The New Risk Landscape for Venues in 2026

Evolving Threats and Rising Claims

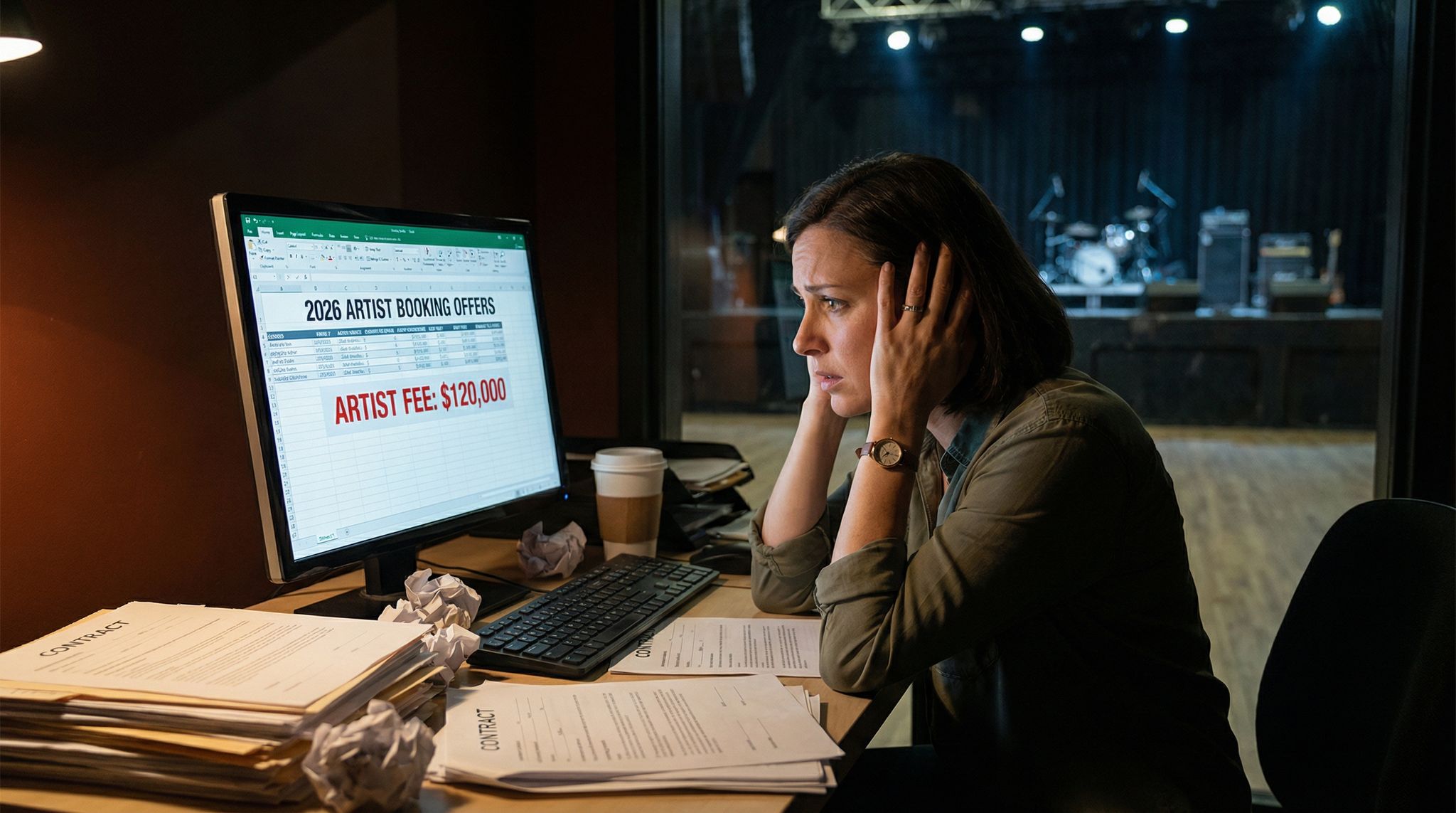

Live music and event venues face an increasingly perilous risk landscape in 2026. From small clubs to massive arenas, a single incident can lead to devastating financial losses if you’re not prepared. Legal liabilities are surging – businesses across the U.S. report soaring insurance premiums due to more frequent lawsuits and huge jury awards. At the same time, extreme weather events amplified by climate change are hitting venues hard. In just the first half of 2025, catastrophic storms and disasters caused over $100 billion in damage in the U.S., with insurers paying out a record $93–126 billion according to recent climate data analysis. Globally, insured losses from natural catastrophes reached roughly $108 billion in 2023 as reported by global insurance monitors. These trends make one thing clear: venues must proactively protect themselves from both liabilities and losses, or risk getting wiped out.

Why Insurance Is Non-Negotiable for Venues

The harsh reality is that one accident, one lawsuit, or one storm can bankrupt an uninsured venue. Seasoned venue operators can recount cautionary tales of peers who lost everything overnight. For instance, in 2021 the Bonnaroo festival in Tennessee was canceled at the last minute when Hurricane Ida’s remnants flooded the grounds, highlighting the need for festival insurance for hurricanes, forcing organizers and the venue to refund tickets and eat enormous costs. Even worse, consider the tragedy at Astroworld 2021 – a crowd crush led to 10 deaths and hundreds of injuries. The venue’s liability insurance policy was only $26 million, nowhere near the hundreds of millions in claims victims sought. Major lawsuits are increasingly common, even outside of headline tragedies. If a concertgoer slips on a wet floor and breaks a leg, or a falling speaker injures a fan, you as the venue owner will likely be on the hook for medical bills, damages, and legal fees. The average slip-and-fall injury claim costs around $20,000, and defending the lawsuit adds about $50,000 more based on average slip-and-fall lawsuit costs – sums that could wipe out a small venue. According to OSHA, slips, trips and falls are responsible for 15% of all accidental deaths and roughly 25% of insurance claims in workplaces according to general industry accident reports, underscoring how common – and costly – these incidents can be. In 2026’s litigious environment, robust insurance coverage isn’t a luxury for venue operators, it’s a necessity. It’s the safety net that keeps an unforeseen disaster from turning into a business-ending catastrophe.

Learning from Real-Life Venue Disasters

Experienced venue managers know that “anything that can go wrong, will go wrong eventually.” The past decade alone has given plenty of sobering examples. Extreme weather has ripped through open-air venues and arenas alike – from sudden windstorms that collapsed stages and killed fans at festivals like Belgium’s Pukkelpop in 2011 as detailed in reports on the tragedy, to winter blizzards that have torn venue roofs. Weather isn’t the only threat. We’ve seen fire catastrophes in packed nightclubs, like the infamous Station nightclub fire (2003) and others, leading to massive liability claims against venue owners. More recently, crowd safety failures such as the Astroworld tragedy have generated a tsunami of litigation – with over 600 victims filing suits against organizers and venue operators resulting in massive damage claim estimates. In that case, multiple defendants had significant coverage (reports suggest one promoter carried $200 million+ in liability insurance) according to legal filings and insurance analysis, yet even those sums may not fully cover the eventual settlements. The lesson is clear: major incidents can produce damage and liability far beyond ordinary policy limits. This is why top venues carry high coverage limits and umbrella policies (we’ll explain those soon) to handle worst-case scenarios. It’s also why smart operators treat insurance as just one part of a broader risk management strategy – you hope to never need to file a huge claim by preventing disasters in the first place. Still, as the saying goes, hope is not a strategy. You need solid insurance as your fail-safe when preventive measures aren’t enough.

Common Venue Risks and Insurance Solutions

In the live events business, it’s not if something will go wrong – it’s when. The table below highlights a few nightmare scenarios that venues face and the insurance policies that can help soften the blow:

Boost Revenue With Smart Upsells

Sell merchandise, VIP upgrades, parking passes, and add-ons during checkout and via post-purchase emails. Increase average order value by up to 220%.

| Risk Scenario | Potential Losses | Insurance to Mitigate |

|---|---|---|

| Fan injury from a fall or accident on-site | Lawsuit costs, medical bills, legal defense fees | General Liability – covers bodily injury claims, legal defense, and settlements arising from injuries or property damage to third parties |

| Stage equipment theft or venue fire | Equipment replacement, building repairs; lost income during closure | Property Insurance – covers damage to your building, sound/lighting equipment, and other assets. Business Interruption – covers lost revenue and extra expenses if you must close for repairs after a covered property loss |

| Major event canceled due to extreme weather | Lost ticket revenue, vendor deposits, refund costs, sunk marketing spend | Event Cancellation Insurance – reimburses lost revenues and unrecoverable costs if an event is canceled or postponed for a covered reason (e.g. severe weather or artist illness, depending on policy) |

| Intoxicated patron causes an accident after leaving venue | Legal liability for injuries or property damage to third parties, potential lawsuit payouts, reputational harm | Liquor Liability Insurance – covers alcohol-related incidents and lawsuits (e.g. a DUI crash or fight) that occur due to serving alcohol at your venue, which general liability typically excludes |

| Cyber-attack breaches ticketing or payment systems | Data theft, customer notification and credit monitoring costs, regulatory fines, business interruption from IT outage | Cyber Liability Insurance – covers data breach response (forensic investigations, notification, credit monitoring), legal liability for compromised customer data, and even cyber extortion payments or system restoration costs |

| Staff member injured while working a show | Medical bills, rehabilitation, lost wages, potential disability claims or lawsuits by employee | Workers’ Compensation (or Employer’s Liability) – covers employee injuries on the job, including medical expenses and a portion of lost wages; often legally required and exclusive remedy in workplace injury cases |

Each of these insurance types plays a role in a comprehensive venue protection plan. In the sections that follow, we’ll demystify each policy – what it covers, why you need it, and how to secure the right coverage for your venue. By understanding these essentials, you can work with your insurance broker to build an ironclad safety net. The goal is peace of mind: when something does go wrong (and it will eventually), you won’t be panicking about how to pay for it.

General Liability Insurance: Your First Line of Defense

What General Liability Covers

General Liability (GL) insurance – sometimes called Public Liability outside the U.S. – is the foundation of any venue’s insurance program. This policy protects your venue from claims of bodily injury or property damage suffered by third parties (your patrons, artists, crew, or anyone else who isn’t an employee). In plain language, if someone gets hurt or their property is damaged in connection with your venue or event, your GL policy will step in to cover:

Ready to Sell Tickets?

Create professional event pages with built-in payment processing, marketing tools, and real-time analytics.

- Medical costs and injury claims – e.g. a concertgoer trips on an uneven step or a falling light fixture injures an audience member. GL pays for the injured party’s medical treatment, and any damages awarded for pain and suffering.

- Property damage claims – e.g. a band’s expensive projector falls and is destroyed because your rigging failed, or a patron’s car is damaged in your parking lot due to venue negligence. GL covers repairing or replacing others’ property that your venue is liable for.

- Legal defense and court judgments – Critically, GL pays for your legal expenses if someone sues you over an injury or damage (often hundreds of dollars an hour for attorneys). It also will pay settlements or court-awarded damages up to the policy limit. For many venue operators, this legal defense coverage is as valuable as the damages coverage – lawsuits get expensive fast.

Think of GL insurance as the “catch-all” liability shield for the countless mishaps that can happen on venue premises or at your events. Without it, even a minor incident could cost you tens of thousands in out-of-pocket payouts. And a major incident, like a life-altering injury, could result in liability well into the millions.

Injuries, Accidents, and Lawsuits: Real Claims Examples

It’s sobering how quickly routine events can turn into costly claims. Consider a real scenario one venue faced: during a live show, a pyrotechnic effect triggered a small fire, causing the crowd to surge. In the chaos, several attendees were injured. Lawsuits followed, alleging negligence in crowd control and safety measures. The venue’s general liability insurer ultimately paid out over $1 million in combined settlements and legal fees. In another case, a fan at a nightclub sued after slipping on a spilled drink on the dance floor, suffering a back injury. That relatively simple slip-and-fall incident led to a $250,000 claim once medical bills and legal costs were tallied – and the venue was thankful to have GL coverage.

Most claims are less dramatic, but they add up. Insurance industry data shows slip-and-fall injuries are among the most frequent and costly claims for businesses. The average cost of a slip-and-fall injury itself is around $20,000, and the legal defense alone can run another $50,000 on average for legal defense in slip-and-fall cases. Now imagine a more severe injury or multiple people hurt – the liability costs can skyrocket beyond the reach of a small business’s finances. GL insurance is designed to absorb those blows. It covers not only the direct payouts to injured parties, but also the attorney fees, court costs, and expert witness fees needed to defend your venue in court. Even unfounded lawsuits still cost money to fight; your insurer takes on that burden.

Without GL, a venue owner has two bad options after an incident: either pay all costs out-of-pocket (potentially bankrupting the business) or refuse to pay and risk a court judgment that could seize business and personal assets. With GL insurance, one accident won’t sink your venue – the insurance company handles the payouts (after you meet any deductible) and protects you legally.

Accept Payments Across 8 Global Markets

Local currency processing in the US, UK, Canada, Australia, New Zealand, India, Indonesia, and Mexico with region-specific payment methods.

Coverage Limits and Umbrella Policies

When purchasing general liability insurance, choosing the right coverage limit is critical. The policy limit is the maximum amount the insurer will pay for a single incident (per occurrence) and often a separate limit for all incidents combined (aggregate) in a year. Industry-standard minimums for small venues are around $1 million per occurrence (and $2–3 million aggregate). However, in today’s environment those figures are on the low side. A severe injury or fatality can easily result in claims beyond $1 million. Larger venues or those hosting high-profile events often carry $5 million, $10 million or higher limits per occurrence to be safe.

How do you determine the right amount? It depends on your venue’s capacity, the nature of events, and your risk tolerance. A 200-capacity comedy club might feel comfortable with $1 million coverage, whereas a 20,000-seat arena likely needs $25 million+ in combined liability coverage. If that sounds like a lot, consider the Astroworld example: a stadium and festival operator carried a $26 million GL policy which proved insufficient for the scale of claims, yet that was a drop in the bucket compared to the claims. Risk experts often advise that venues buy as much liability insurance as they can reasonably afford, because legal costs and jury awards keep trending upward.

Grow Your Events

Leverage referral marketing, social sharing incentives, and audience insights to sell more tickets.

One way venues increase their liability protection is through an umbrella policy (also known as excess liability insurance). Umbrella coverage kicks in after you exhaust the limits of your main general liability (and other liability policies, like auto or employer’s liability). For example, you might have $5 million primary GL coverage, and then a $20 million umbrella policy sitting on top. If a catastrophic claim comes in at $10 million, your GL pays the first $5M, and the umbrella covers the remaining $5M. Umbrella policies tend to be cost-effective, providing high limits for a lower premium per dollar of coverage than basic GL. Many mid-size and large venues use umbrella insurance to achieve the high coverage totals that artist contracts, touring productions, or local regulations might require. It’s not uncommon for major arenas and stadiums to effectively have $50 million or more in liability coverage once you count their umbrella layers – a reflection of just how expensive worst-case incidents can be.

Avoiding Gaps and Meeting Requirements

Having general liability insurance is not just smart – it’s often mandated in practice. In many jurisdictions, you can’t even obtain an event permit or liquor license without proving you have liability coverage in place. Promoters and corporate clients renting your venue will likely contractually require you to carry a certain minimum GL limit (and to list them as “additional insureds” on your policy). For instance, a city might require at least a $1–5 million liability policy to grant a public event permit, and a major concert promoter might require the venue to show $5 million coverage before bringing their tour. Failing to meet these requirements can result in canceled deals or being barred from hosting events.

It’s also critical to ensure your GL policy is tailored to venue operations – some generic business liability policies might exclude things that venues need, like coverage for pyrotechnics, participants (if you have interactive events), or even assault and battery (important if you have security staff). Work closely with your broker to be sure common venue scenarios aren’t excluded. If your venue wears many hats – hosting concerts one day and eSports tournaments the next – double-check that all those activities are covered under the policy. (Often, optimizing multi-purpose venue operations need custom coverage endorsements to address the different liability risks.) The last thing you want is to assume “we have insurance,” only to discover an exclusion when a claim arises.

Bottom line: General liability insurance is your venue’s legal shield against the unpredictable. It should be the first policy you secure. Get sufficient limits, keep the coverage active (lapsed insurance = no coverage for an incident that day), and review it annually to make sure it keeps pace with your venue’s growth and activities.

Property and Business Interruption Insurance: Safeguarding Your Assets

Protecting Your Venue’s Physical Assets

While liability insurance covers claims by others against you, Property insurance covers damage to your venue’s own property and equipment. If you own the building (or even if you just own the contents and improvements inside a rented space), property insurance is what reimburses you when physical things are damaged, destroyed, or stolen. Typical property policies for venues cover:

- Buildings and structures – If you own your venue’s building or any physical structures (e.g. outdoor stages, ticket booths), the policy can cover repair or reconstruction costs if they’re damaged by a covered peril (fire, lightning, wind, vandalism, etc.). Even if you rent, you might be responsible for insuring interior improvements you made.

- Contents and equipment – This includes your sound and lighting systems, musical instruments owned by the venue, seating, furniture, decor, computers, cash registers – all the stuff inside. If a pipe bursts and floods the venue, your property policy would pay to repair the water damage to your gear and furnishings. If thieves break in and steal $50,000 of audio equipment, property insurance covers the loss (after your deductible).

- Inventory and supplies – For venues that sell merchandise, food, or beverages, property coverage can extend to inventory. If your concession stock spoils due to a power outage or your merch booth is ransacked, those losses could be covered.

Importantly, standard property insurance covers specific causes of loss listed in the policy (common ones include fire, smoke, explosion, burst pipes, storms, theft, and vandalism). Some policies are “named peril,” meaning they list exactly what’s covered, while broader “all-risk” policies cover everything except what’s excluded. Key exclusions to be aware of: floods and earthquakes are usually not covered by standard property insurance. If your venue is in a flood zone or quake-prone area, you’ll need separate flood insurance or an earthquake rider. (Many venues learned this the hard way – insurers have largely stopped covering flood/quake in base policies due to high costs.) For example, coastal venues from Florida to Southeast Asia face hurricane and typhoon threats that require special coverage, specifically festival insurance for hurricanes and severe storms, and venues in California or Japan should obtain earthquake coverage due to the real risk of seismic damage.

Property insurance provides funds to repair or replace your assets at current value (make sure to insure for replacement cost, not depreciated actual value, so you can afford new equipment). But damage to physical property is often only half the story when disaster strikes. The other half is the revenue you lose while your venue is out of commission – which is where business interruption coverage becomes vital.

Business Interruption: Covering Lost Income

Imagine a worst-case scenario: an electrical fire breaks out and guts your venue’s main stage and lobby. Beyond the $500,000 in physical damages, you also have to close for 6 months to rebuild. During that time you’ll likely cancel dozens of events, losing ticket sales, bar revenue, rentals, etc. Those lost profits are not covered by standard property insurance – it only pays for the physical repairs. This is why Business Interruption (BI) insurance is a lifesaver. BI coverage (often added as an endorsement or included in a package with property insurance) is designed to replace your lost income and cover ongoing expenses when your venue is forced to shut down due to a covered property loss.

Here’s how business interruption works: if an insured peril (say, a fire) causes damage that requires you to suspend operations, the policy will reimburse you for the profits you would have earned during the downtime, based on past financial records and projections. It also typically covers necessary continuing expenses – think of things like staff salaries, rent, utility bills, loan payments – that still must be paid even when the venue is closed. Essentially, BI coverage aims to put your business in the financial position it would have been if no loss had occurred. This can be the difference between reopening after a disaster or going bankrupt.

A real example: In late 2018, a historic 1000-seat theater in the UK suffered major roof damage after a brutal winter storm. The property policy paid for the £1.2 million in repairs to the building. But equally important, the theater had business interruption insurance that covered roughly £8,000 per day in lost revenue and extra expenses. That policy kept cash flowing to pay staff and contractors for the four months the venue was dark, allowing the theater to reopen smoothly once repairs were done – without piling up debt. Many venues that endure fires, floods, or storms only survive because BI insurance sustains them during the closure.

However, BI coverage has its limits and conditions. It usually only triggers if the cause of the shutdown is physical damage to insured property by a covered peril. This became a huge issue during COVID-19: venues worldwide had to close due to government orders and disease outbreak, not due to physical damage, so insurers denied BI claims in most cases. Policies also often explicitly exclude losses from pandemics or communicable disease. For example, one Atlantic City casino had a $50 million business interruption policy, but insurers refused payout for COVID lockdown losses, arguing there was no physical damage from the virus leading to denied business interruption claims. That issue is still tied up in courts as of 2024. By and large, venues learned in 2020 that standard BI insurance wouldn’t cover pandemic-related closures – a painful lesson that left many scrambling for government aid.

In 2026, you should assume epidemics/pandemics are not covered by your BI insurance unless you’ve bought a special rider (which are extremely expensive and rare now). Some governments stepped in with temporary solutions – the UK, for instance, launched a £750 million government-backed event cancellation insurance scheme in 2021 to support the UK live events industry – but those programs have sunset. So, for risks like pandemics that aren’t covered, you’ll need contingency plans (flexible booking policies, cash reserves, etc.) outside of insurance.

That said, business interruption is still crucial for the classic venue disasters (fire, storm, etc.). When buying BI coverage, pay attention to:

- Coverage amount and period: Make sure the policy limit and “period of restoration” are sufficient for a worst-case rebuild scenario. If your venue would take 12 months to repair after a total loss, ensure the policy can pay for 12 months of lost income. Many policies default to 6 months; you might need to extend that.

- Waiting period (deductible): BI usually has a time deductible (e.g. 48 or 72 hours) – the first couple days of outage aren’t covered. You might arrange events around this or negotiate what’s feasible.

- Extra Expense coverage: Often included with BI, this covers expenses that reduce the overall loss. For example, if you rent a temporary facility to host shows while your venue is repaired, that cost can be covered because it helps you resume operations sooner.

- Utility/service interruptions: Some policies can cover losses due to power outages or other service disruptions from an off-site incident (like the power grid going down). This is a good add-on if a blackout could halt your events.

The takeaway: Insure your income, not just your stuff. Venues have significant fixed costs and thin margins; going dark for even a few weeks can be ruinous if you aren’t compensated for the revenue drought. Property insurance and business interruption together provide a financial lifeline to rebuild and reopen after disaster. Just be clear on what’s covered and what’s not – and consider worst-case scenarios. Insurers and risk analysts are warning that with climate change, certain areas are becoming nearly uninsurable due to repeated disasters as home insurance risks increase nationwide. The cost and availability of property coverage might change, so locking in adequate coverage now and investing in risk mitigation (like proper sprinklers, alarms, weatherproofing) can pay off through both fewer claims and continued insurability.

Ensuring Adequate Coverage (Don’t Underinsure!)

One pitfall to avoid is underinsuring your property. If your policy’s coverage limit is far below the actual value of your building or contents, you could be in for a nasty surprise due to coinsurance clauses. Many commercial property policies include a requirement that you insure at least, say, 80% of the property’s full value – if you don’t, they won’t fully pay even partial losses. Always work with your broker to estimate the replacement cost of your venue and equipment. Update these values annually, especially given inflation and the rising cost of construction in 2026. It’s better to slightly over-insure your property than to come up short after a loss.

For business interruption, calculating the right coverage involves reviewing your financials (revenues, expenses, profit margin) and considering a realistic worst-case downtime. If you do $5 million in revenue a year and a fire could shut you down for 6 months, you’d want something like $2.5 million (plus some cushion for growth) in BI coverage to be safe. This is a simplification – your broker or an accountant can help project an appropriate limit and coverage period.

Lastly, remember that property insurance doesn’t travel with your gear unless arranged. If you send venue-owned sound equipment off-site for a one-off festival or loan it out, your property policy might not cover damage outside your premises. For mobile gear, you may need an Inland Marine or special equipment policy for coverage in transit. Similarly, if you’re leasing equipment, confirm whether it’s your insurance or the vendor’s that covers it (often the venue must insure rented lights, staging, etc., during the rental period). It’s these fine details that can leave a gap – and a huge bill – if overlooked.

Liquor Liability: Alcohol, Lawsuits, and Insurance

The Risks of Serving Alcohol at Events

If your venue serves alcohol – whether you operate a bar, sell drinks at concerts, or host events where alcohol is provided – you take on liquor liability exposure. Alcohol can be a significant profit center for venues, but it also introduces serious risks. Under the “dram shop” laws in many U.S. states and similar laws globally, a venue or bar that serves alcohol to an obviously intoxicated person (or to a minor) can be held liable if that person goes on to injure themselves or others. For example, if a drunk patron drives away from your club and causes a car crash, victims of the crash may sue your venue for contributing to the accident by over-serving that patron. These lawsuits aren’t rare – and juries can be very unforgiving when deadly accidents occur.

Multi-million dollar verdicts have been handed down in cases of alcohol-related crashes. In one state, a bar was ordered to pay $1.5 million after a patron it served caused a fatal DUI accident. In some jurisdictions like South Carolina, laws even allow injured parties to recover 100% of damages from bars/clubs that served a drunk driver, even if the venue was only 1% at fault under strict joint and several liability laws. That means your venue could end up paying the entirety of a huge judgment, simply because you served one person who later did harm. It’s not only car accidents – fights and assaults are common when excessive alcohol is involved, and the venue can be sued for negligent security or over-serving in those scenarios too.

For instance, picture an all-too-real scenario: late one night, two intoxicated patrons start a brawl in your venue’s parking lot, and one of them is seriously injured. The injured patron sues the venue, alleging that security failed to intervene and that staff kept serving the aggressor past the point of intoxication. Even if you ultimately aren’t found fully liable, you may still incur tens of thousands in legal defense costs, or decide to settle to avoid a jury trial. Without proper insurance, this kind of incident is a direct hit to your finances.

Why You Need Dedicated Liquor Liability Coverage

Many venue operators mistakenly believe their general liability policy will cover any alcohol-related incidents. This is a dangerous misconception. Standard GL policies often exclude liquor liability claims if you are in the business of manufacturing, distributing, selling, or serving alcohol. (They typically include only “host liquor” coverage for situations like a company hosting an office party with alcohol – not for businesses whose core is selling drinks.) Since venues, bars, clubs, and many theaters do sell alcohol as part of their operations, insurers expect you to get a separate Liquor Liability insurance policy (sometimes called Dram Shop insurance) to cover those exposures.

Liquor liability insurance covers your venue in cases where alcohol service leads to injury or damage. Specifically, it can pay legal costs and judgments if a patron you served while intoxicated later causes injury – whether that’s a drunk driving crash, a physical assault, property damage, or even alcohol poisoning or other injuries directly related to intoxication. It also often covers incidents like minors being served (which can lead to lawsuits and fines). Essentially, it fills the gap so that if alcohol is a factor in a claim, you’re still protected. Without it, claims involving alcohol will be denied by your general liability insurer, leaving you entirely exposed.

Just like GL, liquor liability policies have coverage limits. Typical limits are $1 million per occurrence (with maybe $2–3 million aggregate). Higher limits are available and may be prudent for venues with big alcohol sales or high liquor-related risk. Some states or provinces mandate minimum liquor liability coverage for venues with certain licenses (e.g. a state might require at least $500k or $1M in coverage to get a liquor license). Check your local requirements – and in any case, shoot for robust limits. The worst liquor-related incidents (multi-victim DUI crashes, for example) can result in claims well above $1 million. If you serve alcohol at sporting events or large festivals, consider opting for coverage in the multi-millions, possibly through an umbrella policy extension, given the scale of potential incidents.

Real Incidents and Cautionary Tales

To drive home how critical this coverage is, let’s look at a few cautionary examples. A famous case in Texas involved a nightclub that was sued after an intoxicated 18-year-old, who had been served at the club, caused a collision that killed a young man. The jury found the club negligent in serving a minor and contributing to the tragedy. The result: a $10 million judgment against the club. Without adequate liquor liability insurance, a payout of that magnitude would be impossible – it would bankrupt virtually any venue (and indeed, many businesses would have to shut down). Even with insurance, that claim likely blew through the standard limits, which is why excess liability coverage is worth considering if you host high-risk events.

In another scenario, a concert venue faced a lawsuit when an overserved patron got into a fight inside the venue, knocking another attendee unconscious and causing lasting injuries. The injured customer sued the venue for medical costs and negligence in over-serving and not providing a safe environment. These types of assault claims can be complex – sometimes they trigger both liquor liability and general liability issues. Fortunately for that venue, their insurance covered the victim’s medical bills and a settlement, totaling around $300,000, as well as the legal defense costs. Imagine if the venue had no coverage: even though staff didn’t throw the punches, they could be on the hook since the incident happened on their watch and involved intoxication.

The cost of liquor liability insurance is relatively modest compared to what a serious claim can cost you. We’ve heard from independent venue owners who pay just a few thousand dollars a year for $1–2 million in liquor liability coverage – pennies on the dollar compared to the potential claims. Insurers price it based on factors like your alcohol sales volume, venue type (a wine theatre vs. a rowdy nightclub), hours of operation, past incidents, and state laws. If you have stringent alcohol policies and training (more on that next), you may get better rates.

Mitigating Alcohol-Related Risks (and Keeping Premiums Manageable)

Having liquor liability insurance doesn’t mean you can be lax about alcohol safety – insurers expect you to implement strong risk management, and doing so can also keep incidents (and your premiums) down. Here are some best practices every venue serving alcohol should follow:

- Train your staff in responsible beverage service. Many jurisdictions require servers/bartenders to complete courses like TIPS or ServSafe Alcohol. This training teaches staff how to spot intoxication, refuse service tactfully, check IDs properly, and handle difficult situations. From an insurance standpoint, a well-trained staff is your first line of defense against liquor liability claims. Insurers may even ask if you do this training when quoting your policy.

- Have clear house policies on over-service and underage drinking. Empower your bartenders and security to cut off patrons who show signs of impairment – and back them up when they do. It’s far better to have an angry customer denied a drink than to risk an accident later. Similarly, use ID scanners or rigorous manual checks to prevent minors from being served. One slip-up with a fake ID can mean a big lawsuit if something goes wrong.

- Document incidents. If an alcohol-related incident or near-miss occurs at your venue (a fight, an ejection, someone who was cut off), record it in an incident log. This helps if a claim emerges later – you have contemporaneous notes. It also helps you spot patterns (e.g. a certain event or promoter’s crowd has more issues) so you can adjust operations or security for future events.

- Coordinate with transportation options. Encouraging patrons to use designated drivers, rideshares, or public transport can reduce drunk driving risk. Some venues partner with taxi or rideshare services to offer discounts for riders from the venue. While this won’t eliminate your liability, it’s a goodwill and safety step that can indirectly reduce the chance of a DUI incident tracing back to your bar.

- Ensure your security protocols are solid. Many alcohol-fueled problems involve altercations. Having trained security who can defuse conflicts or safely remove aggressive individuals helps keep small problems from escalating into major injuries (and claims). Good lighting, surveillance cameras, and regular patrols in dark parking lots or corners of the venue are also deterrents to fights and other incidents.

By being proactive, you not only protect patrons but also make your venue a less risky client to insure. Some insurers will ask about these practices and even give premium credits for things like documented training programs or zero-tolerance ID policies. Ultimately, liquor liability insurance is essential if you serve alcohol, but it goes hand-in-hand with vigilant management. Together, they ensure that one bad night doesn’t ruin your entire business.

Event Cancellation Insurance: When the Show Can’t Go On

Why Cancellation Coverage Matters

Even with rock-solid venue operations, sometimes the show just can’t go on. A freak weather event, a sudden tragedy, a performer’s illness – numerous unforeseen issues can force an event to be canceled or postponed. For venues and promoters, an untimely cancellation can be financially devastating. You might have to refund thousands of tickets, absorb production costs for a show that never happens, and lose expected food, beverage, and merchandise sales. That’s where Event Cancellation insurance comes in (also known as event contingency insurance). This coverage is a must-have for venues that host high-value events, outdoor events exposed to weather, or any situation where a canceled show would mean major losses.

Event cancellation insurance typically covers lost revenue or unrecoverable expenses when an event is canceled, postponed, or interrupted due to forces beyond the organizer’s control. What’s beyond your control? Common covered causes (perils) include:

- Severe weather – One of the biggest triggers. If a hurricane, flood, blizzard, or other extreme weather makes it impossible or unsafe to hold the event, cancellation insurance kicks in. (Many policies specify weather conditions, like winds over X mph, rainfall over Y inches in 24h, etc., that qualify as triggers, so securing weather and cancellation coverage helps.) A real example: Bonnaroo’s 2021 festival was canceled just days before opening because remnants of a hurricane waterlogged the site, necessitating a claim on their storm policy rider. Organizers with insurance were able to recover some of the lost revenue and sunk costs.

- Artist no-show or illness – If your headliner or a key performer is unable to perform due to illness, injury, or even something like visa issues, you might have to cancel (especially if a suitable replacement can’t be found). Cancellation insurance can cover the financial hit. Major tours and festivals often insure against the risk of headliner illness or death – as morbid as it is to think about, it has happened (e.g. when a performer dies mid-tour).

- Venue unavailability – If the venue itself is suddenly unusable due to, say, a power outage, structural damage, or an evacuation order, that could trigger coverage. For instance, if your arena’s roof rips open in a storm the day before a concert, or local authorities shut down the area due to an emergency, the policy would respond.

- National Mourning or Public Events – Some policies cover cancellation due to a national tragedy or day of mourning that causes events to be called off. For example, if a head of state died or there was a major catastrophe, events might be canceled en masse.

- Terrorism or civil commotion – Often available as an add-on, you can get coverage in case an act of terrorism or significant civil unrest forces your event to cancel. Think of the situation in Manchester in 2017, where after a terror attack at a concert, other events were canceled out of precaution. This coverage became more sought-after in recent years.

What’s usually excluded or tricky? One big one: communicable diseases. Prior to 2020, some policies quietly included or offered pandemic coverage, but now nearly all event cancellation insurance excludes pandemics (or has extremely pricey riders). COVID-19 caused a wave of event cancellations globally, and insurers faced billions in potential claims – many were denied if policies had virus exclusions, which most did. Leading into 2026, you should assume your cancellation policy won’t cover any COVID resurgence or new epidemic unless you’ve explicitly arranged it (and paid a high premium).

Other exclusions can include things like war in certain regions, nuclear incidents (hopefully not a common concern!), or financial causes (e.g., you cancel because of low ticket sales or funding issues – that’s not covered, since it’s under your control). Known threats are usually excluded too – for example, you can’t buy insurance for a hurricane when one is already forecasted to hit you next week and expect to be covered.

Real-World Cancellation Scenarios

Let’s look at a few real and illustrative examples:

- Severe Weather: In addition to Bonnaroo, numerous outdoor events have been cut short or canceled by weather. The Pukkelpop festival in Belgium in 2011 suffered a deadly thunderstorm that forced organizers to pull the plug mid-event due to severe thunderstorms and hail. In 2018, the third day of Electric Daisy Carnival (EDC) in Las Vegas was canceled due to high winds, costing millions. Venues with the foresight to have weather insurance or cancellation cover were able to recoup lost revenue and staff overtime, whereas those without it took a direct financial hit. Protecting your events from extreme weather with the right insurance has become standard practice for leading festival venues.

- Global Pandemic: The COVID-19 pandemic was the ultimate cancellation scenario – virtually every venue on the planet went dark for months. Unfortunately, very few had applicable insurance cover (as noted, most policies excluded pandemics or required physical damage triggers). Some high-end event organizers had taken out communicable disease riders in 2019 (a niche product then), and those few actually got payouts. For example, Wimbledon famously had pandemic insurance and received about £141 million when the 2020 tournament was canceled – an outlier case. Post-COVID, this coverage is scarce and costly, but the pandemic taught everyone how ruinous an uninsured global shutdown can be. Now venues build force majeure clauses into contracts and contingency plans as alternative safeguards. In absence of insurance, having a crisis communication and mitigation plan for event cancellations is vital to handle patron relations and credits/refunds.

- Performer Issues: Consider when a star artist cancels last-minute due to vocal cord issues or a tour is cut short. If a venue has a one-night-only concert that gets axed because the singer fell ill, the venue loses that night’s revenue completely – unless they or the promoter had insurance. We saw this with some major tours: when Adele had to cancel final shows of her residency, or when Foo Fighters canceled tour dates after a band member’s death, venues that sold tickets had to refund them. Promoters often carry the insurance in such cases, but it’s a reminder that if a key performer can’t go on, everyone’s revenue is at risk. Many venue operators who self-promote shows will insure any event where a significant portion of annual revenue hinges on that single event.

- Local Incidents: Not all causes are huge disasters. Suppose on the morning of a show, a water main break floods the streets around your venue, and the city closes the block for emergency repairs – no one can access your theater, so the event is off. That’s a random municipal issue, but with valid cancellation insurance, you could claim lost revenue. Or imagine a small fire in the venue a day before a big event – property insurance covers repairs, but not the lost event income, whereas cancellation insurance would cover that specific lost show revenue (property insurance’s business interruption would cover the broader closure if any).

In sum, event cancellation insurance covers those oh-no scenarios where despite all your planning, the event doesn’t happen. It allows you to refund tickets, pay vendors, and cover expenses without absorbing the loss directly.

Weighing the Need for Cancellation Insurance

Not every event or venue necessarily needs separate cancellation insurance for every show – it comes at a cost, of course, typically calculated as a percentage of the potential loss. It makes sense to analyze your risk exposure and ask: Would a canceled show (or season) put us in financial jeopardy? And how likely are cancellations? Here are factors to consider:

- Event budget/earnings at stake: The higher the stakes, the more sense insurance makes. If you have a multi-day festival that represents 25% of your annual income, you absolutely should insure it. If, on the other hand, you are a small venue with nightly shows that don’t individually make or break your finances, you might self-insure (i.e., absorb the occasional cancellation cost) for smaller events and only insure super special big nights.

- Outdoor vs. Indoor: Outdoor events are at the mercy of weather. If you operate an outdoor amphitheater or seasonal open-air venue, weather insurance is highly advisable. For indoor venues, weather is less of a show-stopper (though blizzards or hurricanes can still shut down an indoor show if people can’t travel). Tailor the coverage to the risk – e.g., an outdoor summer concert series might get a rain insurance policy that pays if more than X inches of rain fall on show days, etc.

- Geographic location: Consider local risks. Venues in hurricane zones (U.S. Gulf Coast, Caribbean, Pacific typhoon regions) should strongly consider cancellation coverage during storm season, making festival insurance for hurricanes essential – sometimes even a named-storm insurance rider specifically. If you’re in a place with harsh winters (Northern U.S., Canada, Northern Europe), then snowstorm coverage might be critical during those months. Know your likely peril – it could be air quality issues from wildfires (as some West Coast U.S. events faced), extreme heat, anything.

- Single events vs. year-round schedule: If you run a single big festival or a short seasonal series, one cancellation could zero out your revenue for the year, which argues for insurance. A year-round venue with dozens of events might withstand one lost show, but if one particular show has outsized weight (e.g., a high-grossing New Year’s Eve gala), insuring that event alone could be smart.

- Contractual obligations: If you have contracts with artists, sponsors, or vendors, check if you’re required to carry event cancellation insurance. Some artists (especially for festivals) insist the organizer have coverage for their fee if the event cancels. Also, sponsors might ask what happens if the event doesn’t occur – having insurance to refund sponsor money or offer a make-good helps maintain those relationships.

- Financial cushions: If you have robust cash reserves or parent company support to handle a worst-case cancellation, you might forego insurance and “self-insure.” But most independent venues run on thin margins and can’t easily absorb six- or seven-figure losses, so transferring that risk to an insurer is the prudent path.

Keep in mind that event cancellation insurance can often be bought on an event-by-event basis or as an annual blanket policy. If you only occasionally need it (say for a big festival), you can purchase it just for that event period. Alternatively, an annual policy can cover all your events in a year, typically with a per-event limit. Talk with your broker about the most cost-effective approach. They’ll need details like event dates, revenue values, any unusual risk factors, etc., to get quotes.

One more tip: Mitigate the risk before it triggers a claim. Insurers expect you to act prudently and not just rely on insurance. For weather, that means having rain contingency plans (tents, alternate dates) if feasible. For illness, having backup performers or flexible scheduling. Some cancelation claims only pay if you’ve made genuine efforts to avoid the cancellation or reduce loss. For example, if a storm is forecast, notifying attendees early or rescheduling can reduce costs (which insurers appreciate). Being proactive also keeps your claim history clean – and fewer claims mean lower premiums long-term.

Finally, not to be overlooked: If a major event is at risk of cancellation, it’s not just about money. You have ticket buyers, fans, and your venue’s reputation to consider. While insurance will recoup dollars, you still need a plan to communicate with audiences, handle PR, and possibly appease disappointed sponsors or fans. That’s why part of your risk planning should include a crisis communication strategy for event cancellations or major disruptions. Insurance can make you financially whole, but how you handle the human side will determine your brand’s resilience.

Specialized Coverages for Modern Venues

Beyond the big four policies we’ve covered (general liability, property, business interruption, and event cancellation/liquor liability), there are several other insurance coverages that venue operators in 2026 should understand. These might or might not apply to your specific venue, but it’s worth reviewing them to see if you have any gaps. The goal is to avoid unpleasant surprises – you don’t want to find out after an incident that “oh, that wasn’t covered under any of our policies.” Let’s explore some of these specialized or additional coverages:

Workers’ Compensation & Employer’s Liability

If you have employees, Workers’ Compensation insurance (often just called “workers comp”) is usually mandatory by law. This coverage provides benefits to employees who get injured or sick as a result of their job – covering medical expenses, a portion of lost wages during recovery, and rehabilitation costs. In exchange for these guaranteed benefits, employees typically give up the right to sue their employer for the injury (this is known as “the comp bargain”). Every venue with staff – whether full-time technical crews, part-time bartenders, or administrative teams – needs to have workers comp in place. Requirements vary globally: In the US, each state mandates it above a certain small number of employees; in the UK it’s called Employers’ Liability insurance and requires at least £5 million in coverage by law for most businesses; in Australia and Canada, similar provincial systems exist.

Workers comp is critical because normal liability insurance won’t cover employee injuries – employees are excluded from GL since they’re covered under workers comp by design. For example, if a stagehand falls from scaffolding and breaks an arm, they won’t sue you (in theory), but your workers comp policy will pay their hospital bills and disability payments while they’re out of work. Even if an employee does try to sue (perhaps claiming gross negligence by the employer), most jurisdictions bar those lawsuits in favor of the comp system. In the few cases they can sue, an Employer’s Liability coverage (usually paired with workers comp or included) would cover your liability.

Key points for venue operators:

– Always stay compliant with local workers comp laws – not only is it illegal to not have it, but penalties for non-compliance can be steep, and you’d be on the hook for any employee injury costs directly. Compliance and adequate coverage limits keep your employees protected and your business shielded.

– Workers comp premiums are driven by your payroll and the risk classification of work employees do. A venue’s payroll might be divided into categories like clerical, bartenders, security, stage crew, etc., each with different rates. Accurate classification and payroll estimates help avoid surprises in premium audits.

– If you use a lot of volunteers or interns, understand how they’re treated. In some places, volunteers can be covered under workers comp or you may need a special accident policy for them. The same goes for contractors or temporary staff – make sure either they have their own coverage or you include them in yours if required.

– Some claims will happen – a back injury from lifting an amp, a slip on a wet backstage floor. Managing your safety practices can reduce injuries (which also affect your premium via experience rating). Simple initiatives like proper lifting training, keeping work areas clean and well-lit, providing security staff with protective gear, etc., can prevent common injuries.

In short, workers compensation is usually out of your hands in the sense that you must have it by law. But treat it as part of your insurance program nonetheless – ensure you have a reputable insurer, that you comply with reporting, and that you consider any optional enhancements (like employer’s liability or higher limits if needed). And from an operations standpoint, support a culture of safety for your workers just as much as for your patrons; it’s morally right and pays off in fewer claims and a healthier, happier crew.

Cyber Liability Insurance

Venues in 2026 are deeply intertwined with technology – from online ticketing systems and point-of-sale software at the bar, to digital marketing databases and even IoT devices controlling lights and security. With this tech comes cyber risk. Cyber liability insurance has emerged as an important safeguard as venues realize they are not immune to hacking, data breaches, and other cyber incidents that can cause major losses.

What could go wrong on the cyber front for a venue? Plenty:

– Data breach of customer info: If your ticketing platform or internal database is compromised, hackers might steal personal data of your ticket buyers – names, emails, maybe credit card numbers or other identifiers. In 2018, Ticketfly (a major ticketing service for independent venues) was hacked, exposing customer data and forcing the ticketing system offline for days. Venues had to scramble with on-the-door sales. Similarly, Ticketmaster UK had a breach in 2018 where payment data was stolen, affecting tens of thousands of people. If your venue’s system is at fault, you could face legal liability and regulatory fines for failing to protect data.

– Ransomware or system outage: Imagine hackers infect your box office computer network with ransomware and encrypt all your ticketing and event files a day before a sold-out show. You can’t scan tickets or process transactions. You might have to cancel the event (loss of revenue) or pay a ransom to get systems back – cyber insurance can cover those extortion payments (in consultation with law enforcement) and the loss of income due to the outage. With more venues going cashless and digital for entry, a tech meltdown is a serious business interruption risk (which standard BI insurance likely won’t cover unless there was physical damage). Having robust backup plans for critical event tech is essential, and cyber insurance covers the scenario when those defenses are breached.

– Fraud and social engineering: Venues can fall victim to scams like wire transfer fraud (someone impersonates your vendor and tricks your accountant into sending money to the wrong account) or even fake ticket scams impacting your sales. While insurance won’t cover lost ticket revenue due to fraudsters (that’s more a business risk you handle via anti-fraud measures and secure ticketing practices), cyber policies sometimes cover direct losses from certain fraud if it’s a covered computer-related event. For instance, funds transfer fraud coverage might repay money stolen via a cyber attack technique.

– Privacy lawsuits and regulatory fines: If customer data is breached, you could face class action lawsuits from affected customers, and regulators may levy fines (for example, under GDPR in Europe or state privacy laws in the U.S.). Cyber insurance typically covers legal defense and any settlements or judgments, as well as fines and penalties where insurable by law.

The average cost of a data breach in 2023 hit an all-time high of around $4.45 million globally (per IBM research) – a number that includes all the various costs like investigation, business loss, customer notification, etc. Small and mid-sized businesses are increasingly targets; roughly 42% of SMBs (which many venues are) experienced a cyber breach in the past year, proving cyber insurance is crucial for small businesses. Many independent venues simply could not absorb a major cyber incident cost on their own.

Cyber insurance policies usually provide a package of coverages: incident response services (IT forensics, legal, public relations), data breach notification costs (which can be huge if you have to mail notices to 100,000 customers and offer credit monitoring), extortion/ransom payments, business interruption from cyber downtime, and liability for lawsuits and fines. It’s a very technical area, so involve a knowledgeable broker. Premiums depend on your revenue, data volume, and security measures. Insurers will often ask if you follow best practices (firewalls, employee training, backups, multi-factor authentication, etc.), and having these in place can reduce your premium.

For venue operators, even if you outsource your ticketing to a reputable platform (which itself might have breaches as we saw), you still might shoulder some costs or at least the operational hit. Cyber insurance can be your safety net for when digital systems fail or criminals strike. And investing in strong cybersecurity, just like physical safety, will pay dividends in fewer incidents. The takeaway: as venues become more data-driven and cashless, cyber insurance has moved from optional to essential for risk management.

Terrorism and Security Incident Insurance

Unfortunately, our world has seen an increase in terror attacks and violent incidents at public venues over the last two decades – from the tragic Bataclan concert attack in Paris (2015) to the Las Vegas festival shooting (2017). Large arenas, stadiums, and busy nightlife venues can be targets or caught in the crossfire of terrorism or mass violence. Standard insurance policies often have exclusions for acts of terrorism or require an endorsement to cover them. To fill this gap, venues may consider Terrorism insurance or its modern adjunct, Active Assailant insurance.

Terrorism insurance (often backed by government reinsurance programs in countries like the US and UK) typically covers property damage and business interruption caused by acts officially certified as terrorism. For example, if a bomb attack damages your arena, terrorism insurance would pay for repairs and lost income, since most property policies would exclude the damage (terrorism exclusions became common after 9/11). In the US, the Terrorism Risk Insurance Act (TRIA) provides a framework for insurers to offer this. Premiums are usually relatively low for terrorism coverage unless you’re a very prominent venue or in a high-risk location.

However, terrorism definitions can be narrow. That’s why there’s also Active Assailant/Active Shooter coverage, which is designed to cover losses if a violent attacker causes casualties or disruption at your event, regardless of motive (doesn’t have to be “terrorism” politically motivated). This can cover things like victim lawsuits (if they claim you lacked adequate security), counseling services for affected patrons/staff, public relations costs to rehabilitate your venue’s image, and of course property damage and business interruption. It’s a sad reality that venues now have to consider these scenarios, but many are doing so – especially larger concert halls and sports venues – as part of comprehensive risk planning.

If your venue is relatively small, you might decide the risk is low and skip these. But if you host any high-profile events, or are a large venue where an incident would be catastrophic, discuss these coverages with your broker. In some places, insurers only offer terrorism cover if it’s made available to all commercial policyholders (like in the US under TRIA, you must be offered it – you can decline or accept). The cost could be a few hundred to a couple thousand dollars per year extra for a mid-size venue – arguably a worthwhile spend for peace of mind, given the potential scale of losses in such scenarios.

Commercial Auto and Transit Coverage

Do you own any vehicles as part of your venue operations? Perhaps a van to shuttle artists, or a truck for hauling equipment? If so, you’ll need Commercial Auto insurance just like any business with vehicles. This covers auto liability (if your driver causes an accident) and physical damage for your vehicles. It’s straightforward, but don’t forget it if relevant. Even golf carts or utility vehicles used on premises might need coverage (often they can be added to the auto policy or covered under GL if only on your property).

More uniquely, if you often transport high-value equipment (maybe you manage tours or supply gear to off-site events), consider an Inland Marine policy or transit insurance for those items. As mentioned earlier, standard property insurance often limits coverage away from the insured premises. Inland marine (despite the weird name) covers movable property and can be customized for things like touring sound boards, costumes, instruments, etc., including while in transit in trucks or airplanes. Think of it as insurance for mobile equipment.

Miscellaneous Specialty Policies

Depending on your venue’s structure and activities, there are a few other policies that might be worth looking at:

- Directors & Officers (D&O) Insurance: If your venue is run by a board of directors (common for non-profit theaters, arts centers, or government-owned venues) or you have investors, D&O insurance protects the personal assets of your directors/officers if they are sued for decisions they make managing the company. For example, if a shareholder or stakeholder sues alleging mismanagement, or an employment practices issue at the executive level arises, D&O responds. It’s more of a corporate governance cover, not event-related, but some venue organizations should have it as part of their executive risk management.

- Crime Insurance: Covers internal theft, fraud, or theft of money. If an employee embezzles funds from the box office, or someone fraudulently wires money out of your account, a crime policy can reimburse those losses. Venues that handle a lot of cash (though many are moving cashless) sometimes get this to cover things like employee theft, forgery, or robbery of cash deposits. It’s often an affordable add-on.

- Equipment Breakdown: Available as an add-on to property insurance, it covers sudden mechanical/electrical breakdown of critical equipment – like your HVAC system, generators, transformers, soundboards – things not damaged by external events but by internal failure. It can pay for repair/replacement and lost income due to the breakdown. This is useful if your shows heavily rely on a single system (say the main transformer that powers your stage) that isn’t easily replaced quickly.

- Vendor/Third-Party Insurance Requirements: Rather than an insurance policy you buy, this is ensuring others’ insurance protects you. Make sure any third-party vendors (caterers, staging contractors, etc.) who work on your premises carry their own liability insurance and name your venue as an additional insured. Likewise, if you rent your venue out, require the renter to have insurance naming you. This way their insurance pays if they cause an incident. It’s a form of protection that costs you nothing except contract diligence.

As you can see, insurance can be a bit of an alphabet soup of policies. But a seasoned entertainment insurance broker can simplify the menu and recommend what’s truly necessary for your venue, versus what’s overkill. The right mix will depend on your size, activities, risk appetite, and budget. Now that we’ve covered the coverage types themselves, let’s shift to how to actually go about securing all this insurance and managing it effectively.

Summary of Essential Venue Insurance Policies

To recap the key insurance coverages a venue operator should consider, the table below provides a checklist of policies, who typically needs them, and some key notes:

| Insurance Policy | Who Needs It | Coverage Provided | Key Notes |

|---|---|---|---|

| General Liability (Public Liability) | All venues (essential) – clubs, theaters, arenas, festivals, etc. | Covers claims of bodily injury or property damage to third parties (attendees, artists, vendors). Pays legal defense, medical costs, settlements/judgments. | Minimum ~$1M per occurrence recommended; large venues carry $5M+. Often required by contracts and permits. Umbrella insurance extends coverage for big claims. |

| Property Insurance | Venues with physical assets – building owners or tenants responsible for contents/equipment | Covers damage to buildings, contents, equipment from fire, theft, storms, vandalism, etc. Pays repair or replacement cost of insured property. | Ensure coverage equals replacement value of venue and gear. Standard policies exclude flood/earthquake (require separate cover). Include equipment breakdown cover for critical systems. |

| Business Interruption | Venues reliant on event revenue (most) – especially if a shutdown would threaten the business | Reimburses lost income and ongoing expenses if venue operations are halted due to a covered property loss. Keeps cash flow steady during closure and restoration. | Coverage period should match worst-case rebuild time (e.g. 6–12 months). Communicable diseases not covered on standard BI – plan for those separately. Waiting period (e.g. 72 hours) applies. |

| Liquor Liability | Venues that sell or serve alcohol (bars, clubs, concert venues with alcohol) | Covers liability from alcohol-related incidents (overserved patron causes injury or property damage). Pays legal costs and damages if you’re sued under dram shop laws or similar. | Excluded from GL if you sell alcohol – separate policy needed. Required for liquor license in some areas. Implement responsible serving practices to reduce incidents (and premiums). |

| Event Cancellation (Contingency Insurance) | Venues hosting high-revenue events, outdoor events, festivals, or any events where cancellation would cause major loss | Covers lost revenue or unrecoverable costs if an event is canceled, postponed, or interrupted due to covered perils (weather, artist no-show, venue damage, etc.). | Can be purchased per-event or as annual cover. Excludes known issues and typically pandemics now. Customize triggers to your risks (e.g. weather thresholds). Essential for weather-exposed events and one-off big shows. |

| Workers’ Compensation (Employers’ Liability) | Any venue with employees (full-time, part-time, seasonal) – required by law in most jurisdictions | Covers employee on-the-job injuries: medical treatment, wage replacement, rehab, and employer’s liability if lawsuits arise. Provides no-fault benefits so employees usually cannot sue the venue for injuries. | Legal requirement once you have a certain number of employees (often > 0 or > 1 depending on region). Premium based on payroll and job risk. Emphasize workplace safety to control costs. |

| Cyber Liability | Venues that use digital systems for ticketing, payments, or store customer data (almost all modern venues) | Covers costs of data breaches and cyber attacks: forensic investigation, customer notifications, credit monitoring, legal liability, ransomware payments, system restoration, and business interruption due to cyber incidents. | Growing risk – 40%+ of small businesses suffer breaches highlighting why cyber insurance is crucial. Check if your IT security meets insurer requirements (firewalls, backups, MFA, etc.). Cloud-based ticketing might reduce some risks but you’re still impacted by incidents. |

| Terrorism/Active Assailant | High-profile venues, large public venues, those required by lenders or partners to have it | Covers property damage, business interruption, and liability resulting from terrorist acts or mass violence (shootings, bombings, etc.). Active assailant policies cover violent incidents regardless of motive. | Often an add-on to property or a separate policy. In the US, terrorism coverage offered via TRIA. Consider for venues with >10k attendees or iconic status. Hopefully never needed, but catastrophic if it is. |

| Commercial Auto | Venues owning vehicles (e.g. shuttle vans, equipment trucks) | Covers auto liability (injury/damage you cause with vehicles) and physical damage to your vehicles. Similar to personal auto insurance but for business-owned vehicles. | Ensure any employee drivers are listed and have good records. Include Hired/Non-owned auto coverage if employees drive personal or rental cars for venue business (e.g. picking up artists). |

| Inland Marine (Equipment Floater) | Venues with high-value equipment that moves off-site or tours | Covers specified equipment/instruments on an all-risk basis, including in transit or at other locations. Often used for musical instruments, sound boards, lighting rigs, etc., especially when loaned or rented out. | If your property policy limits off-premises cover, get an equipment floater for mobile gear. Also ask visiting productions for a certificate of insurance covering any of their gear they bring (and vice versa, provide one if you send gear out). |

| D&O Liability | Venues with a corporate board or investors (especially nonprofits or public entities) | Protects directors and officers against lawsuits alleging mismanagement, breach of fiduciary duty, or other wrongful acts in running the organization. Covers legal defense and damages. | Not directly event-related but part of good corporate hygiene. Investors or board members may require it. Doesn’t cover fraud or personal profiting (those are uninsurable). |

| Crime Insurance | Any venue handling significant cash or susceptible to employee theft/fraud | Covers theft of money/securities (robbery, burglary), employee embezzlement, forgery, and similar crimes resulting in financial loss to the business. | Also called Fidelity insurance or Employee Dishonesty coverage. May be packaged with property insurance. In a cash-heavy concert or festival, consider coverage for safes and cash transit. |

This checklist underscores that insurance coverage is not one-size-fits-all – it’s a portfolio of policies addressing different risks. The exact mix you need will depend on your venue’s profile, but most venues will need the majority of these in some form. Next, we’ll discuss how to cost-effectively secure and manage this portfolio with the help of insurance professionals, and how to integrate insurance into your overall risk management plan.

Navigating Global Insurance Requirements and Regulations

Different Countries, Different Rules

Venue operators who work internationally, or even those booking overseas tours or artists, quickly learn that insurance isn’t the same everywhere. Every country has its own legal requirements, terminologies, and market practices for event insurance. As you secure coverage, you’ll want to tailor your approach to wherever your venue operates (or any place you host events). Some key global differences to note:

- United States: No federal law mandates general liability or property insurance for venues, but it’s considered a de facto requirement to do business (and often required by landlords, clients, etc.). Workers’ comp is mandated state-by-state once you have a minimum number of employees (often just 1). The U.S. legal environment is highly litigious, so venues often carry higher liability limits than similar-size venues elsewhere. Dram shop (liquor liability) laws exist in many states, making liquor insurance crucial if you have a bar. The insurance market has many specialized entertainment insurers, and using a broker who understands venues (and perhaps is connected to the live music industry) is valuable.

- United Kingdom: In the UK, Public Liability insurance is analogous to general liability. Interestingly, it’s not legally required for venues, but practically all venues and event organizers carry it because it’s considered essential – and often venues won’t contract with promoters or suppliers who lack it. Many local councils and licensing authorities insist on seeing proof of public liability cover (commonly a minimum of £5 million is expected; large events might carry £10m or more). Employers’ Liability insurance is legally required if you have staff (minimum £5m cover by law). The UK also has specialized insurers for events and a relatively mature market for event cancellation insurance – partly due to weather variability. Note: the UK has the Pool Re scheme for terrorism coverage (government-backed). Also, organizations like the Music Venue Trust advise small venues on insurance and have pushed for better insurance support post-COVID.

- European Union: Requirements vary by country. In much of Europe, there’s a culture of insurance but also often caps on personal injury awards which can make required limits lower than in the U.S. For example, in Germany and France, having public liability coverage for events is standard, and many venues require renters to have it, but typical limits might be on the order of €1–3 million for small events – amounts that could be considered low in America. Always check local laws: some countries require insurance for specific event permits (e.g. a city permit for a festival might mandate a certain coverage level). Workers’ comp is typically part of national social insurance systems in the EU, so private policies might not be needed as they are in the U.S. (employers pay into government funds instead). If you operate a tour or multiple venues across Europe, you might get a master policy that covers all with local admitted insurer partners in each country – a broker can arrange that.

- Australia & New Zealand: These markets are quite safety-conscious. Public liability insurance is basically compulsory for doing anything event-wise – venues, artists, vendors all carry it. It’s common for Australian venues and events to carry AUD $20 million in public liability coverage; it’s almost a standard ask from councils and property owners. Australia has government-run workers’ comp per state and also has a national terrorism insurance pool for commercial property. The climate (cyclones in some areas, etc.) makes property and event cancellation insurance key for certain regions. New Zealand, interestingly, has ACC (Accident Compensation Corporation) which covers personal injury nationally in lieu of liability lawsuits for injuries – meaning if someone is hurt, they typically cannot sue for damages, they get compensation from ACC. This system can reduce the need for huge liability limits in NZ, but you’d still want to insure against property damage or other liabilities.

- Asia (varied): In Japan, earthquake insurance is a big consideration – it’s a separate add-on to property policies and heavily regulated due to quake frequency. Japanese venues will often carry both property and earthquake cover. Public liability is common, particularly for large events, but the litigiousness is lower than West so limits might be moderate. In contrast, some developing Asian countries might have fewer established insurance norms – local promoters or venues might sometimes skip formal insurance if not required, though that’s risky. If you host an event abroad, you may find yourself buying a short-term policy from a local insurer to satisfy permit requirements in, say, India or Brazil. Many multinationals use international insurance programs with global insurers who have local country partners – this ensures compliance with each country’s laws (some countries require you use a locally licensed insurer, which means your U.S. policy can’t directly cover a venue there in some cases).

The important thing is do your homework for each locale. If you operate venues or events globally, work with a broker experienced in international coverage. They can help avoid pitfalls like non-compliance or having uninsured exposures in a foreign country. Also, be mindful of currency differences and policy language – a $5M policy in the U.S. might need to be a £5m policy in the UK to be seen as equivalent, given currency values. And policies will be governed by local law which affects how claims are handled.

Insurance and Touring Artists/Events

Even if your venue is fixed in one country, you’ll likely work with touring artists, productions, or international partners. This creates some additional insurance considerations:

- Artist and Vendor Insurance Requirements: Most large touring artists carry their own liability insurance (often required by the venues they play). As a venue, you should require that any promoter, tour, or artist coming in provides a Certificate of Insurance naming your venue as additional insured for the dates of the event. This way, if the artist’s team causes an injury (say their stage prop falls on someone), their insurance can cover it before yours is on the hook. Likewise, insist that third-party vendors (staging companies, pyro operators) show proof of insurance. This is a standard practice but one to stay vigilant on. According to industry veterans, one of the simplest ways venues protect themselves is by making sure every outside party working on your event carries their own insurance and lists you on it. It keeps claims with the responsible party’s insurer and can prevent strain on your policy.

- Contract Review: Pay attention to insurance and indemnification clauses in your contracts with promoters, artists, and renters. They often specify who’s liable for what and who needs which insurance. For example, a venue rental contract might say the renter is liable for audience injuries and must carry GL insurance, whereas the venue is liable for structural issues. Make sure your insurance aligns with these obligations. If an artist contract requires you to have pyrotechnics coverage or participant accident insurance for a stunt, don’t overlook that. These clauses are enforceable and failure to comply could leave you personally liable if something happens.

- Global Touring Risks: If your venue company expands into running events in multiple countries, consider a global insurance program. This is a coordinated set of policies that ensures consistent coverage everywhere. You’ll get a master policy (often governed by, say, UK or US law) and then local policies where needed. This way, if you run a festival in Canada and a show in Germany, you have coverage in each place and an umbrella global limit. The broker will handle local compliance (e.g., Canada and Germany would require using locally licensed insurers). If this is beyond your scope, at least ensure any one-off international event has its own local insurance – even if that means buying a separate short-term policy in that country.

- Cultural and Legal Differences: Keep in mind how claims might play out differently. For instance, in the U.S. someone might sue immediately for an injury, whereas in some countries they might first go through a government compensation program or take longer to litigate. Don’t assume because you haven’t heard of a claim immediately that it won’t happen – sometimes foreign claims can surface long after the event (within the statute of limitations in that jurisdiction). Always report incidents to your insurer even if you’re abroad at the time, and let them figure out jurisdiction and coverage. A good broker will advise on how/where to notify when incidents occur under international circumstances.

Working with Local Authorities and Compliance