If, for example, an Australian festival partnered with Provider X and saw a high uptake and smooth claims for fans, that’s a good sign. You want an insurance partner that will enhance your attendees’ experience, not generate more complaints.

Integration with Your Ticketing System

Once you’ve selected a provider, the next step is integrating the insurance offer into your ticket sales platform. Many modern ticketing platforms (such as Ticket Fairy) support insurance add-ons natively or via plugins. In practice, this means during the online checkout flow, buyers will see an option like “Add Ticket Protection” with a brief description and price. Integration can often be done with minimal development – the provider supplies code or works with your ticketing vendor to enable a checkbox or selection box on the order page. Key integration tips include:

– Seamless Checkout Experience: The option to add insurance should appear at a logical point (usually right before payment). It should be as simple as ticking a box or clicking “Yes, protect my ticket” – frictionless for the user.

– Clear Description and Link to Terms: Next to the insurance offer, include a concise description (“Get a full refund if you can’t attend due to illness, injury, etc.”) and a link to full coverage details. Buyers should be able to review the fine print easily before buying.

– Default Off (Optional Opt-In): Best practice is to have the insurance unchecked by default, letting the customer actively choose it. This avoids any perception of sneaky fees. That said, make the option stand out enough that people notice it and understand its value.

– Mobile and Multi-Language Support: Ensure the insurance option is visible and works correctly on mobile ticket purchasing, and provide translations of the offer and terms if you cater to international audiences.

If your current ticketing platform doesn’t have an insurance integration, talk to your ticketing provider – they may be in the process of adding one, or you might arrange a custom integration via API. The good news is that providers like Cover Genius and TicketPlan have off-the-shelf integration kits for popular ticketing systems, so you won’t be reinventing the wheel. The goal is a smooth user experience where adding insurance is as easy as adding a T-shirt to a merch order.

Need Festival Funding?

Get the capital you need to book headliners, secure venues, and scale your festival production.

Financial and Legal Considerations

One attractive aspect of offering ticket insurance is that it typically operates at no direct cost to the event organizer. The customer pays an additional fee for the protection, and that fee goes to the insurance provider (who assumes the risk of refunds). Some insurance partners even offer a revenue-share or commission, meaning the festival could earn a small percentage of each insurance add-on sold. However, many organizers treat it primarily as a customer service enhancement rather than a profit center – the real financial benefit is in boosted ticket sales and avoided chargeback losses, not the few extra dollars per ticket in insurance kickbacks.

Legally, you’ll want to ensure that the insurance offering is compliant with regulations in all the regions you’re selling tickets. Insurance is a regulated product, so it’s essential that:

– The insurance provider is licensed or authorized to offer policies in your attendees’ countries or states. (For example, U.S. states have varying insurance rules; your partner should navigate this and provide disclosure wording as needed.)

– All terms and conditions for coverage are clearly presented to the buyer at purchase (usually via a link). Transparency is key – you don’t want anyone accusing the festival of selling a “junk add-on”. Make sure the underwriter’s name and details are available for those who want to know who is actually insuring them.

– The festival’s own ticket terms may need a tweak to mention that tickets are non-refundable unless the optional refund protection is purchased (and even then, refunds are handled by the third-party insurer under certain conditions). This sets correct expectations and legal protection for your team.

– Data privacy and customer information sharing with the insurance provider is done securely and in line with regulations like GDPR. Typically, when a buyer opts in, their relevant info (name, ticket details) will be passed to the insurer to cover them. Ensure your privacy policy covers this type of data sharing with service providers.

Most reputable insurance partners will guide you through the legal and logistical setup. They’ve likely done it hundreds of times. Nonetheless, it’s wise to have your legal counsel or a compliance expert review the arrangement – especially if you’re one of the first festivals in your region to offer such add-ons. Once everything is set up, the ongoing management is usually hands-off for the organizer, aside from promoting the option and addressing basic questions.

Communicating the Option to Attendees

Highlighting Peace of Mind in Marketing

Simply having refund protection available won’t help if ticket buyers overlook or don’t understand it. Effective communication can drive uptake and ensure customers know they have this safety net. In your marketing and ticketing pages, highlight the peace of mind aspect. For example:

– On the ticket purchase page, use messaging like “Optional Ticket Protection Available – Get a refund if you can’t attend” to grab attention.

– Include a brief note in pre-sale emails or announcements: “Worried about ‘what if’ scenarios? We’ve got you covered with optional ticket insurance at checkout.” This plants the idea before they even hit the purchase flow.

– If your festival FAQ or info site has a section about tickets, add a Q&A about refund protection: “Can I get a refund if I can’t attend?” Answer: “All sales are final, but we offer an optional Refund Protection during ticket purchase for situations like sudden illness or emergencies. If you opt in, you can reclaim your ticket cost under those circumstances.”

The tone should be positive – you’re not encouraging people to bail on your event, but rather reassuring them that it’s safe to commit to a ticket purchase. Emphasize that this is about the attendee’s peace of mind. Especially for music festivals or destination events where attendees may be booking travel, mention how insurance adds security. For instance, a festival might say: “Jedha Music Fest partners with XYZ Insurance to offer protection for your tickets – life is unpredictable, but we don’t want that to stop you from planning an amazing weekend!”

Ensuring Clarity of Coverage

To avoid confusion or false assumptions, festivals must communicate clearly what the insurance covers and how it works. Buyers should understand the key points before they purchase it. Best practices include:

– Summary of Covered Reasons: Provide a plain-language summary alongside the offer (e.g. “Covers things like accidents, unexpected illness, family bereavement, travel delays – see full terms”). This helps people grasp the value instantly.

– Link to Full Terms: Always link to the detailed coverage policy provided by the insurer. Some customers will read the fine print about documentation needed for claims or specific exclusions. Make sure that link is obvious.

– Explain the Claims Process: In a sentence or two, tell buyers how they would use the coverage if needed. For example: “If you can’t attend, you’ll simply file a claim online with our insurance partner and get reimbursed in 5-10 business days.” Knowing it’s straightforward will increase trust.

– Make No Promises Beyond Policy: Avoid phrasing that implies any reason is covered or that the festival itself will handle refunds. Use wording like “covered unforeseen circumstances” rather than an unconditional “you will get a refund no matter what.” Honesty builds trust and prevents disappointment later.

After purchase, consider sending a gentle reminder in the confirmation email. If someone added insurance, thank them and include a note: “If an emergency prevents you from attending, visit [Claims Portal Link] to submit a refund request.” If they declined it, you might say: “Please remember all sales are final, so tickets are not refundable (unless you purchased the protection option).” This reminds them they opted out, which can reduce complaints later if something happens.

Training Staff and Handling Questions

Everyone on your team – especially customer support and ticketing staff – should be well-versed in the refund protection offer. They’ll likely get questions from buyers like “What does this insurance cover exactly?” or “I forgot to add it, can I get it now?” Make sure they know the answers:

– Have an internal FAQ or cheat-sheet for staff with the coverage basics and where to direct people for claims.

– Train them to gently upsell the insurance if someone expresses worry. For instance, if a customer says “I’m not sure if I can make it, maybe I shouldn’t buy,” staff can mention the insurance option as a solution.

– Establish a policy for post-purchase inquiries: Generally, once a ticket is bought, insurance can’t be added retroactively (it must be in the original order). Empower your support to explain that and encourage the customer to consider it for future purchases.

– For any fan who did buy protection and then contacts the festival for a refund, staff should kindly redirect them: “Since you opted for refund protection, your ticket is covered! Please follow this link to submit a claim directly to our insurance partner – they handle the refund so we can’t process it on our end.” It’s important the team doesn’t inadvertently promise refunds outside of the insurance process.

By making sure your team is knowledgeable and proactive, you turn refund protection into a smooth part of the overall customer experience.

Handling Claims and Refund Scenarios

Streamlining the Claims Process

While the insurance provider will take care of evaluating claims and issuing refunds, the festival should still care about the claims experience for its attendees. A clunky or slow claims process can reflect poorly on the event by association. Work with your chosen provider to understand how fans file claims:

– Is there a dedicated claims website or portal? Make sure you have that link handy to give to any ticket holder who asks.

– What documentation is required typically? (e.g. doctor’s note for illness, police report for a car accident, etc.) Knowing this lets you give a heads-up in your FAQ: “If you file a claim, you’ll need to provide proof of why you couldn’t attend, per the insurer’s requirements.”

– What is the expected timeline for approval and refund? Top providers process claims quickly (often within a week or two). Set expectations with fans accordingly.

– Can the festival aid in any way? Sometimes confirming the ticket was unused or the event took place as scheduled might be needed. Be prepared to cooperate with the insurer if they need attendance records or verification that the event wasn’t cancelled.

Many festivals solicit feedback post-event; consider asking those who bought insurance about their experience. If you hear that claims went smoothly (or conversely, that folks had issues), use that intel in discussions with your insurance partner. A reliable partner will want to continuously improve the service – after all, happy customers reflect well on everyone.

Emergencies Without Insurance – A Delicate Balance

Inevitably, some attendees will skip purchasing the insurance and later face a crisis that prevents them from coming. How the festival handles those cases is delicate. You have a no-refund policy, but you also want to maintain goodwill. Some tips:

– Stick to Your Policy (Mostly): It’s important to be consistent. If word gets out that “you can just email and they’ll refund you anyway,” it undermines both your policy and the insurance offering. In general, kindly explain to requests that without the protection add-on, you’re unable to refund per the terms agreed.

– Offer Transfers or Resale Help: If your system allows transferring tickets to another person or if you have an official resale/waitlist platform, guide the person to that option. E.g. “While we can’t refund, you are free to give or sell your ticket to someone else. Here’s how to change the name on the ticket…” This shows empathy and gives them a potential solution.

– Discount for Future Purchase: In some cases, if you feel a gesture is warranted (long-time fan, very compelling story, etc.), you might offer a small discount code for a future event as a courtesy. Make it clear this is a one-time goodwill gesture, not a refund. This can turn a soured experience into loyalty, without setting a broad precedent.

Remember, by having offered insurance, you have a reasonable defense: “We truly wish we could help, but as a policy we don’t refund tickets unless the Ticket Protection was purchased. We make this option available specifically for situations like yours.” Most reasonable attendees will understand that they accepted the terms. And for those who don’t – well, that’s exactly why you have the insurance option and clear terms documented.

Real-World Examples and Success Stories

Festivals Embracing Refund Protection

Across the globe, many festivals have started integrating ticket insurance to positive effect. For instance, Country Fan Fest in Utah, USA (a country music festival) implemented an optional “Ticket Protection” during checkout – despite maintaining a strict no-refund policy, they give fans the chance to get a full refund (minus the insurance fee) if they request it by a day before the event. This approach has not only given their attendees confidence to buy passes well ahead of time, but it also virtually eliminated public complaints about the no-refund rule. Fans know upfront that they have an out if needed, which cuts down on frustration.

In the UK, boutique events like the Lazydays Festival partner with refund protection provider TicketPlan to offer coverage for unforeseen circumstances. Ticket buyers can add a small fee to insure their ticket, and if an accident, illness, or other covered incident occurs, they can apply for a full ticket refund through TicketPlan’s process. Festival directors have noted that this option makes attendees more comfortable purchasing because it aligns with the mindset of “plan for the best, but prepare for the worst.” By proactively addressing that concern, these festivals built trust with their audience.

Major ticketing companies have also caught on. AudienceView, a ticketing solution used by venues and events worldwide, reported that adding embedded refund protection in the checkout led to an increase in ticket purchase conversions – more people completed their orders instead of abandoning them. In fact, one insurance tech partner, Cover Genius, saw a significant uptick in events offering refund protection and cited roughly an 8% boost in conversion on those checkouts once the option was present. This mirrors what many promoters observe anecdotally: when buyers see that little checkbox offering peace of mind, they’re more inclined to hit “buy now.”

The Payoff in Goodwill and Loyalty

Festivals that have successfully offered ticket insurance often find it pays back in intangible ways as well. Attendees who ended up needing to use the insurance tend to be grateful rather than angry. Consider a hypothetical scenario: a fan saves up and splurges on a VIP festival ticket, but days before the event, they get appendicitis and land in the hospital. Normally, this would be a double blow – missing a cherished event and losing a hefty sum. If that fan had refund protection, they can recoup their $500 ticket cost. While they’re still sad to miss the show, their impression of the festival isn’t soured by a financial loss. In fact, they may be even more loyal, knowing the organizers had a system in place to take care of them. There are stories of fans sending thank-you notes to festivals for offering insurance, because it “saved” them in a crisis.

On the flip side, festivals without such options sometimes face social media outrage from individuals who beg for exceptions and don’t get them. It’s hard to quantify the negative word-of-mouth that can generate. By contrast, when you offer a clearly communicated path for refunds via insurance, you are effectively outsourcing the difficult part of empathy – you can sympathize with the fan while pointing them to the solution they chose to protect themselves. Over time, this fosters a community that feels the festival truly has their back. And a happy, trusting audience is one that will return year after year, sustaining your festival in the long run.