Introduction

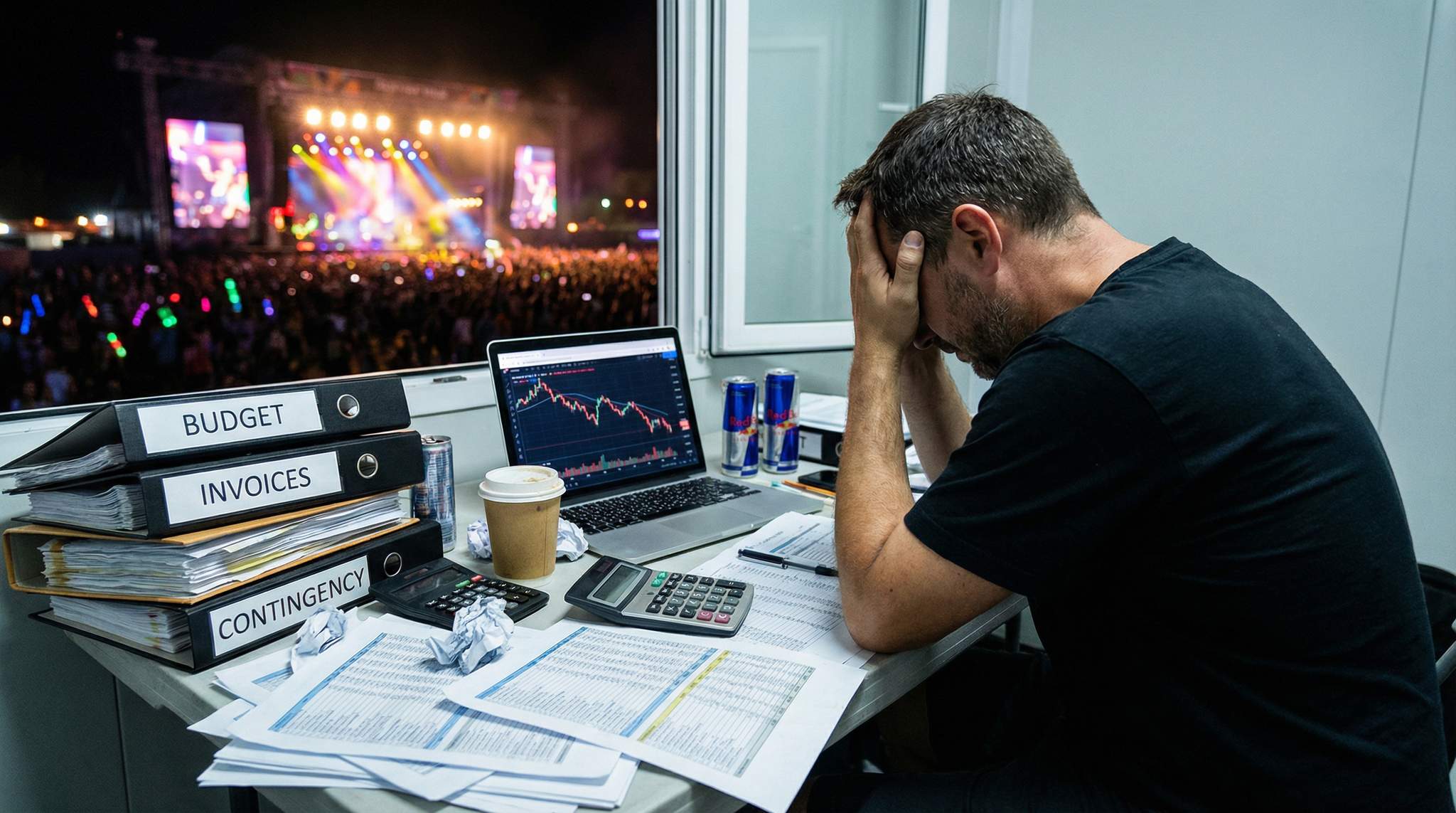

Budgeting and finance are the backbone of every successful festival. Whether it’s a small local gig or a mega event with hundred-thousand crowds, financial planning will often decide if a festival makes magic or goes bust. Festival producers juggle myriad expenses – talent fees, staging, permits, marketing, logistics, and more – while trying to turn a profit or at least break even. Money mistakes can be fatal in this game. Major events run on budgets in the millions and even modest ones need careful control to avoid red ink.

Key Stat: A new economic report revealed that Glastonbury 2023 cost about £62 million (~$72 million) to stage, according to a recent economic report on the festival’s expenses. This eye-opening figure shows the staggering scale of big festival budgets – and why rigorous financial management is vital at all levels.

It’s alarmingly easy for costs to spiral out of control if you don’t plan with care. Many events end up overspending from the original plan. The difference between a festival that turns a healthy margin and one that leaves its organizers in debt often comes down to methodical budgeting and smart money tactics. This guide will explore all aspects of festival finance – from building a rock-solid budget and finding funding, to controlling costs and adapting in tough economic times – so that any festival can stay financially fit without sacrificing the magic on stage.

Table of Contents

- Laying the Groundwork: Festival Budget Planning Basics

- Forecasting Revenue: Tickets, Pricing & On-Site Spending

- Funding Strategies: Sponsors, Crowdfunding & Grants

- Managing Major Expenses: Talent, Production & Operations

- Vendor Relations & Contract Negotiation

- Cost Control: Saving Money Without Sacrificing Quality

- Contingency Planning & Risk Management

- Financial Tracking, Accounting & Compliance

- Post-Event Analysis & Long-Term Sustainability

- Essential Reading

- FAQ

- Glossary

- Conclusion

Laying the Groundwork: Festival Budget Planning Basics

Every festival needs a clear budget framework before any money is spent. This starts with identifying all potential costs and incomes as early as possible. Create a list of expense categories – venue, stages, sound and lighting, artist fees, marketing, ticketing, safety, permits, insurance, and so on – and assign realistic estimates to each. Be conservative and err on the side of overestimating costs. New producers often underestimate expenses like lighting, security or cleanup, only to get a nasty surprise later. A good rule of thumb is to include all obvious line items plus a healthy margin for unexpected things.

Warning: First-time organisers frequently grossly underestimate event expenses. Hidden costs – from permit fees and sales tax to last-minute equipment fixes – can add up fast. Always assume things will cost a bit more and take longer than planned, so you don’t end up with a budget crisis when reality bites.

It’s crucial to start early. Budget planning should kick off a year or more before a major festival, and at least several months for smaller events. This gives time to gather vendor quotes and refine figures. Use real data whenever possible – research similar events, get ballpark prices from suppliers, look at historical costs if you’ve run events before. In fact, a recent industry analysis suggests almost 90% of events end up spending more than initially projected, with typical overruns in the 15–30% range, according to data on event budget overruns. Knowing this, smart festival planners build in buffers and keep a close watch on spending from day one.

Key Stat: Nearly 90% of events end up spending beyond their initial budget, with overruns of 15–30% in many cases, as highlighted by contractor insights on project management. This underscores how vital it is to include contingency and track costs diligently from the start.

One effective tactic is to define your critical expenses versus nice-to-haves. Pay for must-haves first – like stages, sound, safety, and key acts – before you allocate money to things like premium decor or fancy giveaways. This prioritization ensures core production needs are met. Timeline planning also plays a big part in budgeting. Consider when payments are due (deposits for artists, installment payments for vendors, etc.) and make sure you’ll have cash available at the right times.

Pro Tip: Always set aside a contingency fund of 10–15% of your total budget. This built-in safety net will cover unexpected expenses – a sudden repair, a surprise cost increase, or even a last-minute must-have opportunity – without derailing your entire budget.

Proper accounting practices should begin from day one. It’s not just about planning what to spend, but also how to keep track of money. Establish a system to log every expense and every bit of income. Even a basic spreadsheet can work for a small event, while larger festivals should consider dedicated budgeting software or a professional accountant. Early on, make sure you are keeping your festival’s books clean and legally compliant – set up a clear paper trail for all transactions, and know which expenses might be tax-deductible or subject to specific regulations. That way, you’re not scrambling later to ensure your festival’s finances meet legal and tax requirements.

Finally, treat your budget as a living document. You’ll revise it many times as plans evolve. The following table illustrates a basic timeline for budgeting tasks in the lead-up to a hypothetical festival:

| Time Before Event | Key Financial Planning Tasks |

|---|---|

| 12+ months out | Draft initial budget with all major expense categories. Set rough allocations (e.g. venue, talent, production) and identify any big funding needs. Start looking for sponsors or investors if needed. |

| 9 months out | Begin securing funding – approach potential sponsors, investors or partners. Launch early ticket sales (like early bird tickets) to generate income. Get preliminary vendor quotes for major cost items (stage, lighting, etc.) and update budget with realistic figures. |

| 6 months out | Refine the budget: nail down line-up costs, finalize venue expenses, and allocate funds to each department (operations, marketing, etc.) based on updated quotes. Ensure at least 10% of budget is still unassigned for contingencies. |

| 3 months out | Finalize all significant contracts with vendors and suppliers – you should now have a fairly clear picture of expenses. Check ticket sales trends; if revenue is lagging behind forecasts, consider cost cuts or boosting marketing now. Prepare to pay remaining deposits. |

| Event Month | Tighten control on spending – avoid taking on new expenses unless absolutely necessary. Set up your financial controls for on-site spending (like cash handling or cashless payments systems). Have contingency funds readily accessible for any unexpected on-site needs. |

| Post-event (within 1 month) | Conduct a full financial reconciliation. Compare budget vs. actual costs for each line item. Pay any final invoices. Evaluate which cost estimates worked and which went off track. This is the time to learn and create a more accurate budget model for the next event. |

By following a structured approach like this, you give your festival a strong chance to stay on budget. The groundwork of prudent planning, starting early, and including buffers will set the stage for all the financial decisions to come.

Forecasting Revenue: Tickets, Pricing & On-Site Spending

A festival’s viability hinges not just on cost control, but on earning enough income. The primary revenue for most festivals comes from ticket sales. Estimating ticket revenue involves a mix of art and science. Start with a realistic projection of attendance – consider venue capacity, your event’s history (if any), and the effectiveness of your marketing. Be pessimistic in projections; it’s safer to underestimate attendance than to expect a sell-out and overspend. Once you have an attendance estimate, set ticket prices carefully. Look at what similar events charge for entry. If you price tickets too high, you may scare off potential attendees; too low and you leave money on the table or fail to cover costs. Revenue = Attendees × Ticket Price, so you must find a balance that yields enough income and still fills the venue.

To illustrate, say you expect 5,000 attendees and need $500,000 from tickets to break even – that implies an average ticket price around $100. In reality, you might use tiered pricing: early-bird discounts, regular admission, VIP passes, etc. Early-bird tickets sold months in advance help with cash flow and gauging interest. VIP or premium packages can boost per-capita revenue by offering extras (special viewing areas, freebies, backstage access) at a higher price. A well-planned ticketing strategy maximizes revenue and even sets the event vibe via VIP perks.

Warning: Be very careful with assumptions in revenue forecasts. Don’t count on best-case scenarios – for example, assuming 100% of tickets at full price or that every attendee will buy expensive VIP upgrades. Overestimating income can lead to spending money that you won’t actually get back. Always consider a lower attendance or discount uptake in your planning.

Tickets are just part of the story. Successful festivals capitalize on ancillary revenue streams – think food and beverage sales, merchandise, parking, campground fees, and more. Many large events generate as much money inside the gates as from tickets. A key metric to watch is per attendee spending, often called per cap. This is the average extra dollars each visitor spends on site. For example, if your crowd size is 5,000 and collectively they spend $100,000 on food, drinks, and merch, that’s a per cap of $20. Improving that number can significantly lift your bottom line. Tactics include offering plenty of vendor options, festival merchandise that people actually want to buy, and encouraging sales via convenient payment methods.

Key Stat: In a 2025 study, festival-goers in the UK spent an average of £86 before arriving and another £150 on-site, bringing total per-person spending (excluding tickets) to over £230, as shown in new research on festival-goer expenditure. This illustrates the huge revenue potential beyond ticket sales – if your festival can get people to spend on food, drinks, and merchandise.

Unlocking on-site spending without alienating fans requires finesse. A common mistake is hiking vendor prices too high – if drinks or food are absurdly expensive, attendees may buy less (or smuggle their own) and leave with a bitter feeling. Instead, focus on value and variety. Offering a wide range of food choices, merchandise that ties into the festival’s theme, and easy payment options (like contactless payments) can encourage higher spending. Many festivals now use cashless payment systems or festival credit tokens, which have been shown to increase purchasing by simplifying transactions. As a producer, you might also take a share of vendor sales (e.g. 15% of food vendor revenue) or charge a fixed vendor fee – structure this in a way that vendors can still make profit without overcharging the public.

Planning a Festival?

Ticket Fairy's festival ticketing platform handles multi-day passes, RFID wristbands, and complex festival operations.

Pro Tip: Create specialized offers to boost on-site revenue. For example, limited-edition festival merchandise or meal-and-merch bundles can gently push the average spending higher. Happy hour deals from vendors (early in the day to get sales going) or collectible items like festival-branded drink cups can provide extra income. Little tactics like these across food, drink, and merchandise can add up to big revenue gains.

Finally, monitor sales closely during the event. If a particular item or vendor is selling very well (or poorly), you might adjust – for instance, shift stock to popular merchandise designs or run a flash promotion on slow-moving items. Real-time data from sales systems is invaluable for this. The bottom line: a vibrant festival business model isn’t just about getting heads through the gate; it’s about boosting on-site spending per festival attendee in a way that enhances their experience. Happy customers will spend more, and come back next year – fueling a virtuous financial cycle for your event.

Funding Strategies: Sponsors, Crowdfunding & Grants

Not every festival can survive on ticket and vending income alone, especially in the early years. That’s where external funding like sponsorships, community funding, and grants comes in. Sponsorship is often the lifeblood of large events. A major sponsor – whether a brand of beer, a tech company, or a big local business – can underwrite a significant portion of festival costs in exchange for exposure and engagement with your audience. To attract sponsors, festival producers need to put together a compelling package highlighting the festival’s attendance demographics, media reach, and unique value. Essentially, you’re convincing a company that investing in your event will bring them benefits (like brand recognition or sales leads). Be prepared to offer things like logo placement, booth space, naming rights for stages or venues, or exclusive access for sponsor guests.

When seeking sponsorship, relationships are key. Start with local businesses that have a logical tie-in to your festival’s theme or audience. For example, a regional craft brewery might sponsor a music festival’s beer garden, providing both funds and in-kind support (free product in this case). Always deliver value to sponsors – that means fulfilling what you promise in terms of logo visibility, mentions, VIP treatment, etc. Happy sponsors are more likely to come back. Also consider non-cash sponsorship (called in-kind sponsorship). This is when a sponsor provides goods or services instead of money. Think of a sound equipment company furnishing gear at a discounted rate, or a sponsor providing free advertising (saving you marketing costs). These are valuable contributions that reduce your expenses.

Another route, especially for community-based festivals or new events, is crowdfunding. Engaging your fan base via a platform like Kickstarter or via presale festival bonds can generate startup capital and a committed audience. Essentially, the community funds the festival up front. A classic approach is to offer incentives for different funding levels – from simple thanks (like early bird tickets, merchandise) to special experiences (backstage meet-and-greets or the chance to vote on something at the event) for bigger contributions. Community funding not only gives you money to work with, but also creates a pool of invested superfans who will promote the event by word of mouth. However, successful crowdfunding requires a lot of marketing and a solid reputation – people will only put money down if they believe in the festival’s vision. Learning from those who have done it is wise; for instance, read up on engaging community support to fund your festival to understand how to build buzz and trust around a crowdfunded event.

Public sector funding is another avenue. Many local governments and arts councils give grants or funding for events that have cultural or economic significance. For example, in some regions local authorities and tourism boards provide festival grant schemes specifically to encourage events that attract visitors and boost the local economy, as seen in local authority tourism grant initiatives. Research if your festival might qualify for municipal or state funding – there could be grants for arts and culture, heritage, community development, or tourism that fit your event. Keep in mind that grants often come with strings attached (usage restrictions, detailed acquittal reports, etc.), and the application process can be time-consuming. But a successful grant can take a huge financial weight off your shoulders.

Need Festival Funding?

Get the capital you need to book headliners, secure venues, and scale your festival production.

The following table sums up primary funding sources beyond basic ticket sales, with their advantages and challenges:

| Funding Source | Advantages | Challenges |

|---|---|---|

| Corporate Sponsorship – brand partners who give money or in-kind value to support the event. | Major infusion of funds; potential for long-term partnership if sponsor is happy. | Sponsors expect value (exposure/ROI) – you must deliver on promises. Could influence festival identity (e.g. heavy branding). |

| In-Kind Sponsorship – goods or services given instead of cash. | Reduces need to pay for vital services (e.g. free equipment or promotion); can be easier to get than cash. | Still requires you to provide sponsor benefits. In-kind help may not cover critical budget shortfalls (e.g. free pizza won’t pay for lighting). |

| Community Investment (Crowdfunding) – funding from future attendees or fans, typically via small contributions. | Creates a built-in fan base who are financially and emotionally invested in the event. Funds come before the event (helping with startup costs). | A lot of effort to promote. No guarantee of hitting funding target. You must deliver perks/promises to backers. Failure to deliver can damage your reputation in the community. |

| Public Grants – funding from government or foundations. | Non-repayable funding if you win a grant. Endorsement from a respected funder can add credibility to your festival. | Competitive and slow to secure. Usage may be restricted to certain expenses. Requires significant paperwork and follow-up reports. |

| Private Investors/Loans – funds via investment or borrowing. | Can provide capital when other sources are not available. Debt funding (loans) can bridge cash flow gaps. | Loans must be repaid, with interest – risky if ticket sales underperform. Investor money may require giving up some control or profit share. Use with extreme caution. |

A smart funding strategy often uses a mix of these. For example, a festival might have a title sponsor (corporate), some in-kind help from local providers, a small community fundraising campaign to get started, and a bit of grant money for a specific aspect (like eco-friendly initiatives). Diversifying your income in this way reduces heavy reliance on any single source.

Warning: Don’t rely on a single source of funding unless you’re absolutely sure of it. Even well-laid plans can fall through – a sponsor might pull out late or ticket sales might disappoint. A cautionary tale is the Philadelphia Folk Festival, which had to cancel its 2023 edition amid a financial crisis. The organizers faced over $200,000 in debt and only managed to revive plans by starting a last-ditch fundraising drive and finally accepting corporate sponsors after years without them, a situation reported by Axios regarding the Philadelphia Folk Festival. The lesson is clear: secure multiple backstops for money, and have a plan B (and C) if a critical piece of funding fails.

Pro Tip: Approach sponsorship as a long-term relationship. Instead of looking at sponsors purely as piggy-banks, involve them in the festival family. Invite key sponsor reps to planning events, get their feedback on what’s valuable for them, and show appreciation (like special gift bags or recognition at the event). A sponsor that feels valued is far more likely to increase support for next year.

In summary, leveraging outside funding requires both salesmanship and stewardship. You’ll need to sell the vision of your festival to sponsors and funders, and then deliver on your promises to keep them happy. Alongside smart budgeting and revenue maximization, good funding strategy will set up your festival for financial sustainability.

Managing Major Expenses: Talent, Production & Operations

Where does all the money actually go? For a typical festival, a few big categories make up the lion’s share of spending. The main ones are usually talent, production/infrastructure, operations/staff, and marketing. Managing these major expense categories is like balancing four heavy balls – if one gets too large, you might drop all of them. Let’s break them down:

-

Talent costs – Artist, performer or speaker fees are often the single largest expense, especially for music festivals. Large music events famously allocate a hefty portion of their budget to talent – often on the order of 30–50% for artist fees and related costs. Booking big-name headliners can easily run into millions of dollars. For example, a festival might earmark 40% of its whole budget for talent in order to secure a few famous acts. This is high-risk, because over-paying for talent can leave little money for everything else. On the flip side, weak talent can hurt ticket sales. The key is to find a realistic mix – maybe one headline act that will draw a crowd, balanced by promising mid-tier acts and local openers. Also remember to budget for all the expenses around talent: travel and lodging, ground transport, hospitality (artist requests can be lavish), special equipment, etc. Contract negotiations with artists should include clauses so you don’t get hit with unexpected extras (like unplanned overtime or special production needs). Always keep an eye on the talent budget and resist the urge to sign more big names without adjusting elsewhere.

-

Production & Infrastructure – This encompasses staging, lighting, sound, video screens, power, and site infrastructure (fencing, tents, toilets, water, etc.). These are largely fixed costs that you have to layout regardless of selling one ticket or fifty thousand. Production can be 20–30% of the budget or more, particularly if your site is a blank canvas (like a field) that needs everything brought in. For example, renting a quality sound system and stage setup for a mid-size festival can run in the hundreds of thousands of dollars. Site infrastructure such as generators, lighting towers, temporary wifi, and fencing are often underestimated – but are critical for safety and logistics. Work with experienced production managers and get multiple quotes for equipment rental. Sometimes you can save by booking production vendors in their off-season or by signing multi-year deals (locking in a better rate). However, never compromise on essential safety equipment or experienced technical staff – accidents or outages at the event can cost far more in liability and reputation damage.

Building Your Financial Safety Net — Maintaining a sacred reserve fund to protect your event from unpredictable mid-production crises. -

Operations & Staffing – This includes payments to event staff, security, medical services, cleanup crews, ticketing staff, and so on. Some festivals rely heavily on volunteers to reduce labor costs, providing free tickets or other perks in return for work. That can work, but even volunteer programs have costs (crews, food, T-shirts, and a dedicated management team to coordinate). Paid staff, especially skilled roles (electricians, production runners, stage managers) can be expensive but are often necessary. Don’t forget things like staff training, uniforms, and accommodation if you need people on-site. Additionally, basic amenities for staff and artists (like catering/backstage hospitality) fall under ops. Many events also incur costs for public services – such as hiring off-duty police for security or special transportation arrangements. These operational costs can be in the 10–15% range of the budget. Efficiencies here come from good planning: for instance, scheduling staff in shifts that don’t overlap unnecessarily, or coordinating with other local events to share some resources (like barriers or signage). But never skimp in a way that endangers safety or event quality – if you need more security guards or better medical coverage, find a way to fund it.

-

Marketing & Promotion – This might be lower than other categories in pure amount (often around 5–15% of budget), but it’s critical to get people through the gates. Expenses here include advertising (online, radio, billboards), social media campaigns, content creation, and sometimes a kickoff promotional event. Early ticket sales are directly tied to marketing spend and efficiency. A common mistake is under-funding marketing with the idea that the event will “sell itself.” Even with a great lineup, you need consistent marketing. On the flip side, marketing expenses can skyrocket if not managed – paid ads can burn money fast. Always track the return on investment for marketing dollars. Use presale data, web analytics, and so forth to figure out which efforts generate ticket sales. Seek out media partners who might give you discounted rates or free publicity in exchange for sponsorship status. And don’t forget basic things like printing flyers, producing a launch video, or the cost of website and ticketing platform fees – those are part of marketing too.

Now, a helpful way to visualize where your money goes is to look at a sample budget breakdown. Here’s an illustrative comparison of a small festival vs. a large festival budget to show how funds might be distributed:

| Expense Category | Boutique Festival (1,000 attendees) | Major Festival (50,000 attendees) |

|---|---|---|

| Talent (artists etc.) | $50,000 (25%) – mainly local acts with one headliner | $10 million (40%) – multiple big-name headliners and acts |

| Production (stage, sound, lighting) | $60,000 (30%) – basic stage, local sound system, basic lights | $7.5 million (30%) – large stages, high-end sound/lighting, video walls |

| Venue & Infrastructure | $20,000 (10%) – venue rental, minimal fencing, basic facilities | $2 million (8%) – venue lease, extensive fencing, sanitation, site facilities, power generators etc. |

| Operations (staff, security, services) | $30,000 (15%) – mix of volunteers and paid key staff, basic medical & security | $3 million (12%) – large security team, medical tents, site labor, transport, staff accommodation etc. |

| Marketing & Promotion | $20,000 (10%) – local ads, social media marketing, flyers | $1.5 million (6%) – major promo campaign, ads in multiple cities, online video production, PR agency etc. |

| Miscellaneous & Contingency | $20,000 (10%) – slush fund for unexpected needs (e.g. equipment fixes) | $1 million (4%) – contingency funds, unexpected cost overruns, miscellaneous fees (legal, APRA/ASCAP music fees, etc.) |

| Total Budget | $200,000 (100%) | $25 million (100%) |

The exact percentages vary by festival type – a dance music event might spend more on production (lights, effects) and a culinary festival might have high infrastructure costs (kitchen setups for vendors) and lower talent costs. The takeaway is to allocate wisely and in line with your event’s priorities. If you overspend in one category, you must economize in another to stay on budget.

Pro Tip: Separate fixed vs. variable costs in your planning. Fixed costs (stage, venue, main acts) don’t change with the number of attendees. Variable costs (per person usage of food, freebies, wristbands, etc.) will scale. By understanding this, you can forecast how costs change with different crowd sizes and avoid spending as if 50,000 are coming when realistically 10,000 are. Align variable expenses to ticket sales – for example, only expand a venue layout or add more toilets if ticket sales justify it.

Warning: Avoid the temptation to overspend on a single outstanding element while other basics suffer. Splashing out on a huge headline act or an extravagant stage design is risky if it means cutting corners on safety, guest experience, or critical logistics. The horror stories of festivals with incredible lineups but terrible facilities (or vice versa) are real – both attendees and your finances will suffer if the budget isn’t balanced across all fundamental needs.

Managing major expenses is a continuous act of balancing cost versus payoff. It helps to review industry benchmarks and even past budgets from similar events if you can get that data. And always keep a bit of funds in reserve in each category if possible – costs have a way of moving upward as the event draws closer.

Vendor Relations & Contract Negotiation

Most festivals rely on a web of vendors and suppliers – from stage equipment providers to ticketing companies to food vendors. Getting good deals with vendors can make a huge difference for your bottom line. But vendor relationships are a two-way street. You want the best price and terms; they want fair compensation and a lasting partnership. Striking a win-win deal is the aim, and that’s where smart negotiation comes in.

Start by doing your homework. Get multiple quotes for significant expenses like stage and sound rental, lighting, fencing, restroom facilities, etc. Knowing the market price gives you leverage. If Vendor A’s quote is too high, politely show them that others offer a better rate – sometimes they will price-match or give discounts to win your business. However, be careful not to play vendors against each other so hard that whoever wins ends up feeling squeezed – that can sour the relationship from day one.

When negotiating, prioritize critical items. Some costs (like safety infrastructure) simply need the best quality, so it’s less about haggling down and more about making sure you get reliable service. Other things, like sourcing tents or lighting from a vendor, might have more wiggle room. A key tactic is to explore package deals or multi-year contracts. If you plan to run the festival annually, locking in a vendor for a couple of years can yield a better rate. For example, a fencing supplier might drop the price per foot of fence if they know they’ll get a two-year contract. Similarly, an AV (audio-video) company might throw in extra lighting at a discount if they’re providing sound for all stages.

Payment terms are another negotiation point. Many vendors want some payment up front (to cover their materials/labor) and the rest after the event. If your cash flow is tight, try to push for a smaller deposit amount or staggered payments. Some vendors might be willing to take final payment after the event, once you’ve sold tickets, which can help your cash flow. Make sure to get clear cancellation terms too – if your event is canceled or a vendor fails to deliver, you should know what costs you’re on the hook for or what refunds to expect.

A huge part of vendor negotiation is relationship management. Treat vendors as partners, not just cost lines. If you build a strong working relationship, they might go the extra mile for you, such as waiving minor fees or helping fix an issue at the last minute. Simple things like acknowledging good work, timely communication, and fair treatment for on-site vendors (like giving food vendors ample setup time and support) foster goodwill. Remember, a lot of vendors rely on word-of-mouth in their own industry; if your festival is known for being well-run and easy to work with, more will want to do business with you (possibly at a better price). The opposite is also true – a festival that doesn’t honor agreements or is hard on vendors might find fewer willing to work next time.

When it comes to food and market vendors (small businesses who pay vendor fees to sell at your event), negotiation is slightly different. Here your “deal” with them is about what cut of sales you get or what fee they pay for a stall. Be careful in setting these fees – if they’re too high, vendors won’t make money and won’t return. A typical arrangement is a flat fee plus a percentage of sales, or one of the two. To attract a great variety of vendors (and you do want variety for attendee satisfaction and revenue diversity), keep fees reasonable and support their success (advertise vendors on social media, facilitate foot traffic flow to all stalls, etc.). They are part of your festival’s experience; their success is your success.

Here are some considerations for vendor contracts:

- Clear Scope & Specs: Ensure contracts spell out exactly which services or goods are provided, including quantity and quality. For example, if it’s a sound system, list the specific equipment models and setup needed.

- Timeline: Include delivery, setup and teardown dates and times. Vendors need to know when they can start work and when to finish.

- Liability & Insurance: Who is responsible if equipment gets damaged? Vendors typically should have their own insurance. Verify their coverage and add them to your event insurance if necessary.

- Failure clauses: What happens if the vendor fails to deliver or if their equipment breaks down? Get a clause that allows some refund or damage mitigation. Similarly, have a backup option in mind for mission-critical vendors.

- Keen Eye on Extra Charges: Sometimes contracts come with potential extra costs (e.g. overtime for staff, transport charges, etc.). Try to get a all-inclusive rate or understand where add-on charges can happen, and negotiate vendor contracts to cut costs amicably by removing unnecessary fees.

Pro Tip: Leverage local connections for vendor deals. Local service providers might offer community rates or sponsorships (e.g. a local print shop giving a deal on banners in exchange for being a sponsor). Supporting local businesses can reduce shipping/logistics costs and build goodwill – they have a stake in the event’s success and often will be more flexible in negotiations.

Warning: Always read (and understand) the fine print in vendor contracts. Important points like cancellation fees, penalty charges for schedule changes, or cost of damage to rented items can wreak havoc on your budget if you’re not aware. If a contract is vague or heavily favors the vendor, negotiate for more mutual terms – or walk away and find a different provider. It’s better to spend time now than money and trouble later.

In summary, vendor negotiations are part art, part strategy. Aim for contracts that reduce cost and risk for you, but still give the vendor incentive to do a great job. An appreciated vendor is more likely to discount in future or solve problems on the fly. By building a network of trusted vendors, future editions of your festival will become easier and more cost-efficient to mount.

Cost Control: Saving Money Without Sacrificing Quality

Keeping expenses down is a fundamental part of festival finance – but cost cutting should never come at the expense of a great attendee experience or critical safety. The trick is to find efficiency and value, not just cheapness. Here are strategies to control costs while maintaining (or even enhancing) quality:

-

Smart Sourcing & Buying: Leverage bulk purchase and early buying discounts. For example, if you need 5,000 wristbands for entry, getting them made well in advance or from a bulk supplier can save a lot. The same goes for merchandise or freebies – early orders can avoid rush fees. Also, consider alternative suppliers for things like equipment. The established big companies might quote high prices, but smaller or newer companies may offer a better deal to get your business. Just ensure they have credible references – saving money means nothing if the quality isn’t there.

-

Volunteers and Partnerships: As mentioned, volunteers can offset labor costs if managed well. Seek partnerships with local colleges or communities – maybe a local film school helps with video production in exchange for access or credit, or a culinary school lends helping hands for a food festival. In some cases, you can partner with another event to share costs. For instance, if two festivals are back-to-back at the same venue, they might share site setup costs or decorations. It requires coordination but can drastically cut expenses per event.

Constructing Vital Site Infrastructure — Managing the heavy fixed costs of transforming a raw venue into a functional festival environment. -

Cut Wasteful Spending: Review every line item and ask – is this contributing to the attendee experience or festival success? It’s easy to get carried away with nice-to-haves like elaborate artist gift bags or fancy VIP lounge decorations. If money is tight, prioritize the critical stuff. Another example: printing paper programs booklets is expensive and often unnecessary in the digital age; consider a festival app or downloadable schedule instead. Not only is it cheaper, it’s environmentally friendly. Likewise, carefully manage your supply quantities – avoid over-ordering things like extra merchandise, too much food (which goes to waste), or more portaloos than actually needed. This requires good data from previous events or realistic usage estimates.

-

Use Technology for Efficiency: In today’s world, a lot of tasks can be done cheaper (and better) with technology. For instance, using an online reservation and check-in system for camping or parking may eliminate the need for extra staff on the ground. A well-designed website can reduce customer service calls (with clear FAQs and info). Instead of mailing physical tickets (and incurring print and postage costs), use e-tickets. Technology can also help with resource management – e.g., use a power usage tracking system to avoid renting more generators than needed.

-

Negotiation and Competitive Bidding: This ties into vendor management. Routinely review contracts for opportunities to re-negotiate. If one service is getting too pricey, it might be time to open bids to new providers. Just remember to consider the cost of change – switching to a cheaper contractor isn’t worth it if they deliver inferior service. But healthy competition can keep vendors fair with pricing.

A great way to surface cost-saving ideas is to talk to other festival organisers or join industry forums. Often, you’ll learn about innovative hacks others have done. For example, some events found that switching to an AF-?lighting system (just as a hypothetical name) saved 30% on power usage for lighting, or that eliminating gratuitous artist giveaways saved thousands with no ill effect on performance quality. There’s even a known concept in production – “Buy once, use many times.” If you have recurring events, it might be cheaper to buy certain items instead of renting every year (things like signage, basic stage props, etc.), as long as you have storage.

Pro Tip: Tap into the talent of your team and community for cost-saving ideas. Perhaps a team member has a connection for low-cost transportation (like a deal with a bus company) or maybe a local carpentry collective can build stage decor at a fraction of normal cost. Leverage DIY solutions where possible – homemade site decorations or volunteer-driven site cleanup can save money and add a unique authentic touch, as long as it’s executed safely and responsibly.

Warning: Cost cuts should never compromise safety, legal compliance, or basic comfort. Don’t skimp on critical infrastructure like security staff, medical aid, or proper equipment. The savings from hiring fewer security guards are absolutely not worth the risk of a serious incident. Likewise, do not cut corners with permits or safety certifications to save money – fines or event cancellation will cost far more. Aim to save by doing things better and more efficiently, not by leaving out vital pieces.

When you implement cost-saving measures, monitor the effects. Did attendees notice any difference in quality? Did you get complaints about something cheap or bad? If not, great – that’s a saving to keep. If yes, evaluate if the savings are truly worth it or if that’s a budget area to restore next time. Many times, innovation and frugality actually improve the event – for example, using a local farm for ingredients might be cheaper and yield better food quality than using a big supplier.

In short, run a tight ship and remember the adage “take care of the pennies and the pounds will take care of themselves.” Small savings across many areas can add up to a lot – just be sure the quality, safety and core experience remain intact. Adopting some festival cost-saving techniques that maintain quality will help you in this mission.

Contingency Planning & Risk Management

The best budget in the world can be wrecked by a single unexpected event – if you haven’t planned for it. This is why contingency funds and risk management are absolutely critical in festival finance. As mentioned earlier, setting aside around 10% (or more for high-risk events) of your budget for unplanned costs is standard practice. But beyond just money, you need a risk mindset: think of things that can go wrong and have a Plan B (or C).

External factors like weather are a classic risk. If you’re doing an outdoor festival, what if it rains heavily or there’s a lightning storm? You might need to stop the show for a while – which could mean overtime costs for staff, or needing to replace water-damaged equipment, or refund considerations in worst cases. Smart risk management means having funds for things like rain ponchos for sale (or free) to keep people safe, or budget for emergency shelter or evacuation logistics, etc. Insurance is your friend here. At minimum, a festival needs Public Liability insurance. You can also get event cancellation insurance that covers extreme scenarios (like extreme weather or civil cancellations). These policies aren’t cheap, but consider the alternative – a cancelation with no insurance could bankrupt your festival. During the COVID-19 pandemic, many events without suitable coverage faced ruin. Nowadays, some insurers even have specific coverage for communicable disease cancellations (though expensive). Evaluate the biggest threats to your event and insure against what you financially couldn’t handle by yourself.

Inflation and economic swings are a more subtle kind of risk, but they can have a huge effect on festival budgeting. In times of high inflation, your costs for materials, transportation, and wages can rise sharply. If you set ticket prices a year in advance and inflation hits 10%, you effectively lost 10% of value in that income. A recent example: a well-known food festival in Iowa had to double the price of its tasting tokens from $1 to $2 because vendor ingredient costs skyrocketed with inflation, as noted in coverage of the World Food & Music Festival’s price adjustments. Those adjustments can be unpopular, but in this case it was either raise the token price or vendors wouldn’t cover costs. The lesson is to keep an eye on economic trends and be ready to adjust. Perhaps you add an inflation margin to your budget – assuming things will cost a few percent more by event time and budgeting accordingly.

Key Stat: Inflation can hit festivals hard – for instance, when faced with rising costs in 2023, one major festival increased its food & drink token price by 100% (from $1 to $2) to cover vendor expenses, according to reports on festival inflation impacts. This highlights the importance of flexibility in pricing and cost management during economic swings.

For a deeper look at strategies to survive tough financial times, making your festival budget resilient to economic turbulence is a must. Key tactics include locking in prices early (buying essentials in advance, signing contracts with fixed cost), finding ways to cut costs via efficiency rather than blunt cancellation of features, and even adjusting your festival’s scale (for instance, using a smaller stage setup or shorter festival duration) if ticket sales look to drop in a recession. Build flexibility into your budget – if you have to downscale, know which costs come out first.

Human factors are another area for contingency planning. What if a headline artist cancels at the last minute? This can impact ticket sales and require a replacement (possibly at additional cost). Some mitigations: include clauses in artist contracts for substitution or financial penalty if they cancel close to the event. Always keep a shortlist of replacement acts in mind and some budget capacity for them. Likewise, if critical staff fall ill or can’t perform (imagine if your main production manager quits a week before the event), do you have backup via a staffing agency or personal network? Keeping good relations in the industry can help you find last-minute help, though possibly at higher cost – again, budget permitting.

Safety and incidents are also a risk that carry financial load. Plan for extra security or repair costs in case crowd behavior turns bad (riots, vandalism), or in case of accidents. This might involve having some budget for damage control after the event (fixing a venue or park grounds) beyond what’s expected. A surety bond might be required by a city to cover potential damage – factor this in.

Finally, a robust emergency plan is key part of risk management. Your team should know who decides what if things like bad weather or a security incident occur. Fast action can minimize cost – for example, if you see low ticket sales early enough, you might economize on some variable costs (ordering less merchandise or scaling down a costly stage setup) to save money. That’s risk management too – being clear-eyed and proactive when things aren’t going to plan.

Pro Tip: Run a pre-mortem with your team – imagine that the festival is over and lost money, and discuss what likely caused it. This exercise often brings up risks people see. Maybe somebody raises the issue of vendor failure or a key sponsor possibly dropping out. Once the risks are identified in a pre-mortem, you can then specifically allocate funds or plans to mitigate them. It’s like doing a fire drill for your finances – insanely useful for risk mitigation.

Warning: Don’t dip into your contingency fund for planned expenses. Contingency money often looks like it’s just sitting there begging to be used as costs creep up. Resist that temptation. It should be sacred and untouchable except for true unexpected needs. Using contingency for known expenses leads to budget destabilization – if a real crisis arises, you’ll have nothing left to cover it. Allocate discipline along with allocation of funds.

In sum, controlling your festival’s destiny means anticipating as much as possible and having resources ready to deal with the unpredictable. The combination of a dedicated rainy-day fund, appropriate insurance, flexible planning, and quick reaction will save your finances and possibly the event itself when trouble comes knocking.

Financial Tracking, Accounting & Compliance

Amid the chaos of festival production, don’t neglect the bookkeeping. Proper financial tracking and compliance is like maintenance on a car – nobody sees it, but if it’s not done, everything can break down. Good finance tracking means recording all transactions, staying on top of payments, and making sure you meet legal and tax obligations.

Start by having a dedicated bank account for the festival or the producing entity. Mixing festival funds with personal or other business accounts is a recipe for confusion (and potential legal issues). All income – ticket sales, sponsorship money, rental fees – should flow into this account, and all expenses out of it. This way, you have a clear paper trail. Today’s online accounting software can link to your accounts and automatically categorize expenditures, making life easier. Even with a small event, it pays to set up a logical ledger – categories matching your budget lines, so you can easily compare planned vs. actual spending as you go.

Keep a tight watch on accounts payable and receivable. This means tracking who needs to be paid and when, and any money due to come in. Set up a schedule of payments so you don’t accidentally miss a payment or double-pay a vendor. Many vendors will give early payment discounts – if you have the cash, availing those can save a small percentage here and there. Conversely, for big outlays, see if you can do a payment schedule to stretch them out. But always pay on time as per your agreements; doing otherwise can damage your reputation. If you’re in a crunch, it’s better to speak upfront with the vendor about extended terms than to just default on a due payment.

From a legal compliance standpoint, make sure you understand any sales tax or VAT duties. Ticket sales in many jurisdictions carry sales tax that you must collect and remit to the government. The same might apply for vending sales (some regions require events to collect tax on vendor sales). If you have international artists or staff, be aware of any withholding tax requirements (for example, the country may require you to withhold a portion of payments to foreign artists for tax purposes). Failure to do these can lead to fines or trouble later on. If accounting is not your forte, it’s wise to invest in some professional help here – even a few hours of a CPA’s time to set up your accounts and educate you on compliance can save a lot of headache.

On the topic of paying people: get a handle on whether they are considered employees or independent contractors by law. Many festivals use temporary contract labor (like event staff, stagehands) – you’ll likely need to provide tax forms (like IRS 1099 forms in the US) to those who are not employees. Coordinate with a payroll service if needed to ensure proper withholdings for any short-term employees. Misclassifying workers or failing to file the proper tax paperwork can lead to serious penalties.

Cash management during the event is another piece. If you’re running a cash festival (though many are going largely cashless), make a plan for securing cash – how to store money from gate sales or vendor fees safely, how often to empty out cash registers, etc. A common practice is to use a vault and security to regularly take funds from ticketing or merchandise booths, and then deposit them in a night safe or secure location. If using a cashless system, ensure your digital financial data is secure and backed up, and have a way to do audits on transactions to detect any misuses.

Financial control also extends to oversight. It’s good practice to have at least a second set of eyes on festival finances – maybe a finance manager or an external accountant who reviews the books periodically. This helps catch any irregularities early (whether they are errors or worse, like any misappropriation). Foster a culture among your team of cost awareness – encourage them to save receipts, stick to budget on departmental spending, and come forward early if they see a budget issue developing.

In terms of legal compliance, aside from taxes, think about permits and their costs. Some places require a special business license or entertainment license for festivals – make sure all such fees are paid and up to date. If you’re selling alcohol through your own operation, you’ll need to handle excise taxes and reporting. Have a checklist of all licenses and filings needed (e.g. ASCAP/SESAC/BMI fees for music usage, if applicable) and check them off well ahead of time. Ideally, your budgeting will incorporate all these compliance costs from the start.

Warning: Poor financial record-keeping can land you in hot water long after the music has faded. Imagine trying to sort out a tax audit with a shoebox of mixed receipts and no clear income records – it’s a nightmare. Even worse, failing to follow local laws (like paying entertainment taxes or business fees) can result in fines or even event suspension. Treat financial compliance as a core part of festival management, not an afterthought.

Pro Tip: After the festival, do a financial audit and wrap-up as soon as possible. This is when all transactions are freshest in memory. Reconcile every expense against your budget and see if there are receipts/invoices for each (and try to get any missing ones from vendors right away). This will not only finalize your record-keeping, but also feed into better budgeting for the next year. Consider creating a simple “festival financial report” to share with key team members or investors – showing how funds were used, major variances, and the overall financial outcome. This kind of transparency can encourage stakeholder confidence and keep everyone focused on financial responsibility.

In summary, staying diligent with money management is like doing maintenance on a high-performance vehicle – it may not be the glamorous part of festival life, but it keeps the whole operation running smoothly. With good tracking, you’ll know early if you’re veering off budget. With compliance, you’ll stay clear of legal trouble and be free to stage your event again. Think of the paperwork as part of the performance – albeit back stage – and give it the attention it deserves.

Post-Event Analysis & Long-Term Sustainability

The lights are off and the fans are gone – but your work as a festival financier isn’t done. Now is the time to figure out how well (or not) your budgeting and financial planning actually worked. Post-event financial analysis is critical for drawing lessons and improving future editions. Start by doing a line-by-line comparison of your budget vs. actual spending and income. Where did you overspend? Where did you save money? Maybe you spent more on security due to higher attendance than expected, but saved on marketing thanks to a last-minute viral social media boost. Identifying these variances helps refine your future budgets.

A simple way to present this is via a summary like the table below, which illustrates a hypothetical outcome versus plan:

| Financial Item | Budgeted | Actual | Variance |

|---|---|---|---|

| Ticket Sales | $500,000 | $450,000 | –$50,000 (–10%) |

| Sponsorship | $100,000 | $120,000 | +$20,000 (+20%) |

| Food & Merchandise Income | $50,000 | $60,000 | +$10,000 (+20%) |

| Total Revenue | $650,000 | $630,000 | –$20,000 (–3%) |

| Talent Fees | $220,000 | $220,000 | $0 (0%) |

| Production Costs | $200,000 | $210,000 | +$10,000 (+5%) |

| Operations & Staff | $80,000 | $100,000 | +$20,000 (+25%) |

| Marketing | $50,000 | $45,000 | –$5,000 (–10%) |

| Miscellaneous / Other | $0 | $5,000 | +$5,000 (n/a) |

| Total Expenses | $550,000 | $575,000 | +$25,000 (+4.5%) |

| Net Profit (Loss) | $100,000 | $55,000 | –$45,000 (–45%) |

In this illustration, you can see the festival did make a profit but significantly less than planned. The analysis would then dive into why. Perhaps ticket sales were lower due to bad weather or a competing event. Sponsorship performed better than expected (maybe a last-minute sponsor signed up, saving the day). On the cost side, operations went over especially – maybe the security guard hours were extended or cleanup took longer. These details are invaluable. They will allow you to create a more accurate cost model for next time, or to adjust signings and deals (maybe negotiate harder on security costs given the new info, or increase the budget allocation for this area next time). The example above also shows a misc expense that wasn’t even in the original budget – that could be something like damages or a fine or a last-minute equipment rental. Such items, if recurring, should be incorporated as a line item in future budgets or as a bigger contingency.

Beyond the raw numbers, consider the return on investment (ROI) for different things. Did that expensive marketing initiative yield enough ticket sales to justify itself? Was the extra money spent on a high-end sound system appreciated by the audience (via feedback or reviews)? (Sometimes you might do surveys to see if people noticed improvements or issues, which can tie back to spending decisions.) As a festival matures, you might start looking at metrics like cost per attendee (total cost divided by attendance) and see if you can bring that down over time without harming quality, or yield per attendee in terms of revenue. Improvement in these metrics often signals better efficiency.

The post-mortem should also involve key team members from various departments. Get feedback from the production manager, artist liaison, marketing head, etc. They might highlight inefficiencies or saving opportunities that aren’t obvious from the numbers alone. Perhaps the production team will say, “We had too many lights for stage 2, could cut some next time,” or the marketing team might point out a wasteful ad buy that they wouldn’t use again. Conversely, identify what worked well – maybe a particular partnership or a schedule hack saved money.

From a long-term sustainability perspective, think about the lifecycle of your festival. If this was Year 1, did you invest in assets that will benefit Year 2 (like buying a stage backdrop that can be reused)? In your accounts, those could be treated as capital expenses. Also, consider depreciation of any owned assets. If the festival is recurring, you might adopt a multi-year view on big items – for example, a one-time setup of electrical infrastructure that will last 3 years should be amortized in your mental budgeting across those years, not fully burden one year.

Another concept: build reserves in good years. If you turned a significant profit, it might be wise to re-invest a part into a reserve fund or into assets that reduce future costs (like storage containers, DIY staging, etc.). Many festivals have a rainy day fund which saved them in tough times. If attendance unpredictable, having a financial cushion can be the difference between canceling the next year or forging ahead. Major festival operators often keep a percentage of profits in reserve as a risk mitigation strategy.

From a funding and relationship standpoint, fulfill any promises – for example, deliver sponsor reports showing the value they got (with data like media impressions, attendee surveys, etc.). This will help sponsor retention. Pay all invoices to vendors and settle with any revenue-sharing partners (like if you told the venue you’d give them a cut of profits, do the math and settle that). Leaving a festival with zero debts and clear statements is part of fiscal sustainability – the way will be clear for the next year without old liabilities hanging on.

Finally, take a moment to evaluate the festival’s financial viability in the longer term. Did you basically break even or lose money? Many new festivals lose money in initial years as an investment in building the brand. If so, is the loss acceptable and backed by investors or owners for a few years? You might need to adjust the business plan – maybe scale up or down, or find new revenue streams (like add a VIP tier if you didn’t have one, or bring in a new type of high-profit vendor). If you made a profit, congratulations – consider how to build on what gave the best ROI and fix what dragged you down.

Pro Tip: If possible, get somebody outside the immediate festival team to review your final financial results and plans. It could be a seasoned festival organizer from another event (if you have that sort of relationship) or a financial advisor. A fresh pair of eyes might catch things you’ve overlooked or suggest alternative strategies (say, a different ticket pricing model) to improve financial outcomes. Participate in industry workshops or forums – sometimes a tip from another organizer on how they manage a specific expense can lead to big savings for you next year.

Warning: Don’t fall into the trap of “We’ll make it up next year” without real changes. If your festival lost money or barely made any, take a hard look at why. Simply assuming that getting bigger will fix financial issues is a common and dangerous mistake. Growth brings bigger budgets and new challenges; if underlying problems like poor cost control or weak revenue streams are not fixed, even a bigger festival will continue to struggle with profit. Use your analysis to fundamentally improve the model – whether via expense cuts, better deals, ticket price adjustments, or a different mix of income – rather than just hoping for a larger crowd to save the day.

In conclusion for this section, the aftermath of the event is your learning phase. By doing thorough financial analysis and carrying those lessons forward, you refine the art of festival budgeting and finance. Over years, a well-managed festival should see improvements in cost management and revenue optimization, leading to better margins and the ability to invest in even greater experiences for attendees.

Essential Reading

- Festival Accounting & Tax Compliance 101: Keeping Your Books Clean and Legal – A beginner’s guide to event bookkeeping, tax obligations, and financial record management for festival organizers.

- Maximizing Per Attendee Spending at Festivals: Boosting On-Site Revenue Streams – Tips and case studies on increasing revenue through food, beverage, merchandise and creative sales tactics during an event.

- Recession-Proofing Your Festival Budget: Adapting to Inflation and Economic Uncertainty – Strategies to safeguard your festival’s finances in times of rising costs, from locking in prices to flexible scaling of your event plans.

- Crowdfunding Your Festival: Engaging the Community to Fund Your Event – A step-by-step look at how to leverage community fundraising or crowdfunding to finance a festival, including incentive ideas and campaign tips.

- Negotiating Festival Vendor Contracts: Strategies to Cut Costs Without Burning Bridges – Insight into contract negotiation with suppliers and vendors, covering win-win tactics to get better pricing and terms while building lasting partnerships.

- Festival Cost-Saving Hacks: Cutting Expenses without Sacrificing Quality – A collection of savvy cost reduction ideas from veteran festival producers – ways to save money in logistics, production, marketing and more while keeping the attendee experience front and center.

FAQ

How much does it cost to put on a festival?

The cost can vary wildly based on size, location and type of festival. Small local festivals might spend under $50,000, whereas large multi-day events can run into the millions of dollars. Major cost drivers include talent booking (headline acts can cost hundreds of thousands alone), staging and production, and infrastructure. As a rough figure, some mid-sized music festivals (around 5,000–10,000 attendees) may have budgets in the $500,000 to $1 million range. Always break costs down by category to get a clear picture – talent, production, venue, staffing, marketing, etc. – and remember to include hidden costs like insurance, permits and taxes.

How do festivals make money apart from ticket sales?

Besides tickets, festivals rely on various revenue streams. Sponsorship is a big one – funding from sponsors in exchange for brand exposure. Vendor fees and revenue sharing from food, drink, and merchandise sales are another major income source (especially if the festival takes a percentage of sales). Parking and VIP upgrades (like VIP access passes, special viewing areas) generate revenue. Some events charge for things like campsite or special experiences (e.g. workshops). In addition, merchandise sales (festival branded apparel or souvenirs) can contribute significantly. The mix of revenue will depend on the type of festival – for example, a music festival might lean on merchandise and concessions, while a film festival might rely more on sponsorship and entry fees.

What is a typical profit margin for festivals?

Profit margins in the festival world vary. A well-established, well-run festival might target a profit margin in the 10%–20% range of total revenues. Many new festivals, however, do not make any profit in the first few years – breaking even or even running at a planned loss is common until they build up. Successful recurring festivals tend to improve margin over time by building up assets (like owning equipment instead of renting) and gaining bargaining power with vendors. Margins are highly sensitive to things like ticket sales success and cost control. A 15% profit margin is considered healthy in this risky industry. Anything significantly above that might indicate either a very successful event or possibly high pricing. Conversely, margin can be zero or negative if anything unexpected (like low attendance or big cost overruns) happens.

How can I get funding for a festival if I don’t have enough start-up money?

Many festival organizers start by looking for sponsorship and partners – a key sponsor can cover a portion of your costs in exchange for logo placement and access. Seeking support from local authorities or grants is another route (some cities or arts councils provide funds for cultural events). Community-based funding like crowdfunding is increasingly popular: you pre-sell tickets or special perks to fans to raise seed money. Also, consider involving investors or getting a loan, but be mindful of the risk – money from investors typically means giving up some future profits or control, and loans must be repaid regardless of event success. Whichever mix you use, a solid business plan and budget will be needed to convince any sponsor, investor or funding body. Start small if possible – prove the concept with a low-cost version of the event which can then attract more funding for growth.

When should I start working on the budget for a festival?

As early as possible – ideally at the very beginning of planning. For large festivals, budget planning often begins a year or more in advance of the event. This is because key costs (talent, venue, etc.) need to be understood early on. Even for a small festival, you should create a budget several months ahead of time. Starting early allows you to see whether the event is financially feasible, to set ticket prices correctly, and to raise funds if there’s a shortfall (via sponsorship or other means). Early budgeting also gives time to get quotes from suppliers and to involve team members in cost estimates. Essentially, the budget is one of the first building blocks in festival planning – it influences many decisions down the line.

How much money should be set aside for contingencies in a festival budget?

A common recommendation is around 10% of your total budget, though some events go even higher (15%–20%) if they anticipate a lot of risk or cost uncertainty. The exact amount depends on factors like the complexity of the event, weather dependency, and how much confidence you have in your cost estimates. High-risk elements (like an outdoor stage susceptible to weather or a complex new tech that might need backup) merit a larger contingency fund. The key is the money in contingency should be enough to cover a major unexpected expense or a series of smaller ones without forcing you to cut planned essential expenses. Remember, if you don’t use the contingency money, that’s a bonus – but if you need it and don’t have it, the event quality or safety might suffer.

What to do if the festival is running over budget?

If you see that you’re going to exceed the budget, act quickly. First, see if there are any costs that can be cut or reduced without impacting critical parts of the event – maybe optional decor, extra fringe activities, or switch an expensive supplier to a more affordable one. Use your saved contingency funds to cover vital overruns. Also look at revenue – can you introduce a new income source or push ticket sales (like a last-minute promo) to get more funds? Communication with stakeholders is important too: if you have sponsors or investors, it might be worth talking about support to cover a shortfall rather than compromising the event. And absolutely learn from the experience – figure out why the overruns happened (bad initial estimates? unexpected price hikes? scope creep?) so you can prevent that next time. Cost control during the event (like watching staff overtime or cutting off free guest access if it’s costing money) is another lever to pull. Essentially, it’s triage – protect the core experience and safety, cut out the non-essentials, and try to boost income if possible.

Glossary

- Break-Even Point: The stage at which total festival income equals total expenses. At the break-even point, a festival has no profit and no loss. Knowing the break-even attendance or sales is crucial for planning (e.g. how many tickets must be sold to cover costs).

- Cash Flow: The movement of funds into and out of festival accounts. Positive cash flow means more money coming in than going out at a given time. Good cash flow management ensures you have enough ready money to pay bills (like vendor invoices or artist deposits) as they come due.

- Contingency Fund: A reserved amount of money set aside for unexpected costs or emergencies. In festival budgets, this often is around 10% of the total budget. The contingency fund is essentially a safety net for unplanned expenses (like sudden repairs, changes in plans, cost overruns) without needing to cut planned expenditures.

- Crowdfunding: A method of raising funding from a large number of contributors (the crowd) via small contributions, often facilitated by online platforms. Festivals use crowdfunding to involve the community – for example, selling advance tickets or special perks to fans in order to raise start-up capital for the event.

- Fixed Costs: Expenses that do not change with the number of festival attendees. These include things like stage rental, artist fees, venue hire, or license fees. Whether 100 people or 10,000 people attend, these costs remain largely the same. Budgeting must account for covering all fixed costs even at low attendance scenarios.

- Variable Costs: Expenses that change in proportion to the number of attendees or usage. Examples include wristbands, programs, food consumed (if the festival provides catering), or cleaning supplies. As more people come, these costs increase. It’s important to estimate variable costs per person to understand profitability at different crowd sizes.

- Gross Revenue: The total money earned by the festival, before any costs are deducted. This includes all ticket sales, sponsorship funds, vendor fees, merchandise sales, etc. It’s basically the top-line income. Comparing gross revenue to expenses shows how much is left to cover costs and yield profit.

- Net Profit: Also called net income or bottom line. It’s the amount of money left after all expenses have been paid. If revenues are higher than expenses, the event has a net profit (or surplus). If not, it’s a net loss. Net profit is the ultimate measure of the festival’s financial success. (Profit Margin refers to net profit as a percentage of revenue.)

- In-Kind Sponsorship: A type of sponsorship where a sponsor provides goods or services instead of cash. Instead of giving money, the sponsor might give something useful for the festival (example: free products, free usage of a service, or free promo on their platform). In-kind contributions help reduce festival expenses. For example, a sponsorship from an energy drink company might come in the form of free drinks for artists and VIPs, reducing the festival’s hospitality costs.

- Return on Investment (ROI): A performance measurement that calculates the benefit (or return) from an investment relative to its cost. In festival terms, ROI could be applied to a particular expense – for instance, the ROI of a marketing campaign would be the additional ticket sales revenue generated minus the campaign cost, then divided by the cost. Festival stakeholders (like investors or sponsors) are often interested in ROI – whether the money put into the event gave a worthwhile return.

- Profit and Loss (P&L) Statement: A financial report detailing revenues, costs, and resulting profit or loss over a specific period. For a festival, the P&L statement will list all income sources and expense categories and show the net profit or loss for the event. It’s a fundamental tool to analyze financial performance and is often used for reporting to investors, sponsors, or for management analysis.

- Per Capita Spending (Per Cap): The average amount of money spent per attendee. By tracking total on-site sales (food, beverage, merchandise, etc.) and dividing by the number of attendees, organizers get the per cap value. It’s a key metric for gauging success of vendors and identifying revenue potential from attendees beyond ticket sales. Efforts to increase per cap can greatly improve overall festival income.

- Sponsorship: Funding or other support from a third party (individual or organization) in exchange for some form of promotional or branding benefit. Sponsors might pay for a share of festival expenses, provide a service or product (in-kind), or give a fixed amount of money. In return, they usually receive visibility (like logos displayed, naming rights to stages or the event itself, VIP access) or business opportunities (like the right to sell their product on site). Securing sponsorship is often critical for festival viability and can significantly reduce the need for revenue from ticket sales alone.

Conclusion

A festival’s financial health is just as important as the music, film, food or art that it celebrates. In fact, careful budgeting and finance management lays the groundwork for all the creativity and magic that unfolds at the event. By planning diligently, spending wisely, and adapting to changing conditions, festival organizers can navigate the razor-thin margins and high risks of this business and come out with viable, successful events – and hopefully a bit of profit to reinvest in even better experiences for the future.

In essence, being a festival producer is a mix of art and accounting. This guide has walked through strategies to fill your toolkit on the money side – from acing your budget forecasts to cultivating funding and keeping costs under control. Armed with these insights, you’re in a stronger position to create a festival that not only engages the audience but is financially sustainable. Remember: great festivals are built on vision and creativity, but they thrive on sound budgeting and financial savvy. With careful planning and wise fiscal stewardship, you’ll keep the music playing and the lights on for many years to come.