The Festival Insurance Crunch: A New Reality for Event Organizers

A Perfect Storm Driving Up Costs

Festival organizers worldwide are facing a harsh new reality: insurance premiums have skyrocketed in the past few years. Multiple converging factors – from catastrophic crowd accidents to extreme weather events – have driven insurers to hike rates dramatically. In some regions, festival insurance premiums have surged tenfold (www.insurancebusinessmag.com) practically overnight. For example, industry testimony in Australia revealed operational costs up 40%, creating what producers call a “perfect storm” of financial pressure (www.insurancebusinessmag.com). This crunch isn’t confined to one country; it’s a global trend impacting boutique community events and mega-festivals alike.

Shrinking Availability of Coverage

As costs rise, the availability of adequate coverage is shrinking. Several major insurers have scaled back or exited the festival market, deeming it too high-risk. Those still writing policies are imposing stricter terms and lower limits. A few years ago, a festival might secure $10 million in liability coverage; now that same insurer might only offer $5 million (news.pollstar.com). An expert broker noted that “the liability, in particular the excess coverage, had a huge spike” – with some carriers halving their maximum payout and others pulling out entirely (news.pollstar.com). Organizers are left with a closed market of only a handful of insurers willing to cover festivals (www.abc.net.au). This limited competition means higher premiums and less negotiating power for events, especially independent ones.

Impact on Festivals and Cancellations

The insurance crunch is already claiming victims in the festival landscape. Organizers of long-running events have cited skyrocketing insurance costs as a key reason for cancellation or downsizing (www.abc.net.au). In Australia, the famed Byron Bay Bluesfest announced 2025 will be its final year, and other festivals like Splendour in the Grass canceled editions, with insurance expenses named among the primary factors (www.abc.net.au). In the U.K., an emergency government-backed insurance scheme was launched post-COVID, but it had only modest uptake – covering just 169 events under 87 policies before winding down (www.insurancebusinessmag.com). This highlights that stop-gap measures alone aren’t solving the underlying issue. Around the world, from regional food fairs to international music extravaganzas, festival producers are urgently seeking ways to survive this insurance crunch without sacrificing safety or financial viability.

Why Festival Insurance Premiums Are Skyrocketing

High-Profile Incidents and Liability Fears

A series of high-profile festival incidents over the past decade has shaken insurers’ confidence and driven premiums higher. Tragic accidents like stage collapses, crowd crushes, and even unforeseen violence at events have led to massive claims. The 2021 Astroworld tragedy in Texas – where a crowd surge led to numerous fatalities – resulted in lawsuits seeking nearly $3 billion in damages, far beyond the festival’s insurance coverage (www.ticketfairy.com). When insurers face the possibility of multi-million (or billion) dollar payouts from a single event, they respond by raising rates across the board. Major underwriters now scrutinize festival risk profiles more intensely, fearing that one mismanaged crowd or structural failure could incur catastrophic costs. Even festivals with clean safety records feel the ripple effect, as insurers price in the worst-case scenarios.

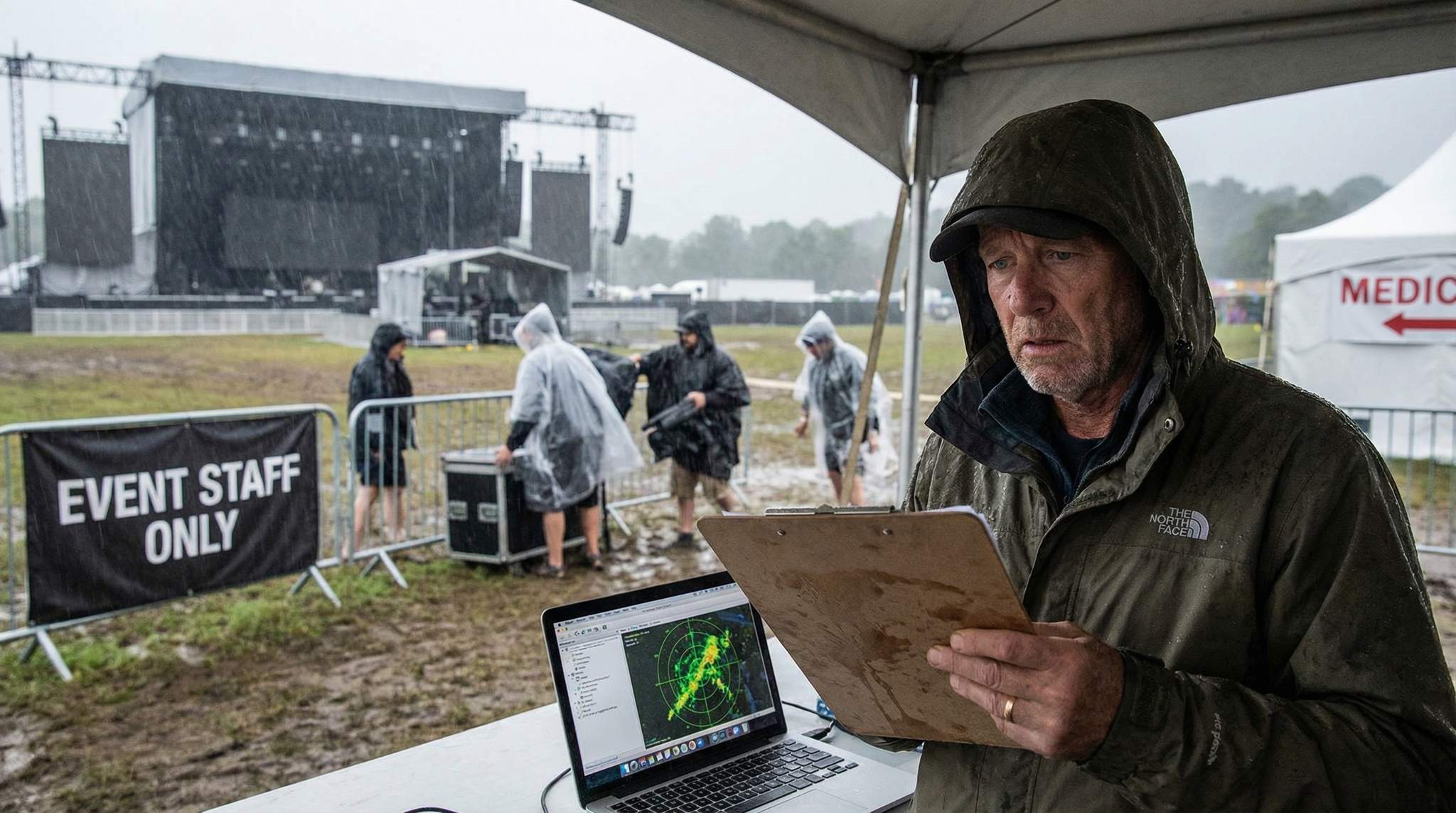

Extreme Weather and Climate Risks

Climate change is another key driver of soaring insurance costs. Festivals are increasingly plagued by extreme weather – torrential rain, windstorms, heat waves, wildfires – that can force cancellations or create dangerous conditions. Insurers have seen a jump in weather-related claims, from flooded campgrounds to lightning strikes halting shows. Additional premiums for adverse weather coverage have climbed about 50% in the past decade according to industry brokers (archiv3-25.iqmagazine.com). In North America, overall event cancellation premiums (often driven by weather risk) have tripled in recent years (archiv3-25.iqmagazine.com). Europe experienced a rash of weather-hit events in recent summers – from Slovakia’s Pohoda Festival to Belgium’s Graspop – underscoring that no region is immune. With record heat and storms becoming the norm, underwriters are charging more for weather insurance or adding exclusions (e.g. no coverage if a certain rainfall threshold isn’t met). The result is that protecting your event against Mother Nature is pricier than ever. A mid-size festival that might have paid a modest fee for rain insurance a decade ago could now face a prohibitively expensive premium for the same coverage.

Post-Pandemic Market Shifts and Exclusions

The COVID-19 pandemic dealt a heavy blow to the live events insurance market. In 2020–2021, insurers paid out huge sums for event cancellations, then swiftly moved to exclude communicable disease from new policies. Festival organizers emerged from pandemic shutdowns to find that “pandemic insurance” was essentially unavailable, or only offered via government programs at exorbitant cost. Even beyond pandemics, underwriters grew more cautious after the long hiatus – some requiring detailed COVID safety plans, others declining to cover events in case of future public health orders. On top of that, general inflation in the economy has increased the cost of claims (medical care, legal fees, equipment replacement, etc.), which insurers pass on as higher premiums. Inflation, coupled with insurers trying to recoup pandemic-era losses, means festivals are now charged more for the same coverage they had pre-2020. And many policies come with new exclusions: not just disease, but sometimes civil unrest, terrorism, or other nightmare scenarios unless you buy separate riders. Organizers must read the fine print carefully – you might assume you’re covered for a government-mandated shutdown or a sudden protest, only to find those risks carved out. In short, today’s policies often cover less but cost more, a frustrating combination for producers.

The Legal Landscape and Claim Severity

Another factor driving premiums upward is the rising severity of claims and legal judgments related to festivals. In some countries, notably the United States, the liability environment has grown more challenging – juries can award substantial sums if an attendee successfully sues for injury or negligence. Even in places with caps on damages, the complex web of liability (organizers, venues, vendors, security firms all potentially at fault) leads insurers to err on the side of higher coverage costs. Festivals now routinely face claims not just for bodily injury, but also class-action lawsuits for things like ticket refunds, ADA accessibility issues, or data breaches. Each new category of potential claim gives insurers more justification to raise rates. An Insurance Council spokesperson in Australia noted that there’s “no silver bullet” here – as long as insurers fear hefty payouts, they will keep premiums high (www.abc.net.au). This is why improving safety and reducing claim likelihood (discussed later in this article) is so critical. The fewer incidents and lawsuits our industry generates, the better our odds of tempering insurance costs in the long run.

The Hard Market: Limited Coverage and Tough Choices

Fewer Players and a “Closed Market”

Festival insurance has entered what experts call a “hard market” – limited supply and high demand. Many insurers that once competed for festival business have scaled back, leaving only specialized underwriters or high-risk markets (like Lloyd’s of London syndicates) willing to write these policies. Festival producers often discover that only a handful of brokers even have access to willing insurers, and quotes from each tend to be similar (and steep). As one organizer lamented, “not too many insurance companies do festivals, it’s a bit of a closed market.” (www.abc.net.au) Fewer providers also means less flexibility: if one insurer imposes a new exclusion or requirement, there aren’t many alternatives. This lack of competition hurts small and mid-sized festivals most of all. Large festivals backed by major promoters might have global insurance programs or longstanding insurer relationships to leverage. But an independent boutique event has little bargaining power and may face take-it-or-leave-it pricing from the remaining carriers. In some cases, festivals have been denied cover altogether for certain risks, forcing organizers into an uncomfortable choice: proceed without coverage for that peril (essentially self-insuring and praying nothing goes wrong) or cancel the event. Neither option is attractive or sustainable.

Reduced Policy Limits and Higher Deductibles

Even when coverage is secured, it often comes with lower limits or higher deductibles than in the past. Insurers are trying to cap their own exposure. For instance, umbrella liability policies that once provided $20–30 million excess coverage might now max out at $10 million total. Property damage or equipment coverage might have sublimits for specific hazards (e.g. a cap on payout for water damage). Organizers also report being offered policies with hefty deductibles (or excesses) as a way to manage premium costs. A policy that used to have a $5,000 deductible might now come back with a $25,000 deductible, placing more risk on the festival to cover minor incidents. This can be a double-edged sword: a higher deductible can reduce premium cost, but it means absorbing more loss out-of-pocket if something does happen. Festivals must assess their finances honestly – could you afford a $50,000 hit if your equipment is wrecked in a storm? If not, skimping on coverage or taking a huge deductible is dangerous. One insurance broker working on large-scale events noted that excess liability coverage had a huge spike – markets were pulling out, or slashing the limits they’d offer (news.pollstar.com). The upshot for organizers is more homework: carefully evaluate your needed coverage limits against worst-case scenarios, and decide where you can accept more risk versus where you truly need full insurance protection. (For guidance on setting realistic coverage levels, see our guide on securing festival insurance with the right limits and key exclusions.)

The Small Festival Squeeze

Smaller festivals are disproportionately feeling the squeeze of limited coverage. Insurance overhead that might be manageable for a 50,000-attendee event can be crushing for a 5,000-person local festival. For example, a modest regional event in 2019 might have paid $10,000 for liability coverage; today that renewal quote could be $30,000+, eating a huge chunk of a tiny budget. Unlike larger events, small festivals often lack cash reserves or diversified revenue streams to absorb these spikes. Some have responded by lowering their coverage limits to reduce premiums – a risky move that leaves them potentially underinsured. Others are passing costs to attendees via higher ticket prices or reduced amenities. Community-based events sometimes seek help from local government or sponsors to cover insurance bills. In a few extreme cases, beloved small festivals have gone on hiatus or permanently ended because insurance either wasn’t available or made the event financially unviable. This insurance gap threatens the grassroots of the festival ecosystem. It’s prompting creative solutions, from festivals joining forces in resource-sharing alliances to cut costs (www.abc.net.au), to industry associations lobbying for public insurance support. We’ll explore some of those strategies later in this article. The key point is that right-sizing insurance is a delicate balance – especially for small players, it’s about securing enough coverage to be responsible, but not so much that the cost sinks the entire production.

Case Study: Big vs. Boutique Budget Impact

To put the insurance crunch in perspective, consider a simplified example comparing a large music festival and a smaller boutique festival:

| Festival Scale | Major 3-Day Festival (50,000+ attendees) | Small Boutique Festival (5,000 attendees) |

|---|---|---|

| Annual Insurance Premium | $250,000 (multiple policies) | $25,000 (basic coverage) |

| Insurance as % of Total Budget | ~5% of a $5 million budget | ~10% of a $250,000 budget |

| Typical Coverage Limits | $10–20 million liability, event cancellation, weather add-ons | $1–2 million liability, maybe no cancellation cover |

| Impact of 2023 Price Surge | +50% increase ($250k ? $375k) | +100% increase ($25k ? $50k) |

| Actions Taken | Negotiated multi-event policy across company’s festivals; increased deductible to $50k; added safety upgrades to appease insurer | Sought local government grant for insurance; reduced event footprint (fewer stages) to lower risk; partnered with another event for group insurance rates |

This illustrative comparison shows how a surge in premiums hits a small event’s bottom line much harder. Both festivals saw insurance costs jump, but the boutique festival had to spend a far greater share of its budget on coverage and make tougher trade-offs. A real-world example: one large U.S. festival reportedly budgeted around $300,000 for insurance (roughly 5–6% of expenses) while a smaller regional event budgeted $50,000 for insurance (over 15% of its costs). Each had to find savings elsewhere to compensate – the big fest trimmed production extras and the small fest relied on volunteers and city support. These adjustments highlight an important reality: coping with the insurance crunch requires flexibility and often rethinking the scale or scope of your event.

Tightening Risk Management to Control Premiums

Safety Culture as a Bargaining Chip

In an environment of rising premiums, one of the best investments a festival can make is in strengthening its safety and risk management practices. Insurers don’t determine your rates in a vacuum – they closely evaluate how you manage risk. Seasoned underwriters will ask about your safety measures, staff training, emergency plans, and past incident history when pricing a policy. Festivals that can demonstrate a robust safety culture often receive more favorable terms (or at least fewer exclusions). On the flip side, a history of frequent claims or a lax attitude toward risk will put you in a higher-risk (i.e. higher-premium) category. To keep premiums in check, make safety a core value: every team member, from production managers to volunteers, should be vigilant about preventing incidents. Emphasize things like professional stage rigging, proper crowd control barriers, regular staff breaks (to prevent fatigue-related mistakes), ample free water for attendees (to reduce dehydration cases), and clear communication channels for any hazards. Building a reputation as a safety-first festival not only protects your patrons and crew – it also makes you a better bet in the eyes of insurers. As one industry guide notes, a strong safety track record can keep your premiums manageable and even win you special coverage considerations (e.g. an insurer might extend weather coverage if they see you have advanced monitoring and an evacuation plan in place) (www.ticketfairy.com).

Training, Drills, and Preparedness

Proactive training and emergency drills are tangible ways to both reduce actual risk and signal to insurers that you’re serious about safety. Many forward-thinking festivals now run annual safety workshops for their crew and scenario drills to practice responding to various incidents. For example, some producers are using virtual reality simulations to run crowd surge and evacuation drills that prepare staff for real-life emergencies. By stress-testing your plans (e.g., a mock exercise of a stage evacuation for a fire, or a lost child response drill), you can identify weak spots and refine procedures before an actual crisis hits. Insurers take note of such efforts – brokers have reported that underwriters may ask whether you conduct regular safety briefings or drills as part of their risk assessment. If you can answer “yes” and provide details, it can only help your case. Some festivals even invite local emergency services to participate in on-site drills, strengthening coordination and confidence. Ultimately, well-trained staff and well-rehearsed emergency plans mean incidents are less likely to escalate to insurance claims, and if something does happen, the impact (and cost) is minimized. It’s a classic win-win: you protect lives and property, and you potentially protect your insurance premiums from future spikes driven by avoidable mishaps.

Infrastructure and Tech: Preventing Accidents

Investing in safer infrastructure and leveraging technology can dramatically reduce the risk of accidents – and by extension, the risk of costly claims. For instance, festivals concerned about stage and tent safety are deploying IoT-based structural monitoring systems that send alerts if high winds or dangerous loads threaten temporary structures. Instead of a collapse that triggers a huge insurance payout, the structure can be cleared or reinforced in time. Likewise, smart power management and backup generators prevent the nightmare of a total power failure (which can cause panic or injury in a crowd). Many events have improved their crowd management infrastructure – using sturdier barrier designs, one-way flow lanes, and real-time crowd density monitoring – especially in the wake of crowd-related disasters. On the health front, festivals in hot climates are integrating wearable health tech for real-time attendee monitoring. Smart wristbands that monitor heart rate and body temperature can flag when a guest may be in distress from heat or dehydration, allowing medics to intervene before a collapse occurs (archiv3-25.iqmagazine.com) (www.abc.net.au). By preventing severe medical incidents, you avoid medical claims and show insurers you’re ahead of the curve in risk mitigation. Even simple tech upgrades like lightning detection systems, high-grade weather radars, or panic-button safety apps for attendees can make a difference in outcomes. Every serious incident averted is not just a human victory but a financial one as well – one less insurance claim to haunt your loss history and drive up future premiums.

Incident Tracking and Continuous Improvement

To truly tighten risk management, festival organizers should adopt a mindset of continuous improvement. This means diligently tracking all incidents, near-misses, and safety observations during the event, then following up on them post-event. Something as small as noticing a particular walkway where multiple people stumbled can lead to a fix (better lighting or re-grading the ground) that prevents a broken ankle next year. Documenting these improvements is key – maintain a log of safety upgrades and incident responses. When renewal time comes, you can present this to your insurance broker or underwriter as evidence of your evolving risk management. For example: “Last year we had an issue with minor electric shocks at a charging station, so this year we installed new ground-fault protectors and we had zero incidents”. These specifics show that your festival doesn’t repeat mistakes. Post-incident reviews are especially important if you did have an insurance claim. Insurers will naturally ask what you’ve changed to avoid a recurrence. If the insurer noted that a certain safety measure could have prevented the claim, implement it immediately – it might earn you premium credits or at least goodwill (www.ticketfairy.com). Festivals that treat an accident as a wake-up call and dramatically improve afterward have even been able to negotiate their premiums back down over time (www.ticketfairy.com). Finally, consider third-party safety audits: inviting a safety consultant or local official to evaluate your plans can provide an outside perspective and further demonstrate your commitment to risk reduction. Over the years, these efforts accumulate into a powerful asset: a safety record you can be proud of and that insurers view favorably.

Claims Management and Insurer Communication

Part of risk management is also being prepared for the worst. How you handle incidents and claims can influence your insurance outcomes down the line. Always report incidents promptly to your insurer as required – late reporting can complicate claims and sour your relationship. Work closely with the insurer’s claims adjusters and attorneys; they are there to manage liability and costs (which ultimately protects you too). Document everything about an incident (photos, witness reports, maintenance logs) to support a fair resolution. A festival that manages a claim professionally – adhering to policy requirements, cooperating in investigations, and taking corrective action – will be viewed as a responsible client. On renewal, your insurer might be more willing to continue coverage or offer reasonable rates, knowing that you approach issues in good faith. Conversely, if a festival is secretive, uncooperative, or repeats the same mistakes, insurers may non-renew the policy or charge a painful premium. In short, make your insurer a partner in safety. Some festivals even invite their insurance broker to tour the site during setup, pointing out all the safety measures in place. This can lead to the broker advocating on your behalf to underwriters, saying “this organizer really has their act together.” It can also prompt helpful feedback – an experienced insurer might suggest additional precautions that could ultimately lower your risk and possibly your premium. The goal is not just to buy insurance as a product, but to engage in active risk management dialogue with your insurer.

Smart Coverage Strategies in a Tight Insurance Market

Prioritize Essential Coverage First

When insurance budgets are strained, it’s crucial to prioritize the absolute must-have policies for your festival. The core coverage for almost every event is general liability insurance (often called public liability), which covers bodily injury or property damage claims from attendees, crew, or the public. This is typically non-negotiable – going without liability insurance could put your entire organization at risk of bankruptcy from one serious lawsuit. Next, consider property insurance for your equipment and infrastructure (tents, staging, A/V gear), or make sure your vendors/production partners have their gear insured. After those basics, event cancellation insurance (for weather or other disruptions) is highly valuable if you can afford it – it can refund lost costs or revenues if you have to cancel or cut short the festival for covered reasons. However, cancellation coverage has become very expensive and often excludes key risks like pandemics, so some festivals are reluctantly choosing to go without it and instead self-insure that risk (more on that below). Worker’s compensation or employer’s liability is another essential if you have employees, to cover staff injuries. In sum, cover the scenarios that would be truly catastrophic first: a liability lawsuit, a major asset loss, or a lost event. Only then look at extras like non-appearance insurance (if your headliner artist might cancel) or specialized add-ons. It’s painful to trim insurance, but if forced by budget, better to skip something like merchandise theft coverage than to underinsure the stage collapsing. Identify your festival’s unique risk profile and make sure every high-severity risk is insured against to a reasonable level. Lower-severity or less likely risks can be higher deductibles or, if absolutely necessary, no coverage (with contingency plans in place).

Exploring Parametric and Alternative Insurance Products

Traditional insurance isn’t the only game in town. In recent years, parametric insurance products have gained traction as a way to protect events from specific risks like weather, often at a lower cost or with more certainty of payout. Parametric insurance pays out based on a predefined trigger or index – for example, if rainfall exceeds 1 inch on the event day, or if wind gusts surpass 40 mph, a payout is issued automatically, regardless of the actual damage. Festivals are exploring parametric weather insurance to weather-proof their finances. The advantage of parametric cover is speed and certainty: you don’t have to fight with an adjuster over whether your losses are covered; if the trigger occurs, you get paid. This can be a lifesaver for weather-vulnerable events, especially as conventional weather cancellation insurance becomes pricier and harder to get. The downside is that if the trigger threshold isn’t met, you receive nothing – even if your festival still suffered (e.g. just under 1 inch of rain could still deter attendees, but no payout). Still, parametric policies for rain, heat, or even pandemics (using local case rates as a trigger) are emerging as innovative hedges against specific threats. Beyond parametric products, some large festival companies consider captive insurance – essentially creating their own insurance subsidiary to cover their events. This only works at scale and requires significant capital, but it’s a way to retain premium money internally (and profit if claims are low). For smaller players, an alternative strategy is joining or forming a mutual insurance pool with other events. By pooling risk (and premiums), a group of festivals might collectively self-insure certain layers of risk, paying out to any member that has a loss. Such arrangements require trust and careful management but have precedent in other industries (and in some country fair associations). Finally, festival organizers are diversifying how they protect their investments – some use weather derivatives, crowdfunding a rain-out fund, or simply purchasing refund insurance for their ticket buyers (so the festival isn’t on the hook for refunds if something goes wrong). In a tight insurance market, it pays to think outside the box and consider blending traditional insurance with these alternative risk transfer tools.

Adjusting Deductibles and Limits Wisely

When budgets are tight, one lever to pull is adjusting your insurance deductibles (the amount you pay out-of-pocket before insurance kicks in) and coverage limits. Increasing a deductible can lower your premium, since you’re essentially agreeing to absorb more of the initial cost of any claim. Many festivals opt for higher deductibles on less critical coverages. For example, you might take a $10,000 property damage deductible if you’re confident only minor losses would occur, saving premium dollars that can go toward liability coverage. However, be careful not to set deductibles so high that an incident would cripple your finances. As a rule of thumb, you should always have cash reserves at least equal to your largest deductible. If you can’t readily access $25,000, then having a $25,000 deductible is risky. It’s often about finding a sweet spot: sometimes a moderate increase in deductible (say from $5k to $10k) yields a good premium reduction, but going from $10k to $50k yields little additional savings (www.ticketfairy.com). Work with your broker to get quotes at a couple of different deductible levels and compare the savings. On the coverage limit side, review if you’re perhaps over-insured in any area, but tread carefully. For instance, if you previously carried a $50 million umbrella liability policy but your contracts and risk profile could suffice with $20 million, scaling back could save money. But always ensure you meet any minimum insurance requirements set by venues, government permits, or sponsors – many require specific limits (e.g. $1M primary, $5M umbrella liability) that you must maintain. One smart approach is to invest in the coverages that protect irreplaceable losses (like third-party liability or cancellation) while considering reducing or self-insuring replaceable losses (like some equipment or signage that you could do without or afford to fix in a pinch). The goal is to optimize your risk retention: retain (through deductibles or smaller limits) the risks you can manage, and pay premiums for transferring the risks you absolutely cannot afford yourself.

Multi-Year and Multi-Event Policies

Given the volatile insurance market, some festival organizers are looking to lock in stability through multi-year insurance agreements or bundling coverage across multiple events. If you run an annual festival, negotiating a 2–3 year policy term at a set rate can protect you from year-over-year premium jumps. Insurers may or may not offer multi-year guarantees (it typically depends on having a stable loss record and the insurer’s appetite), but it’s worth exploring. Another angle is if you organize several events (for example, a summer festival and a winter concert series), you might get a combined policy covering all events within the year. This can sometimes be cheaper than insuring each event separately, because the insurer views it as a larger package (and you only pay one minimum premium and one set of fees). A multi-event policy can also allow shifting coverage to whichever event is upcoming. Insurers do remain cautious with multi-year commitments in uncertain times, so you might only lock some aspects (such as the general liability rate per attendee) while others (like weather) are still rated each year. Still, savvy promoters have managed to negotiate rate caps or loyalty credits by ensuring all their events’ insurance stays with one carrier. The key is to involve your broker early and highlight your multi-event portfolio if applicable – you could position yourself as a valuable long-term client which might prompt an insurer to hold your premium steady for the promise of future business. Additionally, keep an eye on policy renewal timing; if your renewal hits just after a bad year for insurers (say, right after a major loss in the industry), you might explore a short-term extension hoping rates moderate later, or vice versa. Timing and bundling can be a subtle art in squeezing the best deal out of a hard insurance market.

Transferring Risk to Vendors and Contractors

Another cost-conscious strategy is to transfer as much risk as possible to the other parties involved in your festival. This doesn’t mean dodging responsibility for safety – rather, it means using contracts and insurance requirements to ensure everyone shares the burden. Require your vendors, suppliers, and subcontractors to carry their own liability insurance and to list your festival as an “additional insured” on their policies. For example, your stage and lighting provider should have insurance for their operations; if their equipment collapse causes an injury, their policy can cover it first. Similarly, food vendors should have product liability coverage in case of foodborne illnesses, and security firms should carry insurance for any incidents involving their staff. By shifting these specific risks onto those parties (who are being paid for their services), you reduce the likelihood of your insurance being tapped for those claims. Many festivals now impose strict insurance minimums on vendors – and your insurer will favor that. It means if a claim happens due to a vendor’s negligence, that vendor’s policy will pay out before yours. Hold harmless and indemnification clauses in contracts are also critical: vendors should agree to indemnify the festival for any claims arising from their activities. While such clauses aren’t foolproof (they’re only as good as the vendor’s financial health and insurance), they add a layer of protection. In practice, what this strategy does is help contain your loss history. Even if something goes wrong at the event, it might not hit your insurance if it’s covered elsewhere. Over time, fewer claims on your policy means better premiums. Just be sure to actually collect and verify those vendor insurance certificates – it’s an administrative task, but a lapse could leave you exposed. This cooperative risk-sharing approach builds a network of coverage around your event, rather than placing 100% of the burden on your own policy.

Collaboration and Advocacy: Industry Solutions to the Insurance Crunch

Festival Alliances and Resource Sharing

When individual festivals have limited leverage, the solution may be to band together. Around the world, independent festival organizers are forming alliances not only to share resources like equipment and staff, but also to tackle insurance collectively. By presenting a united front, festivals can potentially negotiate group insurance deals or at least share best practices for risk management that lead to lower premiums. In the UK and Europe, associations such as AIF (Association of Independent Festivals) have discussed collective bargaining for insurance. In the US and Canada, some regional event associations pool members to approach insurers with a larger block of business. The principle is similar to group health insurance: a bigger risk pool can spread out the risk and attract more competitive rates. There are already examples of festivals sharing resources to cut costs and build community, such as joint equipment warehouses or bulk purchasing of supplies (www.abc.net.au) – expanding this concept to insurance is a logical next step. One hurdle is that festivals differ in risk, so a collective policy would likely need all members to meet certain safety standards (lest one unsafe event spoil it for the rest). But even short of formal pooled insurance, alliances help by knowledge-sharing: members alert each other to which brokers and carriers are offering fair deals, or team up to educate underwriters about their events. The sense of competition (fear that helping others might lose you an edge) is giving way to a realization that if small festivals don’t collaborate, many won’t survive these cost pressures. Together, festivals are discovering strength in numbers when confronting insurance challenges.

Advocacy for Government Support

The festival industry is increasingly turning to advocacy and government lobbying to address the insurance crisis. In several countries, industry leaders are calling for public interventions similar to those used in other sectors facing an insurance crunch. For example, Australia’s live music industry has pleaded for a government-backed insurance scheme or subsidies to help festivals and venues grappling with quadrupled insurance costs (www.abc.net.au). Festival directors testified in national inquiries that without relief, many cultural events will disappear. The idea of a government-backed festival insurance program is not without precedent – the UK’s £750 million Live Events Reinsurance Scheme (launched in 2021) was one attempt to fill the gap when private insurers withdrew cover for COVID cancellations (www.insurancebusinessmag.com). While that scheme had limited impact (only 169 events covered, as noted, partly due to late rollout) (www.insurancebusinessmag.com), it demonstrated that governments can play a role as insurer of last resort for uninsurable risks. Moving forward, industry associations are recommending solutions like public reinsurance pools for event cancellation (especially for pandemics or natural disasters) and tax incentives for insurers that cover events. They are also pushing for clearer regulations that could reduce uncertainty – for instance, standardizing permitting and safety requirements across jurisdictions so that insurers can more easily evaluate risk. In some places, there’s talk of establishing an “event insurance fund” that festivals pay into during good years and draw from in bad years, possibly with state contributions. While no magic fix is in place yet, the dialogue with policymakers is crucial. If you’re a festival organizer, getting involved with your local event industry association and supporting these advocacy efforts could help turn the tide. At the very least, raising awareness that cultural events are at risk due to insurance challenges might spur creative partnerships or interim grant programs to keep festivals afloat.

Educating Stakeholders and Sharing Data

Part of the long-term solution is educating all stakeholders – not just government, but also insurers, attendees, and the festivals themselves – about festival risk and insurance. There are still misconceptions (even among some insurers) about how festivals operate, which can lead to overly cautious or broad-brush underwriting. Industry groups have started to compile and share more granular data on festival safety improvements, incident rates, and economic impact. The goal is to show insurers actual evidence that, for example, 95% of festivals have zero major claims in a given year, or that specific safety interventions are reducing incidents by X%. The more data we have, the better we can argue for data-driven underwriting rather than blanket assumptions. Some festivals, especially larger ones, now engage with insurance brokers year-round, updating them on new safety measures or changes in the event plan. By building that relationship, you essentially educate your insurer about why your festival is a good risk. On the attendee side, festivals are communicating the importance of new safety rules or procedures by framing them as measures to keep insurance (and therefore ticket prices) under control. There’s a newfound transparency – telling fans “we need everyone to follow these guidelines so that our insurance remains affordable and we can keep this festival going.” Additionally, sharing success stories within the industry is powerful: if a festival tried a new approach (like a different security staffing model or a weather monitoring system) and saw their incidents drop or their insurer praise the effort, spreading that knowledge can help others replicate it. In essence, we need a collective learning approach. Every near-miss, every cost-saving hack, every negotiation win – share it at conferences, webinars, on promoter blogs and forums. The festival industry has always been passionate and cooperative at heart, and by openly discussing insurance challenges and solutions, we can collectively become more resilient.

Recognizing Good Actors in the Insurance Industry

Finally, as we advocate and collaborate, it’s worth acknowledging that not all insurance outcomes are doom and gloom. There are brokers and underwriters who genuinely understand the festival business and are working hard to find solutions for their clients. Maintaining relationships with these good actors is important. If you find an insurer or agent who gives you a fair deal or innovative coverage, sing their praises (to a point, without giving away your competitive advantage) so that they get more business and remain in the market. Similarly, some insurers are experimenting with products like weather parametrics or lower-cost “micro insurance” for single-day events – supporting those pilots by trying them out can encourage the development of better offerings. As an industry, we should highlight positive trends: for example, if overall claims go down in 2024 due to improved safety, make sure that narrative is told in the press and to insurers, to potentially ease the next cycle of premiums. Also, consider inviting insurers to festival conferences or safety workshops as participants. When underwriters see firsthand the professionalism of many event organizers and the training that goes on, it humanizes the risk and might soften their stance. We want to move from an adversarial mindset (“insurers are price-gouging us”) to a partnership mindset (“we’re all trying to manage risk in uncertain times”). By recognizing and rewarding the insurers who truly support the events industry – and constructively engaging with those who are more wary – festival producers can help shape a more sustainable insurance landscape for everyone.

Adapting to Different Festival Scenarios

Strategies for Small and Community Festivals

Smaller festivals and community events must be especially resourceful to manage insurance costs. Here are some tactics tailored to their scale:

– Leverage Local Government Support: Many municipalities value local festivals for the cultural and economic benefits. Don’t hesitate to approach city officials or tourism boards for assistance. Some towns will cover certain insurance aspects if the event is on city property, or they might include your event under a broader municipal insurance umbrella for a nominal fee. Even a grant specifically earmarked for insurance can be a lifesaver (some Australian festivals are seeking exactly this) (www.abc.net.au).

– Join Forces with Similar Events: If you’re a small folk music festival, for example, network with other similar folk or arts events. Perhaps you can collectively hire a risk manager to advise all of you, splitting the cost. Or explore a group insurance program – a broker might create a group policy for, say, 10 small events in one region. This kind of collaborative approach to cut costs can make insurance affordable where it wasn’t before.

– Simplify and Reduce Risk Factors: Scale back on higher-risk attractions that might be driving your insurance up. If you’re a tiny event, do you really need the bouncy castle or the fire-dancers or other elements that add liability? Focus on your core program and make it as safe as possible. By “right-sizing” your festival to reduce unnecessary complexity, you not only save money on production – you also present a leaner risk profile to insurers. Some events that downsized (fewer stages, lower attendance cap) saw their insurance quotes drop significantly the next year, because there were simply fewer things that could go wrong (www.ticketfairy.com).

– Educate and Involve Your Community: Often, the attendees and volunteers at a small festival are locals who deeply care about it. Engaging them in safety efforts can multiply your effective risk management. Consider creating a volunteer “safety ambassador” team that roams the event helping spot and resolve minor hazards. Their presence can prevent incidents (like politely asking someone to pick up a dropped glass bottle before it becomes a cut injury). A safer event means a stronger safety record, which over time helps keep insurance manageable.

– Fundraise for Insurance Specifically: It may sound odd, but some community events have literally crowdfunded their insurance premium – pitching it to supporters as a “keep the festival alive” fund. When people understand that insurance is the make-or-break expense, they might be willing to donate a bit extra to cover it. Similarly, a local business might be more inclined to sponsor the festival if they know their money is going directly to cover insurance (which ultimately protects everyone).

Considerations for Large-Scale Festivals

Large festivals (tens of thousands of attendees) have more complex insurance needs, but they also have some advantages in tackling the challenges:

– Dedicated Risk Management Personnel: By the time an event is of a certain scale, it’s worth having a full-time risk manager or safety officer on the team. These professionals (with backgrounds in event safety or insurance) can focus on continuous risk assessment, ensuring compliance with standards, and liaising with insurers. Large festivals like Glastonbury or Lollapalooza employ seasoned safety teams whose work behind the scenes year-round helps keep incident rates surprisingly low for the size of the event. This in turn can lead to better insurance terms, as the insurers trust the expertise involved.

– Broader Insurance Market Access: A major festival might be able to access insurance markets that smaller events can’t. For instance, you may work with a specialty broker who can tap into Lloyd’s of London or global insurance syndicates to find coverage for unique risks (like pyrotechnics, aviation for drone shows, or on-site camping liabilities). While the premium might still be high, at least coverage can be found. Big events can also buy layered insurance (multiple policies stacking to higher limits) to achieve the necessary coverage, though this comes with multiple premiums. The key is using your scale to your advantage – more insurers will entertain a $200,000 premium policy than a $5,000 one, simply because of revenue, so paradoxically you might have an easier time finding $50 million in coverage than a local fest has finding $5 million.

– Risk Spread and Portfolio Thinking: Large promoters that run several festivals (or multi-city tours) can spread risk across their portfolio. They might accept a loss on one event in a bad weather year knowing others will profit, and structure their insurance program holistically. For example, one major company could purchase a single giant liability policy that covers all 10 of their festivals, instead of individual ones – effectively self-insuring a layer before the policy kicks in for any one event. Independent big festivals can mimic this by maintaining a strong reserve fund: treat a portion of each year’s surplus as your self-insurance kitty, which lets you take higher deductibles and lower premiums the next year. It requires financial discipline (shareholders or investors must understand the need to reinvest in risk mitigation), but it’s a savvy move for sustainability.

– Enhanced On-Site Services: Large festivals have the capacity to implement features like fully equipped on-site medical centers, trained fire rescue teams, and robust site infrastructure that small events cannot. These services absolutely reduce the severity of incidents – e.g., a heart attack victim treated within 3 minutes on-site vs waiting 20 minutes for off-site EMTs has far better odds. Quick response means fewer severe outcomes (and lower liability). Insurers for massive events often inspect these provisions and will price a policy more favorably if, say, you have an on-site clinic with doctors (some festivals even integrate telemedicine links for remote specialist support). The public may not see these investments directly, but they pay off in lives saved and claims avoided. So, large events should continue to lead the way in on-site emergency preparedness – it sets a precedent insurers can appreciate.

Niche Festival Types and Special Risks

Different types of festivals carry different risk profiles, which in turn affect insurance. Being aware of your niche’s particular risks can help you focus risk management and negotiate the right coverage:

– Music Festivals with Young Crowds: Festivals catering to younger, high-energy audiences (like EDM or hip-hop festivals) might face more medical incidents related to dehydration, substance use, or crowd surges. Insurers know this, which is why these events often pay more for liability. Counter this with robust harm reduction programs: free water stations, cooling areas, on-site drug education/testing services (where legal), and a visible security presence to deter crowd misbehavior. Demonstrating these programs to insurers can somewhat mitigate the “young crowd = high risk” perception.

– Cultural or Food Festivals: An arts & crafts fair or a food festival has a different set of risks – perhaps more about food safety or older attendees tripping. Emphasize your controls on vendors (e.g. health department permits, safe food handling training) and accessibility measures for attendees. These events might find insurance relatively affordable except in the case of liquor liability (if alcohol is served) – make sure to either add liquor liability coverage or require vendors to have it, since alcohol-related incidents are a big claim source at food & drink events. If your festival is family-focused, highlight that aspect; insurers may view a daytime family event as less prone to violence or severe incidents than an all-night rave, for instance.

– Adventure or Sports Festivals: Some festivals incorporate adventure sports, rides, or extreme activities (think X-Games style events, or festivals with zip-lines, rock climbing walls, etc.). These carry higher inherent risks and will need specialized insurance riders. The key is to outsource risk when possible: use professional operators for any rides or activities and ensure they carry proper insurance and indemnify the festival. Also, consider participant waivers for those engaging in risky activities (though a waiver isn’t a get-out-of-liability-free card, it can help in legal defense). Document all safety certifications of any attractions. You might work with niche insurers who cover sporting events for those aspects, separate from your main festival liability policy.

– Multi-Location or Urban Festivals: If your festival spans multiple venues or city blocks (like SXSW in Austin or Nuit Blanche art festivals), your risk is spread out but also involves more variables (different venue capacities, street closures, etc.). Coordination with city authorities is paramount. In insurance terms, verify that your policy covers all locations and associated operations (sometimes you may need to list each venue on the policy). If parts of the event are indoors, some risks (like weather) decrease, but others (like venue crowd codes, fire safety compliance) come into play. Work closely with venues to ensure they have their own insurance and that your coverage dovetails (and doesn’t double-pay for the same risk). Insurers may ask if your crowd will migrate between sites and how you manage that safely – having a solid operations plan for a multi-venue fest will again instill confidence and potentially avoid premium surcharges.

– Destination and Remote Festivals: Festivals in remote locations or destination events (on a cruise ship, an island, or deep in the desert) face unique insurance hurdles. Emergency response might be slower or require helicopters; weather can be more unpredictable; infrastructure is built from scratch. As a result, insurance quotes can be eye-watering. To counter this, show that you’ve put in extra preparation: e.g., contracting a private medical evacuation helicopter on standby, or using specialized insurance for remote-location festivals that covers things like medical evacuation and environmental liability. Sometimes separate policies (marine insurance for a festival at sea, or environmental impairment insurance if you’re on sensitive land) are needed. Bundling those into your plan and budgeting accordingly will make sure a remote adventure doesn’t turn into an uninsured nightmare.

Budgeting and Financial Planning Amid Rising Insurance Costs

Integrating Insurance into the Budget from Day One

In the current climate, festival producers must treat insurance as a core line item in the budget, not an afterthought. This means when you start budgeting for next year’s event, plug in a realistic estimate for insurance costs right alongside talent fees, production, and marketing. Many veteran organizers now assume insurance will be at least 5-10% of their total budget (it varies by event size and type, as discussed). By acknowledging this early, you can price your tickets and seek sponsorships accordingly. Sticker shock often comes when insurance is left until late in the planning process and then the premium quote blows the budget. Avoid that scenario by soliciting indicative quotes well in advance – even 6-9 months out, you can ask your broker for a ballpark based on current market conditions. Additionally, build a contingency buffer for insurance increases or last-minute cover needs. For instance, you might set aside an extra 20% of the expected premium in case final pricing comes in higher or you decide to add a rider (like weather or terrorism coverage closer to the event). It’s wiser to have a small surplus if insurance ends up cheaper than expected, than to be caught short. When making your budget public (to investors or board members), explain the insurance assumptions so everyone understands why that line might have jumped from previous years. This transparency ensures that if you need to adjust things (like raise ticket prices), stakeholders see the direct connection to safety and risk management rather than just “inflation.” In summary, make insurance a non-negotiable expense in your financial planning, much like venue rent or artist deposits – it’s part of the cost of doing business in events now.

Cost-Saving Measures to Offset Premium Hikes

While you can’t control global insurance rates, you can get creative elsewhere in your budget to offset the impact of premium hikes. Many festivals are going through their operations with a fine-toothed comb to trim excess costs and improve efficiency. One approach is adopting lean production techniques to streamline operations. This might include reducing build days (and associated labor costs), optimizing power usage to lower generator rentals and fuel, or cutting back on under-utilized site areas to save on fencing and security. Every dollar saved is one that can be redirected to cover insurance. Volunteer programs can also alleviate budget strain – if you can safely replace some paid staff with well-managed volunteers (for roles like info booths, decor, cleanup), that frees up funds for critical expenses. Another strategy: cooperative buying and sharing. If you know another event renting equipment the weekend before yours, see if you can share the rental and split costs (less time that equipment sits idle). The resource-sharing alliances mentioned earlier often extend to cost-sharing on things like fuel, accommodations, or consultants. Some festivals are also negotiating harder with vendors – for example, a food vendor might pay a slightly higher fee to trade if you as the organizer are now providing them with insurance coverage or other support, balancing the equation. And of course, revisit your insurance coverage itself for potential savings: perhaps you can raise a deductible, or drop an optional coverage if you have a solid plan B (like choosing not to insure merchandise inventory if you can accept losing it in a worst case). Finally, consider incremental revenue to specifically cover safety/insurance costs – a small “safety fee” added to each ticket ($1 per ticket x 20,000 tickets is $20k extra) or special VIP experiences whose proceeds you earmark for insurance. Communicate to fans that these contributions help keep the event safe and insured. You’d be surprised – many attendees are willing to chip in if they know it directly supports the festival’s well-being. The bottom line: through smart budgeting and a willingness to tighten belts, festivals can absorb higher insurance costs without gutting the core attendee experience.

Working with Brokers and Taking Bids

If ever there was a time to lean on a knowledgeable insurance broker, it’s now. A good broker is your advocate in the insurance marketplace – they can present your festival in the best light to underwriters and shop around for the most competitive quotes. Make sure you’re working with a broker who specializes in event or entertainment insurance (as opposed to a generalist who might not know all the nuances). Provide them with a thorough information package about your event: past attendance figures, safety measures and credentials, claim history, site plans, etc. The more they have to work with, the better they can argue for lower rates or find creative solutions. Don’t hesitate to get quotes from multiple brokers, but be transparent – there’s a limited pool of underwriters, and you don’t want them getting multiple submissions for the same event (which can make it look disorganized). Instead, consider either switching brokers if one isn’t delivering, or having one broker approach certain markets and another focus on different ones (some festivals use one broker for general liability and a different specialist for, say, weather or cancellation coverage). Compare quotes on an apples-to-apples basis: one quote might be cheaper but has more exclusions or lower sub-limits, so look beyond price at what’s actually covered. Also factor in the broker’s value: did they suggest risk improvements or help negotiate claims in the past? That might be worth a slightly higher premium versus a cut-rate insurer that won’t stand by you in a pinch. Remember, this is a buyer’s market in the sense that you, the festival, are the client – don’t be afraid to ask for justifications on any premium increase. Sometimes a broker can appeal a quote by providing more info or asking for an exception, especially if you’ve been a loyal customer. Treat the insurance buying process as part of your annual festival cycle – start early, have your materials ready, and schedule time to review policies in detail. A few hours of due diligence here can save tens of thousands of dollars or avoid nasty surprises later.

Scenario Planning and Worst-Case Funds

When managing risk, hope for the best but plan for the worst. Financially, this means doing scenario planning around insurance and incident outcomes. Ask “what if?” for key scenarios: What if we have to cancel a day of the festival and our event cancellation insurance claim doesn’t pay out enough? What if an injury lawsuit exceeds our liability limit? By mapping out these scenarios, you can establish contingency funds or backup plans. For instance, some festivals maintain an emergency reserve equal to a percentage of their budget (5-10%) to handle any uncovered losses or deductibles. This could be literally cash in the bank or an open line of credit that can be tapped quickly. If you never need it, great – it rolls over to next year or can be invested in improvements. But if you do, it could save the festival from bankruptcy. It’s also wise to plan operationally for worst-case events: If extreme weather is forecast, what’s the decision tree for cancellation before you incur too many costs? If you lack insurance for a scenario (like communicable disease), do you have an agreement with key vendors on partial refunds or postponements if that scenario hits? Some festivals learned during COVID that force majeure clauses and vendor flexibility can make the difference – negotiate contracts so that if you must cancel due to reasons beyond control, you’re not on the hook for 100% of every expense. Essentially, make a “disaster plan” that aligns with your insurance. Know what triggers a claim, whom to call, how to document losses, and simultaneously know what steps to take if something falls outside insurance. Ironically, having robust contingency plans can sometimes impress insurers too – it shows you’re a proactive organizer. Lastly, mentally prepare your team and stakeholders for the fact that in a worst-case, the event’s survival might depend on tough calls (like a last-minute evacuation or a cancellation to keep people safe). By planning and even practicing those decisions, you ensure that if the day ever comes, you’ll manage it professionally and mitigate the fallout. That can be the difference between a one-time setback and a challenge that shuts down your festival for good.

Key Takeaways

- Premiums are surging and coverage is tighter – Festivals worldwide face rising insurance costs (premiums up 50–300% in recent years) and many insurers reducing their offerings. Even long-running events have seen tenfold price hikes or struggled to find sufficient coverage, forcing tough decisions.

- Major claims and climate events drive the spike – Tragedies like crowd disasters and the growing frequency of extreme weather have made festivals appear riskier to insurers. Big lawsuits and weather cancellations have led underwriters to raise rates and add exclusions to protect themselves.

- Improve safety to improve insurability – A strong safety record and proactive risk management culture are a festival’s best defense. Festivals that invest in thorough training, emergency planning, and hazard prevention often get more favorable insurance terms and avoid claims that would jack up future premiums.

- Be strategic with coverage and alternatives – Prioritize must-have coverages (liability, etc.) and consider higher deductibles or lower limits only where you can afford the risk. Explore alternatives like parametric weather insurance or joining insurance pools with other events to reduce reliance on traditional policies.

- Work with the right partners – Engage experienced festival insurance brokers and start the insurance procurement early. Shop around and compare policy terms, not just price. Require vendors and partners to carry their own insurance to share the risk, and maintain open communication with insurers, treating them as allies in risk reduction.

- Budget for insurance and adapt – Treat insurance as a core expense (5–10% of budget or more) and plan accordingly. To offset rising premiums, streamline operations with cost-saving measures, perhaps scale back certain elements of the festival, and allocate contingency funds for uninsured scenarios. Every dollar saved elsewhere can help cover essential insurance.

- Industry collaboration is key – Small and independent festivals should collaborate through alliances and advocacy. Sharing resources and information can cut costs, and unified industry voices can push for government-backed solutions or highlight the need for more insurers in the market. As a community, festival organizers have more power together than alone.

- Stay resilient and informed – The insurance market is cyclical; today’s crunch may eventually ease. In the meantime, stay informed on industry trends, continuously improve your event’s risk profile, and don’t lose sight of the mission. A well-managed, well-insured festival is not just a cost center – it’s what safeguards the magic of the festival experience for years to come.

27th December 2025

27th December 2025