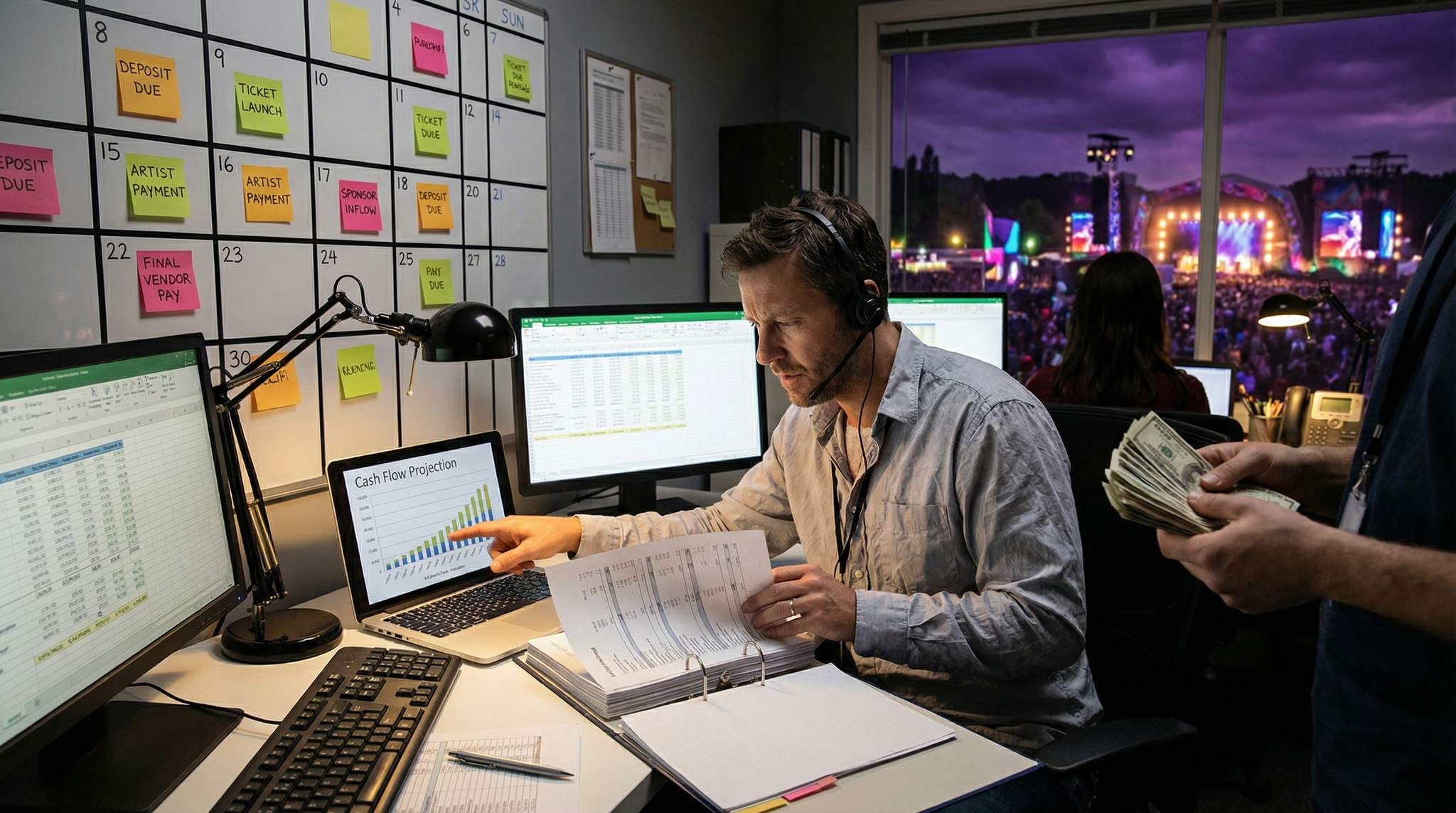

When planning a festival, it’s easy to get caught up in the excitement of booking acts and designing experiences, but one of the most critical underpinnings of it all is money – specifically, managing how money flows in and out over time. A festival’s budget isn’t just about balancing total income vs. expenses; it’s also about making sure you have cash on hand at the right times to pay for things. This is where a budget timeline and cash flow management plan becomes vital. Festivals often have to spend a lot of money upfront (deposits, marketing, infrastructure), while ticket revenue and sponsorship money might come later. You don’t want to be in a situation where you can’t pay a vendor because funds are tied up or not yet received. In this article, we’ll discuss how to map out when major expenses hit, when revenue arrives, and how to keep your cash flow healthy. We’ll also share tips like negotiating payment schedules and arranging short-term financing to bridge gaps.

Map Out Major Expenses vs. Income Over Time

Start by plotting a cash flow calendar. This is different from a typical budget that just tallies totals. A cash flow calendar shows when each transaction happens. You can do this on a monthly timeline (or weekly as the event nears) from now until after the festival.

Expenses Timeline: List all significant expenses and mark when you’ll need to pay them. Common examples:

- Venue Deposit: Often due upon signing or months in advance.

- Artist Deposits: Many performers require 50% deposit on signing, and 50% right before or at the event.

- Production Deposits: Rental companies might ask for a deposit to reserve equipment, then the remainder after the event or upon delivery.

- Marketing Costs: When will you spend on ads, printing flyers, etc.? These might be spread over time.

- Permits/Insurance Fees: Often paid during application, which could be 6-3 months out.

- Staff Salaries/Contract Fees: Are you paying someone monthly? Or a big chunk at the end? Consultants might invoice periodically.

- Infrastructure/Build Costs: Some materials need upfront purchase (like decor items), whereas labor to build may be paid during/after.

- Emergency Funds: Keep a note if you plan to set aside contingency funds (e.g., an extra $5k for unexpected needs) – and decide when you’d tap into that.

Layout these in the month they occur. You might see, for example, a huge spike in spending the month before the festival (final payments, printing, site prep costs). Recognizing those spikes is crucial.

Income Timeline: Do the same for all revenue.

- Ticket Sales: If you start selling tickets 6 months out, you’ll have a trickle or wave of income at certain points – e.g., surges when you launch, another surge at a price increase deadline, and a final surge in the weeks/day-of event ticket sales. Plot out conservative estimates for each month leading to the event.

- Sponsorship Payments: Sponsorship deals have their own schedules. Some sponsors pay 50% on signing the deal and 50% after the event (or upon invoice deliverables), others might pay 100% upfront (rare but great if so), or some might pay right after the festival once they’ve gotten an invoice and report. Clarify with each sponsor and put expected payment dates on your timeline. You may need to invoice them by a certain date to get paid in time.

- Vendor Fees: If you charge vendors (food trucks, etc.) a fee or percentage, note when those are collected. Often vendors might pay a deposit to reserve spot (income pre-event) and maybe any percentage of sales after the event.

- Grants or Public Funding: If applicable, note when grant funds are disbursed (could be upfront or reimbursement-based after showing costs).

- Merchandise Sales: If you sell merch online before, that might bring some revenue early. On-site merch sales will only materialize during the event.

- Other Income: Maybe parking fees, VIP upgrades, etc., likely come with ticket sales or on-site.

Now, line up the expenses vs. income by month. You might use a spreadsheet with one column for each month leading to the event (and even a month or two after, since some bills come due post-event). Then mark totals of cash out and cash in each month.

Planning a Festival?

Ticket Fairy's festival ticketing platform handles multi-day passes, RFID wristbands, and complex festival operations.

This will reveal potential problems, e.g., a huge cash outflow in July but not enough inflow until August, meaning you’d be running negative in July if you don’t have reserves.

Ensuring Funds are Available (Avoiding Cash Crunches)

Many events are profitable on paper but face a cash crunch because money comes in after money needs to go out. To avoid that:

- Build a Reserve/Emergency Fund: In your budgeting, try to maintain a buffer of cash (even a few thousand) that you don’t allocate until you’re sure all bills are covered. This helps with unplanned costs or delays in expected revenue.

- Schedule Ticket Income Wisely: That usually means launching ticket sales as early as feasible to get money in the door. Early bird sales not only boost marketing momentum but give you working capital. Some big festivals start sales a year out. For a new fest, maybe 6 months out at least. Offer tiered pricing or special bundles early – basically incentivize attendees to buy sooner, which helps your cash situation.

- Push for Upfront Payments: For sponsorships, try to negotiate at least part of their fee upfront. If a sponsor is paying $10k, ask for 50% on signing (which might be a few months out) and 50% by the event date. If they insist on post-event payment, see if they can do within 15 days after event – you don’t want to chase money months later while interest is adding up on your credit card because you fronted costs.

- Stagger Expenses: Some costs can be timed. For example, can you split an invoice? Many vendors are willing to take a deposit and then final payment after. Use that! If a stage rental is $20k, paying $10k now and $10k later gives you breathing room. Also, order non-urgent items (like some decor or merch) at times when cash flow is stronger. Perhaps delay some purchases to just-in-time if that helps (but careful not to cause rush fees).

- Monitor Monthly Cash Position: As the festival nears, update actuals vs. expected on your cash flow calendar. If a sponsor payment is late, you’ll see a shortfall. If ticket sales are better than expected in a given month, note that you have extra cushion. I recommend calculating a running balance: “Starting cash + income this month – expenses this month = ending cash.” This shows if any month goes negative. If you see a negative, you need to address it in advance (either by cutting or delaying expenses, or accelerating income or having a loan/line up).

Negotiating Payment Schedules with Vendors and Talent

Most vendors and talent have standard terms, but there is often wiggle room, especially if you communicate early and professionally.

- Talent Payments: The standard is usually 50% on signing and 50% shortly before or at performance. Some smaller artists might even accept payment on the day of (especially if trust is built). However, big agents might demand full balance a week or two out via wire transfer. Try negotiating deposit to be smaller (like 25% deposit, balance after performance) – not all will agree, but if an artist is particularly keen or it’s a local act, they might be flexible. Always follow through on whatever you agree, or you’ll burn bridges.

- Equipment Rentals/Production: Many production companies are used to events where money can be tight until ticket sales come in. See if they can agree to, say, 30% deposit, 40% by delivery, 30% net 15 days after event. Or any breakdown that pushes some payment post-event. They might charge a little more or need a credit card on file, but if it helps cash flow, consider it. If they won’t budge on schedule, maybe they’ll accept a credit card (which effectively gives you a grace period if you can pay it after your next influx of cash).

- Venues: Some venues (especially city or public ones) might require full payment upfront or by event date. Private venues might take a deposit and then balance after event, especially if any damages or overtime need settling. Talk to them – sometimes you can pay a bit less upfront if you have a good relationship or if they trust your event’s projections.

- Vendors (Food/Market): If you are paying vendors (sometimes festivals pay guarantees to food trucks, but often it’s the opposite – they pay you or it’s revenue share), try to structure it so you’re not out of pocket too early. Usually, you wouldn’t pay vendors; they pay you or keep their sales. But if you promised something like covering their travel or a per diem, you can provide that on site rather than before.

- Marketing Contracts: If you hire agencies or place ads, ask if any large invoices can be split. For example, an agency doing a $5000 campaign might accept 50% upfront, 50% at campaign end (which might align near the event date when you have ticket revenue).

- Staging & Site services: Portable toilet companies, fencing, generators – often smaller vendors might be fine with net-30 invoicing (meaning they invoice after event, you have 30 days to pay). If you can secure those terms, that’s ideal because then you pay after hopefully your ticket money has come in. It doesn’t hurt to ask what terms they offer; sometimes they even have early payment discounts – flip side, if you do have cash early, maybe pay some things early to get a small discount.

Always get payment terms in writing (in contracts or emails) to avoid misunderstandings. And set reminders for each payment due – missing a deposit due date can cause a contract to be voided potentially.

Handling Revenue in Phases

Say your festival has multiple ticket tiers or revenue streams; plan their timeline:

- Early Bird Ticket Phase: e.g., 6 months out, maybe at a discount. Good injection of cash early. Make sure to calculate how many early birds you can afford (too many at discounted rate might hurt later cash, but needed early).

- General Sale Phase: e.g., 3-4 months out onward, main bulk of sales.

- Last-Minute Sales: final weeks, often peak sales. But that money arrives very late, maybe days before show or at box office. Don’t rely on last-minute sales to pay for things that were due earlier.

- Sponsorship Installments: If multiple sponsors, stagger their asks. Maybe aim to have some deals closed (and partial paid) 6 months out, some mid, some new late sponsors can be allowed if they’re paying at signing.

- On-site Sales: like merch or food revenue cuts. Those you likely only get days after event when you count and settle with vendors. So they won’t help pre-event cash but can help pay off any short-term credit used.

Short-Term Financing Options

Even with careful planning, you might find a gap – e.g., you must pay $50k in production and talent this month but you only have $30k on hand and expect another $30k from tickets next month. How to cover that $20k shortfall for a few weeks?

Need Festival Funding?

Get the capital you need to book headliners, secure venues, and scale your festival production.

- Loans/Lines of Credit: If you have a business entity for the festival, you might secure a line of credit from a bank or a short-term loan. This can be tricky for first-time events without track record. Sometimes organizers finance via personal loans or credit lines. If you go this route, account for interest costs in your budget and have a clear plan to pay it back as soon as the revenue comes in.

- Bridging with Personal Funds: Some people stash savings or other personal money to float gaps, expecting to reimburse themselves after. If you do this, track it as a loan to the festival in your budget. Only advisable if you’re confident in the incoming revenue.

- Sponsor Advances: If you have a good relationship, see if a sponsor can pay earlier (maybe in exchange for a small discount or extra benefit). Or if a friend or family investor believes in the event, maybe a short-term investment that you repay with a small premium after the festival.

- Crowdfunding or Pre-sales: Some events raise funds via Kickstarter/Indiegogo – those usually give you money upfront in exchange for future tickets/merch and a sense of community support. It’s an option if you need seed cash long before ticket revenue flows.

- Vendor/Supplier Credit: Occasionally, a supplier might agree to be paid after event because they trust you or want the business – that’s essentially them giving you short-term credit. This is ideal if you can negotiate it (e.g., a printer prints your programs and agrees to get paid 30 days after event).

Whatever the method, be cautious about borrowing more than you truly need, as paying it back can eat into your profit. But a strategic small financing can oil the gears and prevent, say, an artist dropping out because you didn’t pay their deposit on time – which would be catastrophic for sales.

Keep the Budget Updated and Tight Control

Cash flow management is an ongoing task:

- Revisit your cash flow sheet whenever a major change occurs (ticket sales pacing differently, a new cost added). Adjust those monthly tallies.

- Cut or Delay costs if needed: If you see a cash shortfall coming and can’t increase revenue in time, consider where you can trim or delay. For instance, maybe you planned an expensive decor piece – could you scale it down or cut it to save money? Or delay printing an expensive brochure until closer (or do digital) so you spend in a later month when you have cash.

- Regular Financial Check-ins: Make finance a part of team meetings. Maybe monthly early on and weekly later, share a quick “financial health” update: current cash in bank, expected outflows soon, any concerns. Don’t keep money talk siloed with just one person; other leads should know if budgets are tight so they act accordingly.

- Avoid Unnecessary Early Spending: It’s tempting to start buying cool stuff early (like merch way ahead, or bunch of supplies). But unless necessary, hold off non-critical purchases until you have stronger cash inflow. Essentially, prioritize spending that’s crucial for making more money or is time-sensitive (e.g., marketing early yields ticket sales, do that; buying decorative lanterns can maybe wait a bit).

- Post-Event Settlements: Remember, you likely have some post-event expenses: staff payments, venue settlement (for any damages/overtime), processing refunds if any, etc. Keep some of the on-site revenue to cover those. List them in the cash flow timeline after event so you don’t splurge all income not realizing some bills remain.

A final note: It’s often said, cash flow is king in events. You might have an overall budget of break-even or profit, but if cash flow is mismatched, you can hit a crisis. Many events fail not because they couldn’t eventually turn a profit, but because they ran out of money at a critical juncture and couldn’t continue. For example, if you can’t pay the final venue installment a week before, they might cancel your event – a disastrous outcome even if you were going to get ticket money later.

By carefully planning the budget timeline and actively managing cash flow, you’re essentially acting as your event’s financial air-traffic controller, making sure every dollar lands and takes off at the right time without causing a crash. With keen oversight and smart negotiating, you can navigate those tricky cash flow turbulence and keep the festival financially on solid ground from beginning to end.

Frequently Asked Questions

How do you create a festival cash flow calendar?

Create a cash flow calendar by plotting expenses and income on a monthly timeline rather than just tallying totals. List significant costs like venue and artist deposits in the specific months they are due, and align them against expected revenue streams like ticket sales and sponsorship payments to identify potential cash shortfalls.

How can festival organizers avoid running out of cash before the event?

Organizers can avoid cash crunches by building an emergency reserve fund and launching ticket sales early to generate working capital. Additionally, negotiating staggered payment schedules with vendors and requesting upfront payments from sponsors helps ensure funds are available to cover deposits and infrastructure costs before the event occurs.

What are standard payment terms for festival artists and vendors?

Standard talent payments often require a 50% deposit upon signing and the remaining 50% before the performance. For equipment rentals and production, organizers can often negotiate split payments, such as a 30% deposit, 40% upon delivery, and the final 30% paid 15 days after the event to ease cash flow pressure.

Why is cash flow management different from a standard festival budget?

A standard budget balances total income against total expenses, whereas cash flow management tracks exactly when money moves in and out. This distinction is critical because a profitable event can still fail if expenses like deposits fall due in months before sufficient revenue from tickets or sponsorships has been collected.

What financing options are available to cover festival budget gaps?

Short-term financing options include securing a business line of credit, utilizing personal funds, or requesting advances from sponsors. Organizers can also explore crowdfunding campaigns for seed money or negotiate vendor credit, where suppliers agree to be paid 30 days after the event when ticket revenue is fully realized.

When do sponsors typically pay festival sponsorship fees?

Sponsorship payment schedules vary, with some deals requiring 50% upon signing and 50% after the event. To improve cash flow, organizers should negotiate for larger upfront portions or ensure post-event payments are due within 15 days to avoid long delays. Always clarify specific payment dates in the contract.